Daily Comment (September 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that China has purportedly found a big, new deposit of rare earth minerals, possibly further cementing its lock on this key resource as the world electrifies. We next review several other international and US developments with the potential to affect the financial markets today, including a proposed European Commission cabinet that could lead the European Union toward adopting French-style economic policy and a few words on the fallout from the second assassination attempt against former US President Trump.

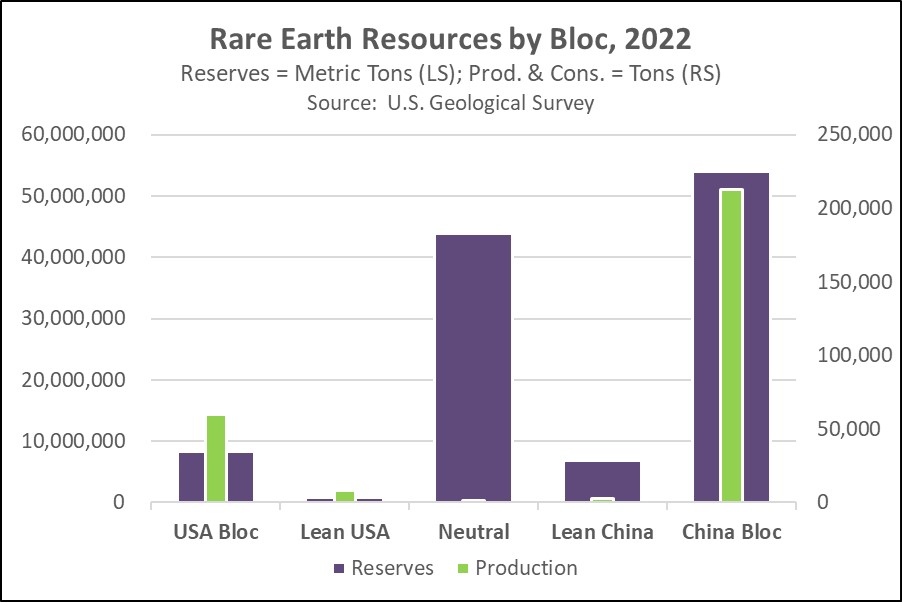

China: A Chinese mining firm told an international conference last week that it has discovered a 5-million-ton deposit of rare earth minerals in the southwestern Sichuan province. If confirmed, the find would increase China’s recognized reserves of rare earths by approximately 5%.

- Rare earths are a critical class of minerals for the electrified economy of the future, and China and its geopolitical bloc already account for the bulk of the world’s reserves, production, and refining.

- The new reserves would further boost China’s control over the key minerals, increasing the risk that Beijing could weaponize the minerals. Indeed, Beijing has already started to clamp down on exports of the minerals to the US and its allies.

United States-Japan-China: Washington and Tokyo are reportedly close to a deal that would cut exports of advanced semiconductor manufacturing equipment from Japan to China. Washington has also pressured The Hague to cut China’s access to Dutch exports of such equipment. The US demands aim to limit China’s economic and military development, but reports say Japan is especially worried that China could retaliate for such a deal by cutting off exports of key minerals, as discussed above.

Japan: The yen (JPY) yesterday appreciated to 139.56 per dollar ($0.0717), marking a 13.5% rise in just the last two months and leaving it at its highest level in more than a year. The appreciation largely expects rising expectations for an aggressive 0.50% interest-rate cut by the Federal Reserve on Wednesday.

European Union: European Commission President von der Leyen today revealed her nominees for the commissioners who will fill out her cabinet. In the EU system, each member country gets to appoint a commissioner, and the commission president gets to decide what portfolio each will get, subject to approval by the European Parliament. In her nominating statement, von der Leyen vowed her commission would focus on economic competitiveness and defense, while de-emphasizing the climate policies that were prevalent in her first term.

- France’s nominee, Stéphane Séjourné, who is a close ally of President Macron, will lead EU industrial strategy, with a charge to focus on investment and innovation. Under the last-minute deal between Macron and von der Leyen that we noted yesterday, Macron will now have increased influence over EU economic policy, while von der Leyen will be rid of former French Commissioner Thierry Breton, a bitter political rival.

- Spain’s Teresa Ribera, the commission’s most senior Socialist, will be in charge of EU competition policy, with a charge to modernize it and develop a new state-aid policy.

- Slovakia’s Maroš Šefčovič will head up the EU’s foreign trade policy.

- Lithuania’s Andrius Kubilius will have a newly created post for EU defense policy.

United Kingdom-European Union: New modeling by an Aston University economist shows that British trade with the EU has plummeted after Brexit and the UK-EU Trade and Cooperation Agreement that came into force in 2021. According to the study, UK exports to the EU are now 17% lower than they would have been without Brexit, while imports from the EU are 23% lower. Prime Minister Starmer has ruled out rejoining the single market or forming a customs union with the EU, but the report will likely put new pressure on him to improve UK-EU trade.

United Kingdom: As British businesses increasingly worry that the government will impose new taxes to close its big fiscal deficit, Prime Minister Starmer yesterday insisted next month’s budget will include no provisions that would hurt economic growth. However, since Starmer has now ruled out increases in income tax, value added tax, corporation tax, and employee national insurance, it appears that he may be setting the stage for increased taxes on capital gains or assets held by the wealthy.

US Politics: As we continue to monitor the aftermath of the second assassination attempt against former President Trump on Sunday, we are struck by two issues.

- First, there was very little market reaction to the incident either Sunday or Monday. Volatility measures remained relatively low. In a sense, that is disturbing, since it suggests the markets and perhaps the broader society is becoming desensitized to political violence. Of course, a successful assassination attempt could well have a bigger impact.

- Second, the reports we’ve seen so far suggest the would-be assassin traversed a wide range of political positions and grievances over time, similar to the first attempted assassin. Whether or not that is ultimately confirmed, there will be plenty of fodder for accusations on either side of the political divide, which could exacerbate political tensions as the November election approaches. In other words, the relative calm in the markets yesterday could still give way to market volatility in the coming weeks.

US Monetary Policy: The Fed begins its latest policy meeting today, with its decision due tomorrow at 2:00 PM ET. The policymakers are widely expected to cut the benchmark fed funds interest rate at least 0.25% from its current range of 5.25% to 5.50%. Of course, some investors are still looking for a cut of 0.50%, but we think it’s more likely that lingering concerns about price inflation will keep the policymakers from being that aggressive.

US Labor Market: Amazon yesterday told its full-time office workers that they must be on site five days a week beginning in January. The move is one of the most aggressive back-to-office directives among US companies. If successful, the directive could prompt a more general return to the office, which would benefit both office building owners and related service businesses surrounding major office buildings.