Daily Comment (October 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently analyzing the latest PPI data. In sports news, the Minnesota Lynx managed to win game one against the New York Liberty in the WNBA Final. Today’s Comment will cover our thoughts on the latest inflation report, explore reasons behind the upward movement of the 10-year Treasury, and provide a review of France’s government budget proposal. Additionally, the report will include a roundup of international and domestic data releases.

Mixed Bag Inflation: While the BLS inflation report offered some relief about the path of inflation, it also raised some concerns.

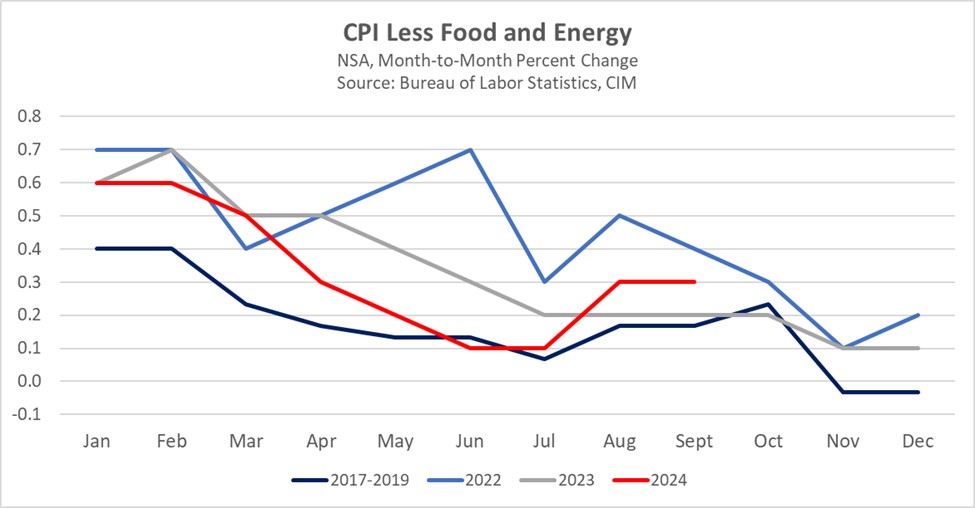

- The September CPI report surpassed consensus expectations, with core goods and services inflation accelerating from the prior month. Overall inflation rose 0.2% month-over-month and 2.4% year-over-year, exceeding the projection of 2.3%. Excluding energy and food, inflation increased by 0.3% month-over-month and by 3.3% year-over-year, surpassing the anticipated 3.2%. The broad-based jump in the inflation report was driven by spikes in apparel, new cars, and medical services. However, shelter inflation decelerated to its slowest pace since August 2021.

- Although a significant decrease in shelter inflation might be seen as a positive development, other offsetting factors suggest persistent underlying inflationary pressures. Throughout the year, Fed officials have emphasized that shelter inflation is a key factor in their efforts to bring overall inflation down to the 2% target. However, the latest report highlights the risk posed by other components to the Fed’s inflation target. This marks the second consecutive month where inflation has risen at a pace exceeding that of the previous year.

- While the report is concerning, we think it is too soon to become overly worried. As the chart above shows, it is normal for inflation to accelerate in the fall, and this should moderate over the next few months. Additionally, many of the factors that drove the spike may have been related to Hurricane Helene, particularly for medical services. Nevertheless, we believe the Fed will closely monitor inflation to ensure its convergence toward the target. If inflation begins to accelerate, we anticipate the Fed will slow the pace of its easing cycle.

Treasurys Not Convinced: Investors have become less willing to take on longer-duration debt as supply continues to be a problem.

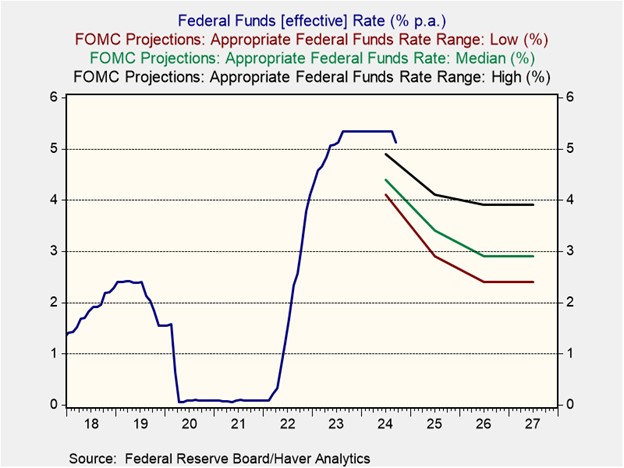

- The 10-year Treasury yield has increased by 40 basis points since the latest FOMC rate decision, as investors have become increasingly concerned about the policy path. The sharp rise was primarily driven by concerns that the Fed may have shifted away from prioritizing maximum employment too quickly. Furthermore, there is a growing concern that the market may not be able to absorb the large issuance of government debt as the US continues to run large deficits. Earlier this week, the Treasury auction for 10-year bonds experienced somewhat weaker demand due to the uncertainty.

