Daily Comment (November 8, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] There isn’t much more we can add on the election at this point. It appears the financial markets have discounted a narrow Clinton win, but we would still not be shocked to see Trump prevail. We have been concerned about the reliability of polls and betting sites in this election due to political polarization. There is a pretty good chance we will know the outcome when we publish tomorrow, although even that outcome isn’t certain. Given that the financial markets expect a Clinton win, if she does meet expectations, we would not expect a major market reaction. On the other hand, a Trump win will likely lead to a short, but sharp, equity selloff; most analysts put this in the 5% range. We are less sanguine and would expect something closer to 10%. However, the drop shouldn’t last too long.

We got a plethora of data from China overnight (see below). We want to highlight a couple of items. Exports (in USD) were weak, falling over 7%.

This chart shows the yearly change in Chinese exports along with the 12-month moving average. Since January 2015, we have only seen two months with positive readings and the yearly average has been negative all year after steadily declining last year. China’s export sector is suffering and it’s showing up in two other numbers, the exchange rate and reserves.

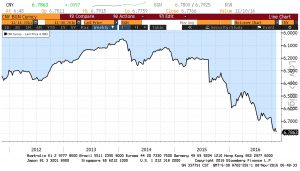

This chart shows the CNY/USD on an inverted scale. As China’s exports began to falter last year, China has been guiding its exchange rate lower.

Foreign reserves have been weaker as well.

In October, China’s foreign reserves fell $45.7 bn. As the chart shows, the pace of the decline has slowed to some extent, but most of that slowdown probably occurred due to tighter regulations on capital flight. However, falling exports will tend to lead to a weaker currency and a steady decline in foreign reserves. With less growth coming from exports, China will be forced to either live with slower growth or use other means to maintain growth. This may mean more investment (and debt) or, with luck, rising consumption. Although it may be too soon to tell, we do note that the Xi regime fired its finance minister, Lou Jiwei. Mr. Lou was an outspoken reformist figure who supported economic restructuring. Removing him could signal that Chairman Xi intends to maintain the investment model. The firing was a surprise, although we do note he was approaching retirement age and it was highly unlikely he would have been reappointed. The fact that Xi decided to fire him rather than allow him to retire suggests the leadership of the CPC wanted him removed, probably for a less independent replacement.