Daily Comment (October 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently awaiting the release of the jobs report data and Israel’s response to Iran. In sports news, Lionel Messi’s Inter Miami has won the 2024 Supporters’ Shield for the second year in a row. Today’s Comment will discuss the ongoing dockworkers’ strike, how hurricanes can impact inflation, and the implications of the French government’s debt plan. As usual, the report concludes with a roundup of international and domestic data releases.

Union Tension with AI: The ongoing dockworkers’ strike may be a prelude to future disputes over AI and automation.

- US dockworkers have gone on strike at both East and Gulf Coast cargo facilities, demanding higher wages and a ban on automation for certain jobs. The strike is in its early stages, but it appears that workers have the upper hand. President Joe Biden has warned that if employers fail to reach an agreement with workers, it could lead to a man-made disaster. Meanwhile, both Vice President Kamala Harris and former President Donald Trump have expressed sympathy for the workers’ demand for higher wages to offset the rising cost of living.

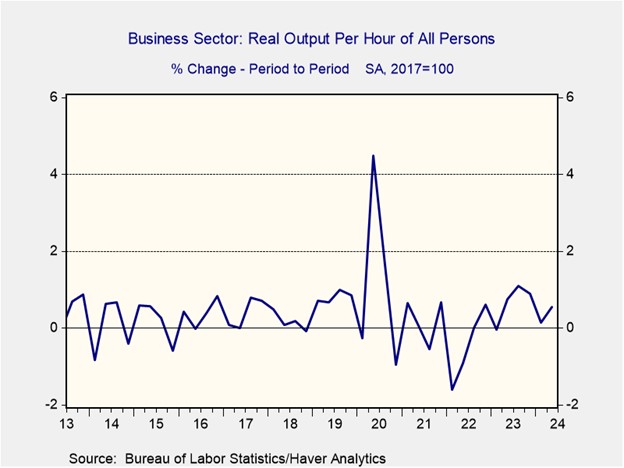

- One of the most overlooked issues in this strike is the role of automation and AI. While lawmakers have primarily focused on immigration as a means of protecting workers, few have specifically addressed the potential for technology to displace them. Politicians’ reluctance to discuss the impact of automation on the job market is linked to the hope that new technology will be crucial in boosting productivity, which can not only help lower inflation but also increase profit margins.

- While the overall impact of AI on jobs may be overstated, the fear is real. According to a study by MIT professor Daron Acemoglu, AI is currently capable of doing only about 5% of jobs. Although this offers some reassurance to workers, it’s unlikely to quell their anxieties as 38% of workers think AI will hurt their jobs. Consequently, resistance to AI integration is likely to intensify in the coming years. This growing opposition could hinder firms’ efforts to increase productivity through AI, potentially leading to a reevaluation of AI’s promise and contributing to future inflationary pressures.

Insurance Costs: The estimate for the damage from Hurricane Helene is increasing, but this might not have as significant of an impact on insurance premiums as many would expect.

- The storm’s total economic losses are expected to reach approximately $35 billion. However, insurance companies are not anticipated to incur significant losses. Unfortunately for most homeowners, the majority of the damage caused by the storm was due to flooding, which is typically underinsured, as most policies only cover large-scale wind damage. Insurance companies in Florida, a region prone to hurricanes, are expecting damages from Helene to result in moderate losses compared to the devastation caused by Hurricane Ian in 2022 and Hurricane Michael in 2018.

