Daily Comment (September 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some interesting new research on how much the Chinese are spending on their military — an issue that has raised concerns about China’s intensions, which helped spawn global fracturing. We next review several other international and US developments with the potential to affect the financial markets today, including signs that the Bank of Canada may be ready to embark on aggressive interest-rate cuts and new reporting on how utility-sized batteries helped the US electrical grid handle near-record demand this summer.

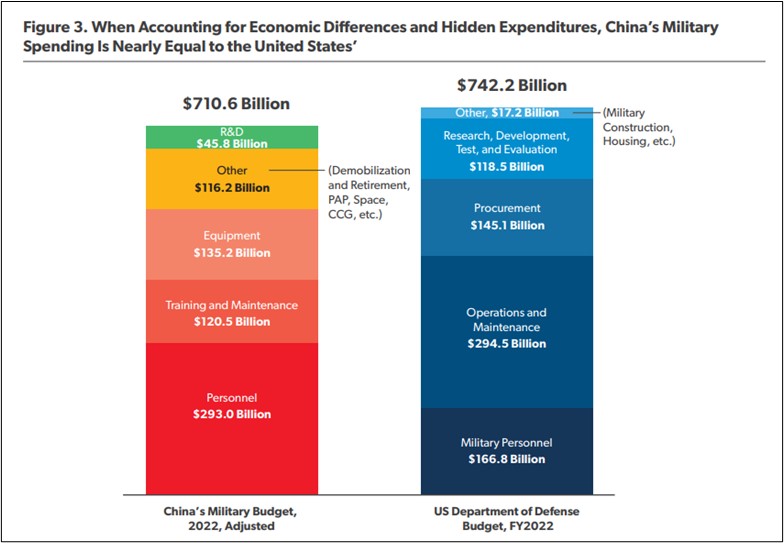

China: A recent study by the American Enterprise Institute (AEI) estimates that China’s true military spending is about three times bigger than it admits publicly and rivals that of the US. Adjusting Beijing’s published defense budget to account for hidden military outlays, defense industry subsidies, and price distortions, the study finds that China’s all-in defense spending in 2022 was $710.6 billion, almost matching the US Department of Defense’s budget of $742.2 billion and rivaling the US’s all-in spending of $860.7 billion.

- Like the Soviet Union during the Cold War, China currently releases only minimal information on its defense spending. The few figures Beijing does release are widely seen as under-counting China’s military effort.

- The AEI estimate is consistent with Congressional statements suggesting that the CIA believes China’s all-in defense spending is around $700 billion per year.

- Leaders in Beijing almost certainly want to replace the US as the global hegemon eventually. For now, however, China remains more like a regional power, with a defense sphere covering roughly the eastern half of the northern hemisphere, or one-quarter of the earth’s surface. If the AEI estimate is correct, China’s military spending is now more than $14,000 per square mile of its defense sphere.

- The US, in contrast, is still the global hegemon, with a defense sphere covering the entire globe excluding Antarctica (which is nominally neutral). US military spending today amounts to only about $4,800 per square mile of its defense sphere.

- The enormous resources that China is pouring into its military within the East Asian region is one reason why countries around the world have become more fearful of Beijing’s intentions. The Chinese military expansion is therefore a key reason why the world is fracturing into relatively separate geopolitical and economic blocs, with big implications for the global economy and financial markets.

(Source: American Enterprise Institute)

(Source: American Enterprise Institute)

China-Philippines: On Sunday, the Philippine coast guard ship Teresa Magbanua, which had been anchored at a disputed shoal in the South China Sea since April to assert Manila’s sovereignty, returned to a Philippine port for repairs and supplies. Manila said the ship will soon return to the disputed shoal, but China is likely to swarm the area in the meantime with its own vessels, potentially setting the stage for a dangerous new crisis.

Russia-Ukraine: Russian forces today continue their counteroffensive against the Ukrainians who have seized some 1,200 square kilometers of Russia’s Kursk region. However, they have apparently only taken back about 63 square kilometers. Since one key reason for the Ukrainian incursion was to gain a bargaining chip for future negotiations, the question now is how tenaciously the Ukrainians will fight to hold the area and what military resources they might lose in defending it.

France: President Macron has nominated his outgoing foreign minister, Stéphane Séjourné, to be France’s next EU commissioner. The move followed a deal in which European Commission chief Ursula von der Leyen told Macron she would give France a more powerful commissioner post if Macron would sack France’s previous commissioner, Thierry Breton, who is a political enemy of von der Leyen. Upon hearing of the deal, Breton resigned, opening the way for Séjourné. (A bit hardball? Yes. But this is why we love French politics.)

Canada: In an interview with the Financial Times, Bank of Canada Governor Tiff Macklem said his policymakers are increasingly concerned about the country’s weakening labor market and the prospect for further declines in oil prices. With consumer price inflation now almost back down to the central bank’s target of 2.0%, Macklem’s statement sets the stage for further and/or more aggressive interest-rate cuts over the coming months.

Argentina: In a speech yesterday, President Milei proposed a 2025 budget with a primary surplus (i.e., revenues minus outlays excluding interest payments) of 1.3% of gross domestic product. Milei’s austerity program produced a primary surplus of about 1.4% of GDP in the first seven months of 2024, but political and popular opposition is rising, and his 2025 goals depend on a dramatic increase in economic growth and a sharp decline in price inflation. It is not yet clear whether he can continue his reforms and rein in Argentina’s destabilizing debt.

United States-China: The Biden administration on Friday proposed a rule change that would dramatically tighten up the “de minimis” tariff exemption, which allows foreign producers to ship goods directly to US customers if the shipment’s value doesn’t exceed $800. The exemption was used by low-cost consumer goods producers in China, such as Shein, to send about one billion tariff-free shipments to the US last year, creating competitive challenges for US producers.

US Monetary Policy: The Fed begins its latest policy meeting tomorrow, with its decision due on Wednesday at 2:00 PM ET. The policymakers are widely expected to cut the benchmark fed funds interest rate at least 0.25% from its current range of 5.25% to 5.50%. Of course, some investors are still looking for a cut of 0.50%, but we think lingering concerns about price inflation will keep the policymakers from being that aggressive.

US Electrical Grid: Despite record-high temperatures and strong electricity demand for air conditioning this summer, a Wall Street Journal article today shows the US electrical grid managed to handle the load with relatively few problems. The article tags the success largely to recent investments in both renewable energy, such as solar and wind farms, and battery storage, especially in California and Texas. The surprisingly critical role played by batteries suggests investors will continue pouring funds into battery makers and battery materials.

US Technology Industry: In another article today, the Journal highlights a little-noticed announcement as Apple rolled out its new iPhone last week. According to the company, the Food and Drug Administration has approved use of its AirPods Pro 2 as a hearing aid. Once Apple releases the required software update this fall, an AirPod Pro 2 will be a medical device. It also could well become one of the most popular, low-cost, over-the-counter hearing aids on the market and open a whole new market for consumer tech firms.