Daily Comment (October 19, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are mixed this morning, and the Las Vegas Aces are the new WNBA champions. Today’s Comment begins with our thoughts on why investors will be paying close attention to Powell’s speech today. Next, we explain why investors have preferred commodities over bonds, how China and Russia are teaming up to woo countries in the Middle East, and we conclude with other news. As usual, our report also provides an overview of the latest domestic and international data releases.

Investors All Ears: After months of convincing the market that he will not shy away from the inflation mandate, Powell will now need to assure investors that the Fed will not overdo it.

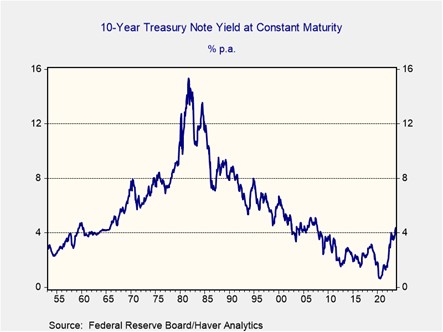

- Fed Chair Jerome Powell is set to speak at the Economics Club of New York today. Investors will closely follow his remarks to gauge the Federal Reserve’s appetite for more rate hikes as it seeks to bring inflation back to its 2% target. Strong economic data, such as retail sales and September’s job numbers, have led to speculation that the economy may be running too hot for comfort for members of the Federal Open Market Committee. These concerns have caused a steady rise in Treasury yields, with 10-year bonds now approaching 5% for the first time since 2006.

- Momentum is growing for a pause in Fed rate hikes. The Beige Book released on Wednesday showed that economic activity is slowing in the United States. Investors who are betting on a slowdown saw this as a positive, as it could deter policymakers from raising rates further. Additionally, dovish comments from Federal Reserve Board member Chris Waller and New York Fed President John Williams have boosted optimism that the Fed may be nearing the end of its hiking cycle, as higher interest rates in long-duration Treasuries have convinced some policymakers that they have done their job.

- Powell’s speech is unlikely to change the Fed’s “higher for longer” mantra, which will likely carry over into 2024. The latest forecast from the CME FedWatch Tool suggests a more than 60% chance that the Fed will keep rates unchanged through the end of the year and then cut rates by a combined 50 basis points in 2024, which is roughly in line with the latest FOMC dot plots. We expect policymakers to cut rates once in June and once again after the election to avoid being accused of partisanship, but a severe recession could lead the central bank to act more aggressively.

Gold Is Back? U.S. government bonds have lost their appeal as a safe-haven asset, as investors are more worried about tighter monetary policy and political uncertainty.

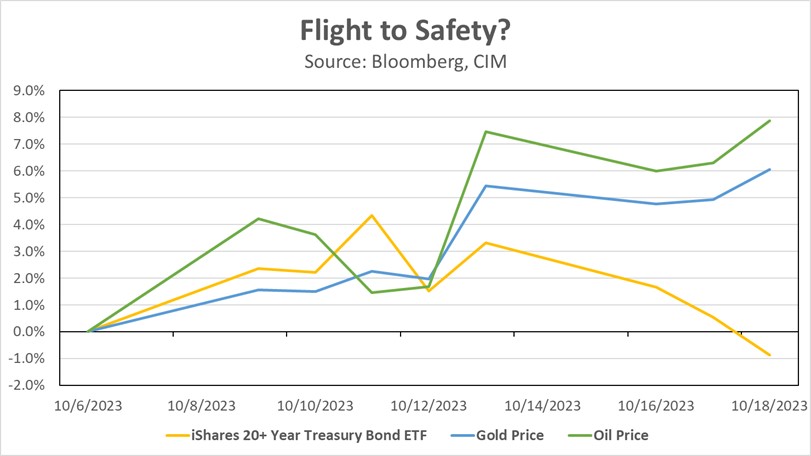

- Oil prices have surged 7.9% since the start of the Israeli-Hamas conflict on October 7. The rally in fuel prices reflects investor fears that expanding strife in the Middle East will lead to supply disruptions and trade tensions. Following reports of the bombing of a Gaza hospital, Iran has called on Middle Eastern countries to halt oil shipments to Israel. Meanwhile, hopes of a diplomatic resolution were dashed after Jordan and Egypt refused to meet with President Biden following the atrocity. While U.S. intelligence suggests that Israel was not responsible for the bombing, it is unclear whether other countries agree.

- Despite a historical preference for 10-year Treasury notes during crises, investors have opted for gold instead in response to the conflict in the Middle East. The yield on the 10-year U.S. Treasury note jumped 10 bps since the outbreak of war, compared with a decline of 25 bps following the Silicon Valley Bank collapse earlier this year. Some of this discrepancy may be related to Fed policy expectations. A war in the Middle East could increase oil prices, leading to inflation; thus, prompting the policymakers to raise interest rates. Meanwhile, the drop in yields following SVB’s collapse was due to optimism that the Fed would back out of its hiking cycle as a way to prevent further damage to the economy.

