Daily Comment (October 25, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! S&P 500 futures are trading lower before the open and the Diamondbacks made it to the World Series for the second time in franchise history. Today’s Comment starts with a discussion about the resurgence of the S&P 500. Next, we will give our thoughts on the recent rally in bitcoin and China’s hardball tactics with foreign companies. As always, our report includes an overview of the latest domestic and international data releases.

There is Life: The S&P 500 rebounded after briefly testing the 4,200 support level earlier this week, but it doesn’t appear that the asset class is out of the woods yet.

- Strong earnings and positive economic data boosted the large-cap equity index performance on Tuesday. Several companies, including Verizon (VZ, $34.30), 3M (MMM, $90.12), and Coca-Cola (KO, $55.64), reported better-than-expected earnings, lifting sentiment that companies are becoming more profitable. Microsoft’s (MSFT, $330.12) results also supported an improved outlook, with the second-largest company by market capitalization rising 4% overnight after posting strong growth for its cloud services business. Additionally, S&P Global data showed that U.S. manufacturing activity entered expansion for the first time in six months, with the Purchasing Manager Index hitting 51. The report suggests that economic momentum from Q3 may carry over into the next quarter.

- However, negative news for the tech sector has dampened some of the S&P’s momentum. Google parent company Alphabet (GOOG, $140.12) reported a failure in its cloud services business, which overshadowed its estimate-beating revenue and earnings. Investors are concerned that Alphabet may not be able to catch up to rivals Amazon (AMZN, $128.56) and Microsoft, especially as it looks to make gains in generative artificial intelligence. Meanwhile, Meta (META, $312.55) is facing lawsuits from 41 different states and the District of Columbia, alleging that the tech giant has harmed children by making its platform too addictive. The allegation comes as lawmakers from both parties are becoming increasingly concerned with the impact social media is having on society.

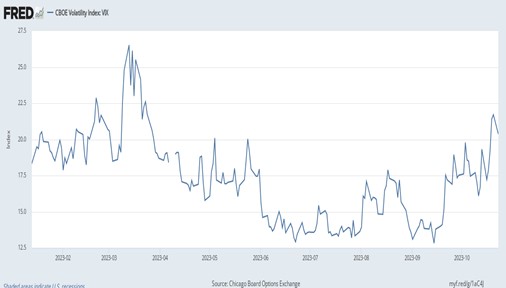

- A sustained rally in large caps is far from assured, given the lingering risks both domestically and abroad. The Federal Reserve has maintained the possibility of another rate hike, defying suggestions that rate increases are coming to an end. Furthermore, concerns about an escalating conflict in the Middle East are growing, with the U.S. issuing a warning to Iran against exploiting the situation in Gaza to target American troops. This heightened uncertainty explains why the CBOE VIX index briefly exceeded 20 on Tuesday, as investors worry about more volatility over the next 30 days.

Crypto Rally: Investors have flocked to digital currencies, drawn by the prospect of exchange-traded funds based on crypto and rising global tensions.

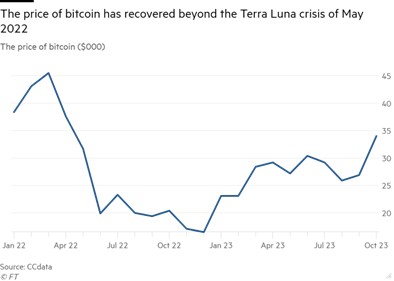

- A federal judge ruled against the SEC in its bid to block Grayscale’s Bitcoin ETF on Monday. The regulator argued that the ETF lacked adequate oversight to detect fraudulent activity and manipulation. Earlier this week, the SEC stated that it will no longer contest the ruling, boosting optimism that it was ready to allow Grayscale’s Bitcoin Trust to become a listed BTC ETF. So far, regulators have not approved a single spot crypto ETF to be listed on U.S. exchanges but have paved the way for similar investment vehicles containing futures for bitcoin and ether.

- The ongoing conflict in the Middle East has prompted investors to flock to digital currencies as safe-haven assets. Bitcoin rose 7% in the days leading up to the court’s ruling and following the outbreak of the Israel-Hamas conflict. Comparatively, gold price futures rose about 8% within the same period. Bitcoin’s strong performance has led to optimism that it may be maturing past the early adoption stage and into a legitimate asset class. Several asset managers have argued that cryptocurrencies can be used to diversify geopolitical risks similar to other hard assets.

- Despite cryptocurrency’s recent momentum, we remain skeptical of its readiness for widespread adoption. Persistently low trading volumes and a 30-day moving average below pre-stablecoin crash levels suggest that confidence in the asset class remains relatively low, making it vulnerable to substantial price fluctuations. Additionally, significant regulatory challenges loom ahead, including demands for more oversight of the crypto industry, especially related to anti-money laundering. Senators Elizabeth Warren (D-MA) and Kristen Gillibrand (D-NY) are pushing their party to take a stand against the industry. Consequently, we believe that more traditional hard assets and commodities are better suited for conservative investors looking to hedge against geopolitical risks.

Companies Must Choose: Beijing is increasingly assertive in pushing foreign companies to lobby their governments for better trade ties with China.

- Chinese regulators opened an investigation into Foxconn (2354.TW, TWD, 53.30), a Taiwan-based Apple (AAPL, $173.44) iPhone supplier, over alleged tax and land violations. The crackdown appears to target Terry Gou, the company’s founder and largest shareholder, who is running as a long-shot independent candidate in Taiwan’s presidential election in January. Although he has stated that he would push to improve ties between the sovereign island and Beijing, he has maintained that he will not be bullied. The probe has unnerved investors, suggesting that Beijing may be preparing to crack down on other foreign multinational companies as well. Shares of the Foxconn’s stock have dropped 2.2% over the past two days.

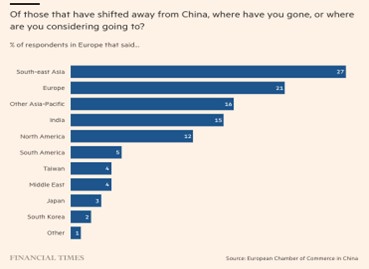

- Beijing’s heavy-handedness may have discouraged Western companies from taking sides in the escalating feud with China. Mercedes-Benz (MBGYY, $16.26) CEO Ola Källenius has walked back his claims that China was a potential growth market by describing it as maturing. Tesla (TSLA, $216.52) CEO Elon Musk has warned that the U.S. no longer has a significant edge over its geopolitical rivals and could be defeated in a conflict. European auto suppliers have advocated for regulators to focus on creating incentives for cheaper car production in Europe instead of imposing tariffs on Chinese car imports. However, many companies have responded to China’s actions by redirecting investments to other countries.

- China’s decision to target companies that do not comply with its demands comes with significant risks. Increased pressure on foreign businesses could lead them to seek out alternatives, undermining China’s efforts to attract foreign investment to resolve its debt problems. Additionally, China’s tactics could encourage governments to increase scrutiny of Chinese investment. U.S. regulators are already cracking down on Chinese partnerships and purchases of American tech companies, and this trend could spread to other industries. The growing friction between the West and China suggests that domestic companies with exposure to the other’s market may become less attractive as global tensions rise.