Daily Comment (October 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently processing the latest comments from Fed officials as it looks for further evidence of a soft landing. In sports news, the Minnesota Lynx were able to knock out the Connecticut Sun to make it to the WNBA finals. Today’s Comment will discuss the growing crackdown on US tech firms, why lower rates may not be enough to boost economic optimism, and signs of easing in the Middle Eastern and European conflicts. As usual, our report will conclude with a roundup of domestic and international data releases.

Breakup of Big Tech: US officials are considering Google as a potential target for antitrust action as they seek to take a stronger stance against monopolies.

- The US Department of Justice is contemplating asking for court approval to compel Google to divest portions of its business. This potential breakup aims to curb the company’s dominance in web search and could require Google to share the underlying data used for its search engines and other AI products. The DOJ’s action follows an August court ruling that found Google guilty of monopolizing online search markets. While Google is expected to appeal the decision, the judge has allowed the DOJ to proceed with potential remedies for the violation.

- The crackdown on Google is part of a broader effort by US regulatory agencies to increase competition among Big Tech companies. The Department of Justice is also suing Apple for allegedly imposing restrictions on software and hardware to hinder rival competition and discourage consumers from switching phones. Additionally, the Federal Trade Commission has been granted permission to proceed with its case against Amazon, accusing the company of using its monopoly power to charge consumers higher prices both on and off its platforms.

- Regulatory scrutiny of Big Tech companies is likely to persist in the coming years, as these firms increasingly resemble the Wall Street banks of the previous decade. Although we don’t anticipate a major upheaval among the top tech names, regulatory compliance may necessitate changes in business practices. These changes could hinder efforts to maintain a competitive edge and weigh on earnings growth. While it’s premature to completely abandon Big Tech stocks since these court cases are far from resolved, investors may find it useful to explore other opportunities.

Rainy Day Savings: The decision to ease policy has helped protect household balance sheets, but time will tell if it will lead to further economic stimulus.

- The decrease in mortgage rates led to a significant increase in refinancing activity last month, according to the mortgage automation company Optimal Blue. Homeowners drove the surge, with rate-and-term refinance loans increasing by a remarkable 700% from the previous year, while cash-out refinancing rose by 50% in the same period. Borrowers used the drop in interest rates to lower their mortgage payments and consolidate some of their debt. In the same month that refinancing jumped, revolving credit experienced the most significant monthly drop since March 2021.

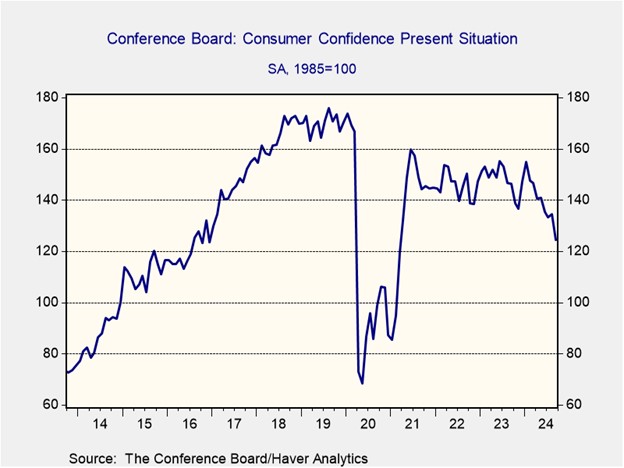

- The improvement in household debt levels is encouraging, but it may also indicate economic concerns. According to the latest Conference Board Consumer Confidence report, consumers have become more pessimistic about the labor market. A large number of survey participants mentioned that they were having a harder time finding jobs, and fewer people said that there were plenty of job opportunities available. These worries about the job market caused consumers’ confidence in their current situations to decrease to the lowest level since the beginning of the pandemic.

- The impact of the Fed rate cuts will depend on consumer confidence in the economy. If households believe that the economy is strong, then they will likely increase consumption using their improved financial position. However, if they think the economy is starting to stall or weaken, then they may be more inclined to wait until everything improves before increasing their spending. As a result, it may take some time before the easing starts to have an effect on the economy. Nevertheless, the robust September jobs report suggests that the Fed rate cut may have come in time to prevent an outright recession.

Tensions are Easing: There are indications that the warring countries in Europe and the Middle East may be open to reaching a settlement.

- On Tuesday, it was reported that Ukrainian President Volodymyr Zelensky may be open to coming to the negotiating table to discuss an end to the war with Russia. The report comes as Ukraine tries to keep Russian troops at bay in the east, while also trying to hold onto Russian territory in its border region. In the Middle East, Hezbollah has dropped its demand for a truce in Gaza as a condition of any ceasefire. This decision comes after it was reported that Israel had killed the group’s leader Hassan Nasrallah as well as his successor.

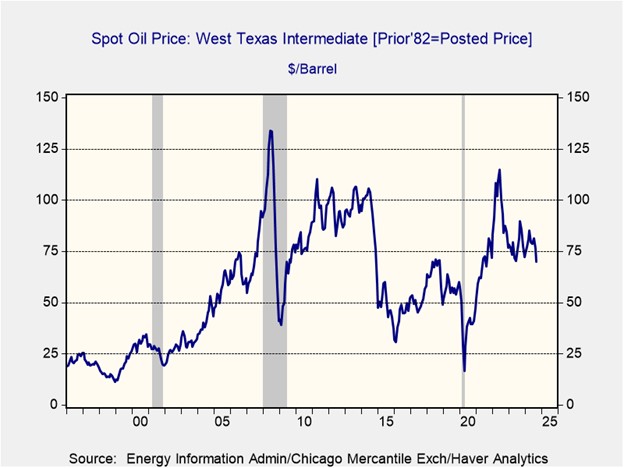

- A resolution to the ongoing conflicts could potentially lead to a decline in commodity prices, especially crude oil. A ceasefire between Israel and Hezbollah could reduce the likelihood of an Iranian attack on oil facilities, which has been a major concern following Iran’s recent missile barrage. Additionally, ending the conflict in Ukraine could enable Russia to resume selling its crude oil on the global market without sanctions. As a result, optimism about a reduction in tensions has already led to a pullback in crude prices, which fell by 5.3% on the day.

- While both outcomes are desirable, the resolution of the Ukrainian conflict appears to be more likely. Unlike Israel, Ukraine is not negotiating from a position of strength. It has likely maximized its gains from the conflict with Russia and should therefore engage in talks while it still has leverage. In contrast, Israel may be more inclined to demand further concessions from its adversaries as it continues to pressure them. However, the United States is likely to urge both parties to negotiate at some point, suggesting that the conflict may not extend significantly into 2025.

In Other News: Federal Reserve Vice Chair Philip Jefferson mentioned that the risk to the labor market and inflation remains balanced. This indicates that the central bank may be shifting its focus away from inflation and toward preventing an undesirable increase in the unemployment rate. US Secretary of State Antony Blinken is heading to Laos for the ASEAN summit. The White House aims to reassure its Asian allies of its commitment to their security, even as China continues to escalate tensions in the South China Sea.