Daily Comment (October 19, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] It’s a relatively quiet morning on the macro front. Chinese data came in on forecast to slightly weaker than expected. While GDP rose 6.7% annually, as expected, industrial production rose 6.1% annually, weaker than expected.

Yesterday afternoon, the Treasury International Capital (TIC) net monthly flows report was released. The TIC report shows almost all international capital flows in and out of the country, including Treasury, bond, equity and other financial instrument flows. Total net TIC inflows rose $73.8 bn in August compared to the $118.0 bn purchases seen in July. At the same time, net long-term TIC flows, which mostly include Treasuries, rose $48.3 bn compared to the $102.8 bn. Historically, long-term TIC flows increase alongside market volatility and falling international equity sentiment. August’s moderating inflows indicate that international sentiment is improving as fewer investors are seeking the safety of Treasuries.

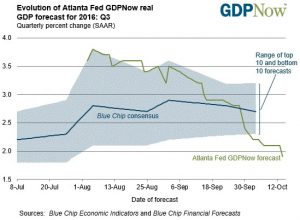

September domestic housing data disappointed this morning, with multi-family housing starts falling 40.8% annually (see below). Despite continued strength in single-family starts, housing in general is shaping up to be a drag on economic growth. The chart below shows the Atlanta Fed GDPNow series. It does not yet include this morning’s housing data. We would expect the weak housing data to add to the lower-trending GDPNow forecast.

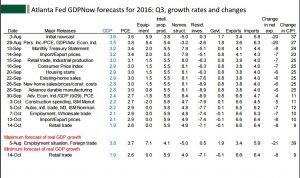

The chart below shows the revisions and contributions to the forecast. Before the starts data, residential investment was the second largest drag on the economy after net exports.