Daily Comment (October 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start, and the Diamondbacks look to prove doubters wrong in the first game of the World Series. Today’s Comment begins with our analysis of the S&P 500’s recent poor performance, followed by a closer look at the GDP data and rising geopolitical risks in the Middle East and the South China Sea. As always, our report includes an overview of the latest domestic and international data releases.

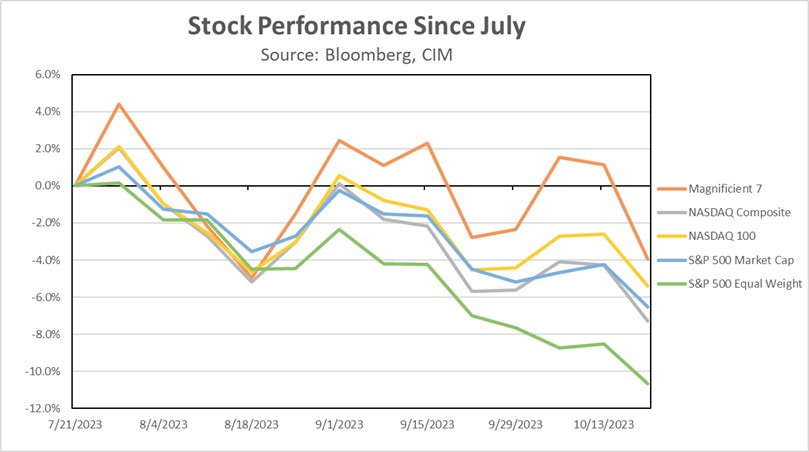

Correction Coming? After getting off to a strong start to the year, large caps may have finally hit an inflection point.

- The S&P 500 closed below its 200-day moving average of 4,238.41 on Thursday, ending the day at 4,179.50. This dip below a key technical level has historically signaled a broader sell-off. The index’s fall was related to a confluence of negative factors, including rising yields on long-duration Treasuries, a war in the Middle East, and a deteriorating outlook for tech stocks. The last of the three has come under scrutiny due to their high valuations relative to earnings, as investors have been willing to pay a premium for companies with strong AI capabilities.

- The Magnificent Seven—Alphabet (GOOG, $123.44), Amazon (AMZN, $119.57), Apple (AAPL, $166.89), Meta (META, $288.35), Microsoft (MSFT, $327.89), Nvidia (NVD, $388.65), and Tesla (TSLA, $205.76)—have seen the least amount of losses since July 21, 2023, outperforming the broader tech sector and the overall S&P 500. Their strong performance is likely due to investor confidence in these companies’ ability to capture market share given their size and expertise. According to an analyst at Bernstein Quantitative, the Magnificent Seven are projected to have profit growth of 33.1% and revenue growth of 10.9% year-over-year, while the remaining companies are predicted to have profit contraction of 8.6% and revenue growth of 0.3%.

- Despite their strong performances, the Magnificent Seven remain more vulnerable to fluctuations than investors may realize, due to their sensitivity to idiosyncratic risk. This was evident in the sell-off in Alphabet and Meta stocks this week, despite both companies reporting strong overall earnings. Alphabet’s cloud business is struggling to meet investor expectations, while Meta’s forward guidance was weakened by changes in the macroeconomic landscape. Investors should keep in mind that the Magnificent Seven’s strong year-to-date performance is due in part to lofty expectations, and it is unclear whether these companies can live up to them. As a result, investors may find value by focusing on other companies with strong fundamentals that are being ignored.

Blowout Q3: The latest GDP report showed that the economy surged in the third quarter in another sign that a recession is not imminent.

- The U.S. economy grew at a robust 4.9% annual rate in the period from April to September, a significant increase from the 2.1% growth in the preceding three months. This sharp rise has raised doubts about the possibility of a recession, as the report showed that consumption remains strong even in the face of rising interest rates. Strong retail sales have boosted optimism that households have not yet run down their pandemic savings, raising the likelihood of a spillover effect into the following quarter. The report was also supported by strong inventories, but this is unlikely to persist.

