Daily Comment (October 4, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with U.S. news, with a focus on last night’s historic vote in Congress to remove House Speaker McCarthy. We next review a wide range of other international developments with the potential to affect the financial markets today, including a bond market intervention by the Bank of Japan and big, new military spending plans by Russia.

U.S. Politics: In a historic vote last night, the House of Representatives voted to end Republican Kevin McCarthy’s tenure as Speaker, leaving the chamber in chaos. As is tradition, all 208 voting Democrats cast their ballot to remove McCarthy, but they were also joined by eight far-right Republican rebels who have criticized McCarthy for being insufficiently committed to sharp cuts in federal spending and other conservative causes. The votes against McCarthy totaled 216, just enough to beat the 210 Republicans who voted to keep him in his position.

- McCarthy quickly announced that he will not try to reclaim his post, and House Republicans said they would leave Washington and return next week to vote on a new Speaker. That leaves the chamber without a leader for the time being.

- McCarthy had earlier named North Carolina Rep. Patrick McHenry as the pro tempore Speaker, but McHenry will not have the full powers of the office.

- The result will likely be another messy Republican battle for the Speakership. Currently, the front-runners are probably McHenry, along with the Republicans’ #2 and #3 leaders in the chamber: Rep. Steve Scalise of Louisiana and Rep. Tom Emmer of Minnesota. It isn’t clear whom the hard-right Republican rebels would support.

- Press reports indicate the Democrats’ decision not to save McCarthy stemmed largely from anger over his efforts to placate the hard-right members of his caucus. Going forward, key questions include whether the Republicans’ chaos will discredit their party and boost the Democrats politically.

- For the economy and financial markets, a central question is how the leadership vacuum will affect the negotiations over the federal budget for Fiscal Year 2024. The weekend’s stopgap spending bill has authorized federal outlays at FY 2023 levels only until the middle of November. If the Republicans and Democrats can’t agree on appropriations after that, there would be renewed risk of a partial government shutdown.

U.S. Bond Market: Investors continue to sell off fixed-income assets, pushing prices lower and boosting the yield on the benchmark 10-year Treasury note to a fresh 16-year high of 4.831%. The two-year Treasury note has risen more tepidly to about 5.159%, narrowing the 10-2 yield inversion at just 32 basis points. As we had long warned, investors are finally repricing bonds downward after realizing the obligations had been priced too richly in the face of persistent inflation pressures and the Fed’s intention to hold interest rates higher for longer.

- Separately, CBOE Global Markets (CBOE, $157.24) and S&P Dow Jones (SPGI, $356.42) said they will launch four new indexes aimed at tracking the volatility of U.S. and European corporate bonds. The indexes will launch next week.

- The companies hope the new indexes will match the success of the original VIX for stocks. Over time, options or other financial products tied to the new bond VIX indexes are likely to become available.

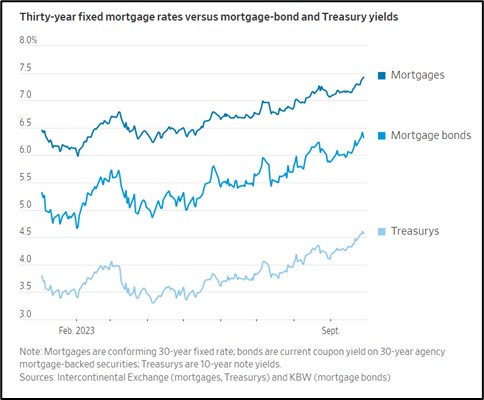

U.S. Housing Market: With bond yields rising, investors probably expect the interest rate on residential mortgages to be rising in tandem. In reality, mortgage rates have been rising even faster than the yield on the 10-year Treasury note, which is their typical benchmark. The reason is that even as Treasury yields have been rising, the Federal Reserve and commercial banks have been actively unloading their holdings of the mortgage-backed securities, driving up MBS yields. Since MBS issuance funds so much of the nation’s mortgages, the result is that residential mortgage rates could well be on their way to 8% or more.

Global Airline Industry: Reports say airlines around the world are dealing with a potentially costly scandal in which they inadvertently bought engine replacement parts with falsified safety certificates from what appears to be a phantom company in the U.K. The airlines are now scrambling to identify and replace any uncertified parts that have been installed on their aircraft. The questionable parts have been found on approximately 100 planes so far, forcing the airlines to take them out of service, pull their engines, and replace the parts.

Japanese Bond Market: As Japanese bond yields rise along with the upward trend in U.S. yields, today the Bank of Japan offered to buy an extraordinary 1.9 trillion JPY ($12.7 billion) of Japanese government bonds with maturities ranging up to 10 years. The unexpectedly large purchases appeared to be tied to the BOJ’s controversial yield curve control policy, in which it is keeping short-term interest rates negative while capping the yield on the 10-year JGB at 1%.

- Despite the intervention, however, the yield on the 10-year JGB rose to 0.783%, as investors increasingly bet that the central bank will soon have to abandon its YCC policy.

- Meanwhile, the yen today strengthened by 1.8% to 147.3 JPY per dollar ($0.0068), compared with yesterday’s value of 150 JPY per dollar ($0.0067).

Japanese Industrial Policy: As Tokyo continues working to secure a domestic supply of advanced semiconductors in the face of China’s growing geopolitical threat, the Industry Ministry yesterday announced it will provide up to 192 billion JPY ($1.3 billion) in additional subsidies for U.S. semiconductor manufacturer Micron Technology (MU, $67.83) for its new memory-chip factory in Hiroshima Prefecture. That comes on top of the 46.5 billion JPY ($310 million) in aid to Micron that the government announced previously. Tokyo also continues to provide enormous subsidies to build up a domestic supply of advanced logic chips.

European Union: The Financial Times carries an interesting report today saying that some home buyers who used to flock to places like Portugal, Spain, or the South of France for the warm, sunny weather are now eying properties in northern regions seen as less susceptible to global warming. After a summer of unusually hot weather and wildfires in southern Europe, northern regions like Brittany in France offer not only cooler weather but also much cheaper prices—for now. The article is a reminder that even if you’re skeptical about climate change, the markets you participate in could be affected by others who are trying to respond to it.

United Kingdom: In a speech at the Conservative Party’s annual conference, Prime Minister Sunak offered several red-meat policy changes for the right wing, including cancellation of an expensive rail line extension to the northern city of Manchester, tighter standards for secondary education, and tougher restrictions on youth smoking. The proposals come just weeks after Sunak got a bump in the opinion polls from easing Britain’s climate-stabilization policies. Nevertheless, Sunak and the Conservatives continue to trail the support for Keir Starmer and his Labor Party.

Russia: The government’s draft budget for 2024 indicates the military will get 29.4% of all spending, equal to about $109 billion. That’s more than double the 14.4% of the budget that the military got in 2021, before the Kremlin launched its invasion of Ukraine. In RUB terms, the proposed military spending in 2024 would be about three times greater than in 2021.

- Since Russia has a long history of hiding some military spending in ostensibly civilian budget accounts and off-budget, it is likely that the country’s true military spending is even greater than indicated.

- As such, Russia’s defense burden is now clearly a strain on Russian state finances. To fund the enormous new military outlays associated with the war in Ukraine, Russian officials have said they will freeze spending on healthcare and education, while cutting spending on infrastructure and other economic development projects. They have also indicated they will have to increase borrowing.