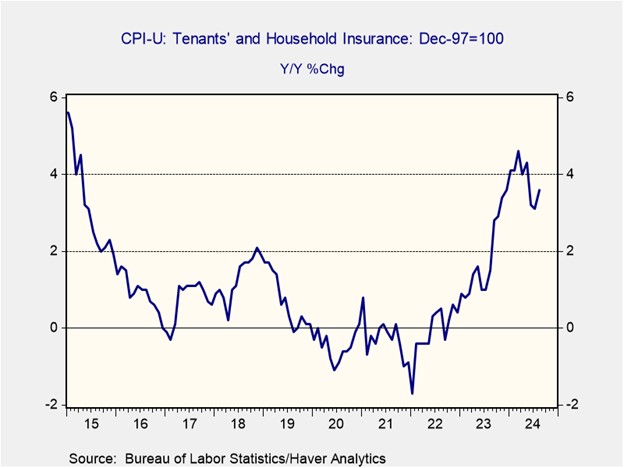

- Although overall price pressures have eased this year, insurance costs remain persistently high. This inflationary trend is largely attributable to several factors: pandemic-related restrictions, rising operational expenses, and escalating repair costs. Unlike many other businesses, insurance companies cannot immediately adjust premiums to offset losses, as policies are typically locked in for a set term. Consequently, they are forced to wait until the renewal period to implement pricing changes that reflect the growing risks in the market, which is why insurance inflation can rise even as other prices are moderating.

- Insurance serves as a poignant reminder of the capricious nature of inflation. Certain factors can dramatically influence price levels without warning, underscoring the necessity for investors to be cognizant of the potential inflation volatility in the years ahead. Economic shocks stemming from natural disasters, geopolitical events, and pandemics are particularly concerning. While Hurricane Helene is not anticipated to influence inflation for the upcoming year, the likelihood of other events affecting it remains elevated, especially as the world transitions away from globalization.

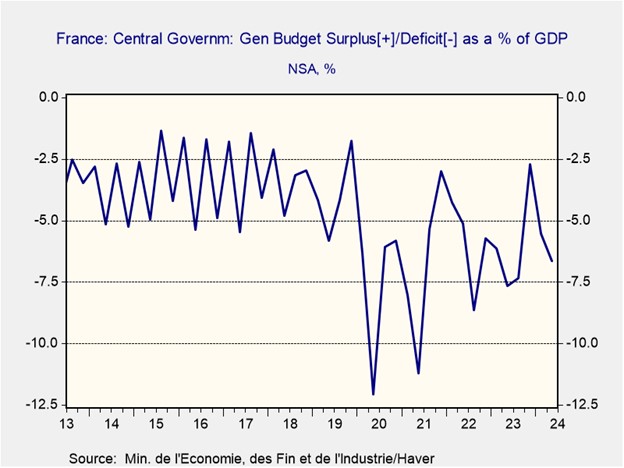

Tackling the Budget: After pressure from Brussels to rein in its budget, it looks like France is finally doing something about it.

- French President Emmanuel Macron has endorsed raising taxes on the country’s largest companies. His shift from his typical pro-business stance comes amid calls for the government to get its fiscal house in order. The government is expected to make around 60 billion EUR ($66 billion) in spending cuts and tax increases for the next budget year. Much of the increased tax revenue will be targeted toward wealthy individuals, large corporations, and activities that are harmful to the environment. Meanwhile, two-thirds of the savings are expected to come from cuts to ministries, local authorities, and the social security system.

- The shift to reduce its deficits comes as France has pushed to extend the deadline for meeting EU deficit targets. The French government is expected to lower its deficit from its current rate of 6% of GDP to 5% of GDP by 2025, with an overall goal of bringing the deficit below the 3% fiscal ceiling by 2029, two years later than it had anticipated. While the plan is not considered ideal, EU officials seem satisfied with the proposal, provided the government can enact the necessary reforms to lend it credibility.

- The shift to make the wealthy primarily responsible for repaying debt shows that governments are becoming less willing to impose austerity measures on the general population. This is a significant change from a few years ago when France increased taxes on the lower and middle classes, leading to the Yellow Vest protests. Targeting the wealthy and corporations may result in capital outflows to countries with more favorable tax policies and could lead to increased resistance to green initiatives in Europe.

In Other News: Microsoft-backed startup OpenAI has asked its investors not to support rival xAI as it looks to ensure dominance within the space. New Japanese Prime Minister Shigeru Ishiba downplayed the need for another rate hike due to the state of the economy, which has weighed on the yen (JPY). Additionally, Bank of England Governor Andrew Bailey has suggested that the central bank may favor cutting rates aggressively if inflation shows signs of improving.