- In addition to the uncertainty over Fed policy, congressional dysfunction has also weighed on bond prices. On Wednesday, the House failed for the third time to nominate a speaker, erasing some of the intraday gain in 10-year bonds after the release of the Beige book. The situation may improve over the next few days, as bipartisan support has emerged for empowering Speaker Pro Tempore Patrick McHenry to enable Congress to resume budget talks and send aid to Israel and Ukraine. While electing a House speaker would calm nerves, investors are likely to wait for the Fed to assure them that its policy path has not changed before they return to government bonds.

Closer Than Ever? Russia and China have formed closer ties as they try to recruit more countries to join their bloc against the West.

- Russian President Vladimir Putin and his Chinese counterpart Xi Jinping met on Wednesday at the Belt and Road Initiative forum. The two leaders reaffirmed their “no limits partnership” and sought to portray themselves as alternatives to the West. Unlike the United States and Europe, they have yet to condemn the Hamas attack and have instead criticized Israel’s response. There is speculation that Putin and Xi are using the Middle East conflict to win over developing countries with a history of colonialism. Saudi Arabia is likely their biggest target, as they can leverage the Saudis’ relationship with the Palestinians to draw them into their orbit.

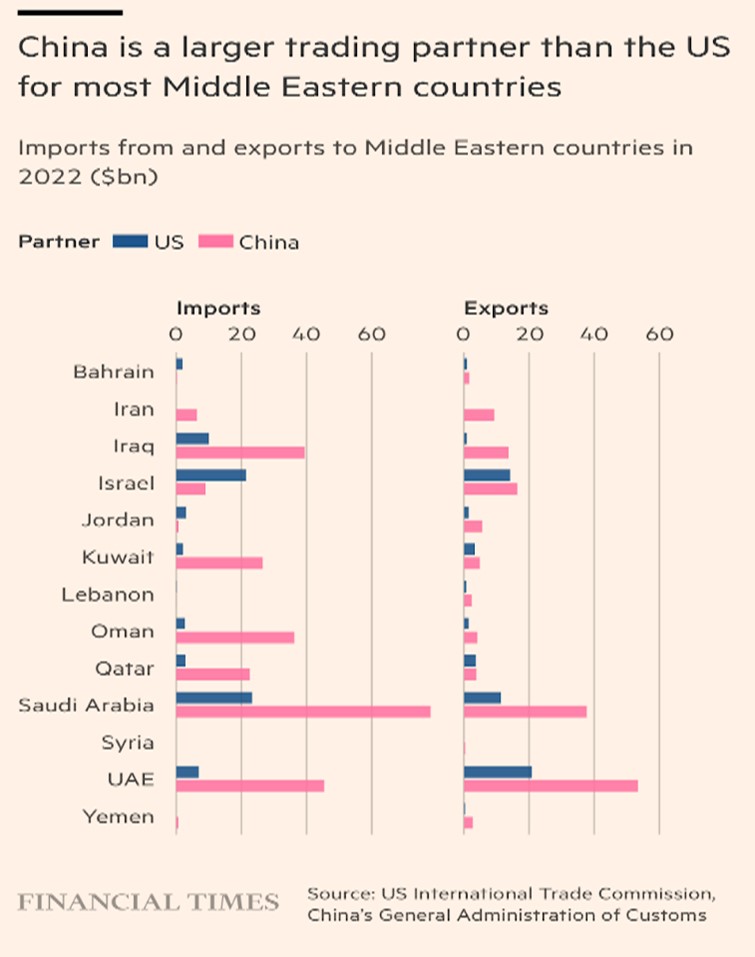

- Over the past few years, Xi Jinping has been trying to convince countries within the Middle East to become less dependent on the West for economic support by expanding China’s investment reach through the Belt and Road Initiative (BRI) and through the expanding the members of its BRICS group. By increasing its economic reach, it has been able to build new relationships with countries within the Middle East and has become a major player in the region. In March, China was able to broker a deal between Iran and Saudi Arabia, ending their long-standing feud. Meanwhile, Egypt issued its first Panda bonds earlier this week, taking advantage of Chinese credit markets.

- The battle for influence in the Middle East is still tilted in the West’s favor, but Russia and China are making gains. China is now the largest trading partner for most countries in the region, and its BRI is expected to increase its investment in the region. If Middle Eastern countries embrace Beijing, the United States will need to spend more resources to keep its allies in the region on its side. This could push Washington to delay its pivot toward Asia. Over time, competition among major powers for influence in the Middle East and other emerging markets could make equities in those regions more attractive.

Other News: Household wealth soared during the pandemic. The increase explains why the economy has been more resilient even as borrowing costs soared over the last few months.