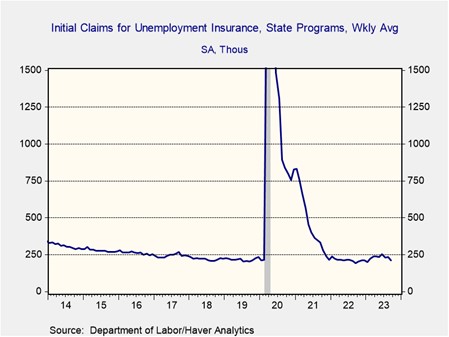

- Despite strong consumption, GDP data shows that spending has shifted to smaller ticket items. Expensive and interest-sensitive goods like new and used vehicles declined in Q3, while recreational goods like TVs and PCs jumped. This may reflect households having more spending power due to higher wages, as firms compete to retain workers. The stubbornly low jobless claims reinforce this view as they show that labor hoarding is still rife throughout the economy. Assuming our assessment is correct, the economy may be more resilient to higher interest rates than investors realize.

- Despite the strong reading, the report is unlikely to sway policymakers at next week’s Federal Open Market Committee meeting. The yield on the 10-year Treasury fell 4 bps to 4.91%. Meanwhile, the CME FedWatch Tool shows that there is an 80% chance that the Federal Reserve will hold rates steady for the rest of the year. The indifference to the report reflects the broader sentiment that the market expects Fed officials to enter a new phase in its policy stance, in which it looks to navigate a soft landing. Projections show that the Fed will look to cut interest rates in the second half of 2024.

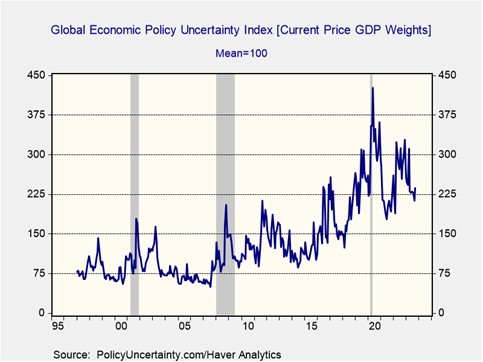

Rising Geopolitical Tensions: The chances of a broadening conflict in the Middle East are increasing, while tensions between the U.S. and China show no signs of abating.

- Israeli forces have undertaken another operation in Northern Gaza, with the aim of neutralizing Hamas fighters and disabling their anti-tank weaponry, as they prepare for an imminent ground invasion. Simultaneously, the U.S. military conducted airstrikes against two facilities located in eastern Syria, which were suspected of having connections with Iran-backed militia groups. These actions by the Israeli and U.S. governments have sparked concerns about the potential for escalating violence across the Middle East, which could result in disruptions in the sales of essential commodities. Following the report, Brent oil prices surged $2 per barrel overnight, hitting $90 per barrel.

- Across the Pacific, the U.S. and China have accused each other of provocations in the South China Sea. The situation started after a Chinese vessel collided with a Philippine boat on Sunday near the disputed Second Thomas Shoal. After the incident, President Joe Biden warned Beijing that the U.S. was willing to defend the Philippines from Chinese aggression. The row escalated on Thursday after a Chinese fighter jet was recorded flying within 10 feet of a U.S. Air Force B-52 bomber. China responded to the allegation by showing a video of a U.S. ship harassing a Chinese navy task group during routine training in the South China Sea.

- Despite strong advocacy for diplomatic mediation, geopolitical tensions and the ever-present risk of miscalculation loom large, significantly heightening the possibility of a major conflict. The situation in the Middle East remains precarious, with uncertainty surrounding the extent of Israel’s invasion of Gaza, while incidents in the South China Sea threaten a more extensive conflict in the Pacific region. Despite recent promising developments, such as a delay in Israel’s invasion and high-level talks between Washington and Beijing, the mounting geopolitical tensions underscore the potential for defense companies to deliver substantial value to investors in the coming years.

Other News: China’s former premier, Li Keqiang, died on Friday. He was seen as a rival of President Xi Jinping and as an advocate of the business class in China.