Daily Comment (October 13, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning and happy CPI day! U.S. equity futures were moving higher in front of the report, and we will cover the CPI numbers in detail below, but in short, they were bad, leading to a sharp reversal in equity futures. Our coverage begins with economics and financial news, with a deep dive into the Fed Minutes. Up next is China news as the U.S. is cracking down on technology transfers. War coverage follows and we close with the international news roundup.

Economics and Finance: The Fed Minutes offer some insight into the bank’s thinking.

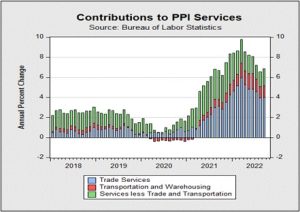

- The September FOMC minutes revealed that the Federal Reserve favors hefty rate hikes, but we are starting to see some concern emerging about overdoing it. Although the report showed that supply chains are improving, officials are worried that the pace of increases in goods prices is still elevated. The persistent pick up in goods inflation has led some members of the committee to take a look at firms’ profits. Wholesale and retail margins, referred to as trade services below, is the largest contributor to producer services inflation.

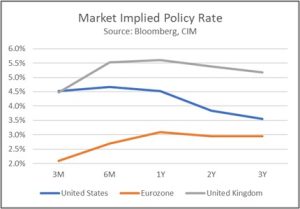

- Central bankers across the world are plowing ahead with tight monetary policy regardless of the economic impact. Minnesota Fed President Neel Kashkari warned against bets in favor of a Fed pivot, stating that the bar is very high given the level of inflation. In the U.K., officials from the Bank of England signaled that rates are likely to rise sharply and announced plans to end its bond-buying program on Friday. Lastly, the European Central Bank President Christine Lagarde dismissed speculation that the EU is in recession in a sign that the bank plans to forge through with additional rate hikes. Tightening financial conditions will hurt risk assets and slow the global economy.

- One of the complicating factors for the Fed is that labor markets remain tight. A factor driving this situation could be a condition called “labor hoarding.” For the past four decades, firms treated workers as expendable; the entire gig working industry is essentially built on an idea that a firm can call on labor only when needed. As the labor force growth slows, firms are finding that it has become difficult to fill positions, leading companies to hold on to workers even as economic activity slows. If the Fed doesn’t take this situation into account, it may lead the FOMC to overestimate the economy’s strength and overtighten.

- One way to resolve the lack of labor force growth is through immigration. We note that the U.S. is planning to issue the maximum legal level of H-2B visas.

- Hawkish central banks have added to the debt burden of emerging market countries. Most emerging markets rely on foreign debt due to their favorable interest rates. However, as the central banks have raised their benchmark interest rates, investors are pushing up borrowing costs to compensate for the additional risk. The problem will likely get worse as the global economy begins to slow. To prevent an emerging market debt crisis, the International Monetary Fund is trying to rework the debt for developing countries, but it would like China to participate in the restructuring. The risk of an emerging market debt crisis is elevated especially as Beijing continues to drag its feet on negotiations.

- Tomorrow, the BOE says it will halt its bond buying, which has led pension funds to increase selling to build liquidity. As we noted earlier in the week, central banks are facing the Tinbergen problem of not having enough policy tools for the problems they face. Specifically, if central bankers prioritize financial stability, then inflation will rise while if they instead fight inflation, then financial risks increase. We note that there are rumors that the Truss government is considering backing away from some of its fiscal expansion policy, which may be enough to give the BOE some room.

- The IMF warns that there is a 10% risk of negative global GDP growth next year.

- Although we will cover the information in more detail in tomorrow’s Weekly Energy Update, OPEC+ has cut its global demand forecast for oil, which is probably why it made its controversial output cuts. In its monthly report, the IEA warned that OPEC+’s actions could trigger a global recession.

- Japan’s bond market traded today for the first time in five days. Yield-curve control has made actual trading just about non-existent.

- Florida’s orange crop is set to be the smallest since WWII. Hurricane Ian contributed to the small crop.

The Ukraine War: Sensing weakness, NATO ramps up its support for Ukraine against Russia, while Moscow gets a needed break on oil.

- Western countries pledged more military equipment to Ukraine and new penalties to curtail Russia’s revenue generation. The new ammunition will allow Ukraine to defend itself from retaliatory attacks from Russia. New reports suggested that Russia has targeted 40 Ukrainian cities with missiles. Meanwhile, the new penalties will likely be an alternative way to punish Russia after OPEC+ cuts have put price caps at risk.

- The latest developments in Ukraine suggest that the war is not close to being over; however, there does seem to be hope for de-escalation. Russian President Vladimir Putin offered to resume gas supplies through Nord-Stream 2. The plan was quickly denied by Berlin, who fears that the move would come at the expense of Ukraine.

- The IMF warned that Ukraine would need $3 billion a month in 2023 to fund its debt obligation. The war-torn country has not been able to run its government without additional aid from the West.

- Putin is pressing Belarus to join the war. We doubt President Lukashenko wants to join this war and it isn’t obvious if Belarusian troops would be effective, but, it may draw some Ukrainian forces to guard its northern border.

- Winter offensives are difficult. Cold weather complicates armor operations and soldiers must fight both the weather and the enemy. Thus, there have been expectations that the pace of operations will slow as winter sets in. However, Lloyd Austin, the U.S. Secretary of Defense, indicated that the offensive would continue through the winter.

- Russia has formally blamed Ukraine for the Crimea bridge attack.

China News: The U.S. increases pressure on China’s semiconductor industry.

- In the wake of new U.S. restrictions on semiconductor equipment sales to China, the chip toolmakers announced the suspension of equipment sales. There have been some exemptions granted, but only for a year. We also note that the FCC is likely to ban all new sales of Huawei (002502, CNY, 3.10) and ZTE (ZTCOF, $1.79) equipment in the U.S. Although complete isolation isn’t likely possible, supply chain disruption is clearly underway.

- After a long delay, the Biden administration did issue its National Security Strategy. The document makes it clear that China and Russia are its main focus.

International Roundup: There is flooding in Nigeria, and Orbán gets shunned.

- Massive flooding in southern Nigeria has killed at least 500 and displaced 1.4 million people. Disruptions to agriculture and energy production are likely.

- Germany made it clear it isn’t pleased with Hungary’s actions.