- The main source of concern in the Treasury bonds market may be attributed to uncertainty regarding the Fed’s neutral rate, which is the policy rate at which it neither stimulates nor restricts the economy. The latest FOMC dot plots highlight the substantial disagreement among Fed officials on this issue, with the highest long-run fed funds rate at 3.75% and the lowest at 2.25%. Assuming one more rate cut this year, the central bank could potentially cut rates another 4-10 times over the next few years.

- The wide dispersion in the FOMC dot plots is likely to be a key focus for the market in the coming months as it assesses the Fed’s terminal rate. Consequently, we believe that speculation about rate cuts will have less influence on bond markets than the broader trajectory of monetary policy. While favorable inflation data has historically impacted bonds, we expect weak labor and economic data to play a more significant role. Fed officials are likely to be more responsive to signals of an economic slowdown than to indications of easing inflation when deciding the size of future cuts.

French Austerity: French Prime Minister Michel Barnier has released details of the budget for the next fiscal year as he looks to solve the country’s deficit problem.

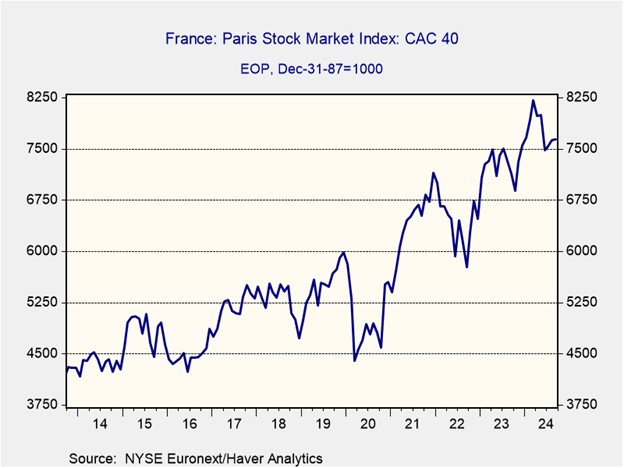

- The budget proposes over 60 billion EUR ($65 billion) in spending cuts and tax increases on large corporations. A new exceptional tax would be imposed on corporations with annual revenue exceeding 1 billion EUR ($1.1 billion), aiming to generate over 12 billion EUR ($13.1 billion) in revenue over two years. Additionally, the state-owned utility company, EDF, would be required to pay a special dividend of 13.6 billion EUR ($14.8 billion) to the government. Furthermore, the government plans to raise two-thirds of the funding through cuts to medical costs, unemployment benefits, and staff reductions.

- If enacted, the budget plan could dampen investor sentiment toward French financial markets. France already faces relatively high 10-year bond yields compared to its peers, and concerns over corporate profitability under the new proposal may further deter investment. The country’s benchmark index, the CAC 40, is currently down nearly 10% from its May peak. In contrast, Germany’s benchmark stock index, the DAX 50, is hovering near an all-time high, despite the country’s recession.

- Nevertheless, the budget remains subject to several hurdles before its finalization. The proposal has faced opposition from lawmakers concerned that the tax increases could hinder efforts to improve the country’s competitiveness. Additionally, today’s Fitch rating outlook will offer insights into investor views on the budget’s credibility. If it is able to pass through parliament and avoid a downgrade in its outlook, French yields should fall. However, a major concern moving forward will be avoiding a budget that is so onerous as to negatively affect tax receipts in the upcoming year.

In Other News: Iran has warned that a strike on its nuclear sites would potentially cause the country to change its nuclear doctrine. Atlanta Fed President Raphael Bostic was the first Fed official to signal a willingness for a pause in rate cuts following the hotter-than-expected CPI report. China is expected to release $283 billion in new stimulus over the weekend, in a sign that it is ready to follow through on its promise to boost its economy.