Daily Comment (October 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that consumer price inflation in the eurozone is now below the European Central Bank’s target of 2% for the first time in three years — a development that portends further interest-rate cuts and potentially renewed depreciation of the euro. We next review several other international and US developments with the potential to affect the financial markets today, including the inauguration of a new president in Mexico and a statement by Federal Reserve Chair Powell suggesting US interest rates will fall only gradually going forward.

Eurozone: In an initial estimate, the September consumer price index was up just 1.8% from the same month one year earlier, after a 2.2% gain in the year to August. That means price inflation is now below the European Central Bank’s target of 2.0% for the first time in three years. The continued cooling in inflation, which stems in part from weakening economic activity, will likely encourage the ECB to keep cutting interest rates at its next policy meeting later this month. As a result, the euro so far today is trading about 0.5% lower to $1.1079.

Japan: The Bank of Japan’s third-quarter “tankan” index of major manufacturers’ sentiment came in at a relatively subdued +13, matching the second-quarter figure. The third-quarter reading suggests Japanese manufacturers remain cautious as they face slowing economic growth in China and an appreciating yen (JPY). As we mentioned in our Comment yesterday, they are also now dealing with a new prime minister, Shigeru Ishiba, who was confirmed by the Diet today.

Russia-Ukraine: The Russian government’s proposed budget for 2025 envisions defense outlays jumping to the equivalent of $145 billion, up 25% from 2024. According to the government, the proposed military budget is necessary to ensure victory in the invasion of Ukraine. The huge increase also suggests President Putin is comfortable with the massive economic stimulus that has come with increased defense spending.

- The proposed defense budget would equal almost 7% of Russian gross domestic product, as forecasted by the International Monetary Fund. As we’ve noted before, higher defense spending tends to correlate with higher economic growth, so long as the “defense burden” remains below about 10.0% of GDP.

- However, given that the Russian military retains so many Soviet-style habits and operational approaches, it would not be surprising if Russia was hiding some defense spending in ostensibly civilian budget accounts or off budget. If so, Russia’s total defense spending could be above 10% of GDP, in which case it could soon start to weigh on the country’s economy.

Israel-Hezbollah: The Israeli military last night began what it called “limited, localized” ground raids against Hezbollah positions in southern Lebanon, marking Israel’s latest step in its nearly year-long war to eliminate the threats from Iran-backed Islamist militants. Israel’s increasingly aggressive moves suggest Prime Minister Netanyahu senses his country’s huge preponderance of power versus Hamas, Hezbollah, and Iran and is looking to defang them while he can.

- The risk, of course, is that Netanyahu could go too far, perhaps by attacking Iran directly to try to eliminate its nuclear program.

- Such a scenario could prompt Iran to retaliate against Israel or other regional countries with whatever weapons it can muster, leading to further destruction and potential economic disruptions across the region.

Mexico: Claudia Sheinbaum of the leftist Morena Party will be inaugurated today as the country’s new president. However, all signs suggest outgoing President Andrés Manuel López Obrador, the founder of Morena, will remain closely involved in governance and constrain Sheinbaum’s actions as she manages problems such as Mexico’s expanding budget deficit and high crime rate. Both those problems have hurt Mexico’s ability to benefit from global fracturing and the shifting of production toward the US from China.

US Politics: Republican vice presidential candidate JD Vance and his Democratic counterpart, Tim Walz, will square off in their only debate of the campaign season tonight at 9:00 PM ET. Vice presidential debates typically get somewhat less television viewership and attention than presidential debates. However, given how close this year’s race is, the success or failure of either vice presidential candidate could have a meaningful impact on who wins the presidency.

US Monetary Policy: At a conference yesterday, Fed Chair Powell said that the monetary policymakers are aiming to cut interest rates only to the “neutral” level, and that the course to get there is not pre-set. Rather, Powell said the path of rate cuts could still be gradual, depending on how the economic data comes in. In other words, Powell seemed to be suggesting that the Fed could cut rates more slowly than some investors still expect.

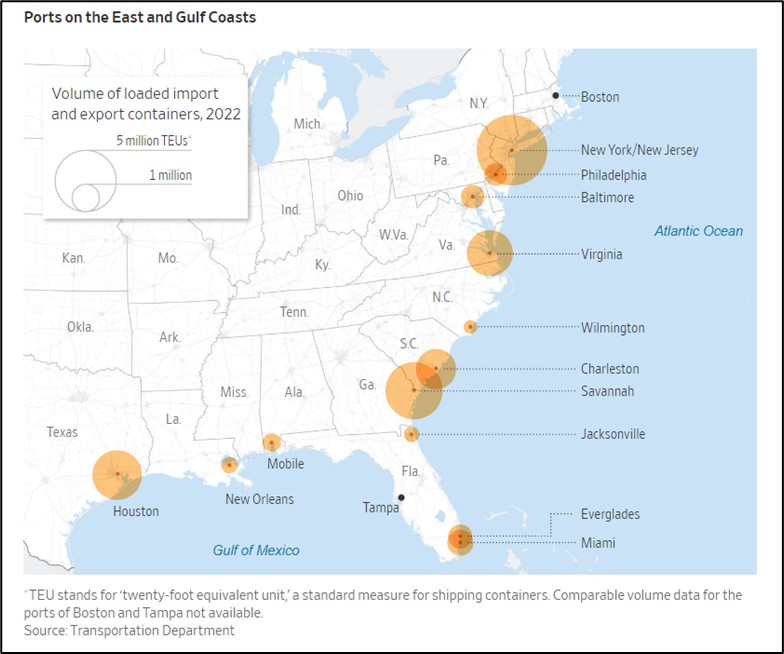

US Shipping Industry: As expected, the International Longshoremen’s Association today launched its big strike at East Coast and Gulf Coast ports. The affected ports typically account for about 41% of US containerized shipping volume, so the work stoppage is anticipated to have a major impact on the country’s exports and imports for as long as it lasts. Importantly, the disruption to imports could spark a new round of price inflation. As we’ve noted before, key issues in the dispute center on dockworker pay and the use of automation at the ports.

US Storm Damage: Authorities are still assessing the damage caused by Hurricane Helene as it moved across Florida, Georgia, and the Carolinas over the weekend, but it now appears the storm killed more than 100 people. In addition, Moody’s has estimated the massive hurricane caused at least $15 billion in property damage, and Fitch Ratings puts insurable losses between $5 billion and $10 billion.