Daily Comment (September 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news of a new Western alliance to help develop strategic mineral resources outside of China’s control. We next review several other international and US developments with the potential to affect the financial markets today, including a surprise win for the German ruling party in state elections yesterday and potential new US restrictions against automatic driving and vehicle communications technology from China and Russia.

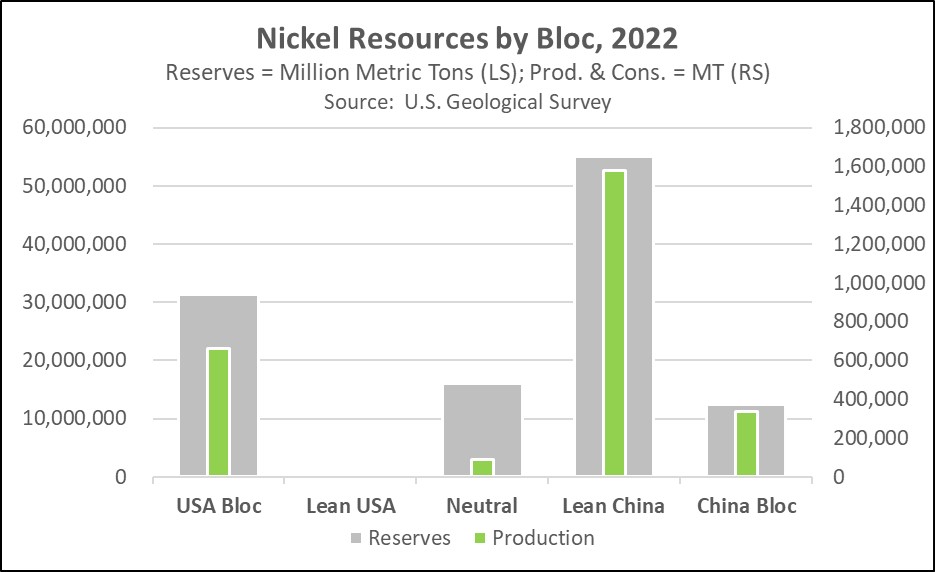

Global Strategic Minerals Market: On the sidelines of the United Nations’ General Assembly in New York this week, the European Commission and 14 allied countries ranging from the US to Australia will announce a new Minerals Security Partnership (MSP) to finance strategic mineral projects around the world. To reduce China’s near monopoly on the supply of many key minerals, MSP participants will direct their development finance and export credit agencies to work with private industry in support of projects such as a new nickel mine in Tanzania.

- Now that the US and rest of its bloc have come to perceive the military and economic threat from China over the last decade or so, they have increasingly imposed trade, capital, and technology restrictions against Beijing. As we have noted in the past, the China bloc and the China-Leaning bloc will likely respond by weaponizing their chokehold on key minerals in the coming years.

- The US and allied governments recognize that threat and are working to reduce it. A key question for investors is whether those allied efforts will help shield Western companies from potential supply disruptions and/or create new opportunities in the basic materials or industrial sector.

United States-Japan-Australia-India: At the “Quad” alliance summit over the weekend, the US, Japan, Australia, and India approved a plan for joint coast guard patrols in the Indo-Pacific region starting in early 2025. Under the plan, coast guard vessels from the Quad countries would be jointly manned by US, Japanese, Australian, and Indian personnel as they patrolled against illegal fishing in the region.

- Although the patrols would be ostensibly against illegal fishing, the focus almost certainly would be on Chinese vessels, which have been particularly aggressive and numerous in the Indo-Pacific fishing grounds.

- The joint crews are clearly meant to send a message to Beijing that if it continues its aggressive efforts to assert sovereignty over the region, it will have to deal with all four Quad members, rather than just one.

- The move, therefore, is likely to raise tensions with Beijing and lead to further decoupling between the US and Chinese blocs, with big risks for global investors.

United States-China-Russia: As early as today, the US Commerce Department is expected to unveil new rules banning the use and testing of Chinese and Russian technology for automated driving or vehicle communications. The new restrictions aim to keep the Chinese and Russians from being able to track, spy on, or sabotage US drivers remotely — a concern heightened by Israel’s attack last week on Hezbollah militants using compromised pagers and walkie-talkies.

- The US and allied governments have long worried about China-bloc countries infiltrating internet-connected equipment, from port cranes to electrical-grid computers, to spy on the West or be able to disable those systems in time of conflict. After the Israeli attack, it is now better understood that connected products, from cars and phones to refrigerators, can also be used for highly targeted kinetic attacks if their supply chains are compromised.

- In effect, Israel may have opened Pandora’s Box, which is now internet-connected. Having seen a successful kinetic attack using connected equipment whose supply chain was compromised, state and non-state actors around the world today are almost certainly exploring how they could do the same.

- In response, the US and other Western governments will impose even more restrictions on using connected goods or components from abroad. We suspect this will lead to further global fracturing as countries bring even more production back home or at least back to the friendly countries in their own geopolitical and economic bloc, despite the cost. As we have noted before, the result will be shortened, less efficient supply chains, higher and more volatile price inflation, and higher and more volatile interest rates.

Israel-Hezbollah: Following Israel’s attacks on Hezbollah last week, the militants dramatically increased their tempo of missile and drone strikes against Israel over the weekend. They also struck Israeli targets much farther to the south than they previously had and claimed the volley was only the beginning of a new phase. Israeli Prime Minister Netanyahu warned of even stronger attacks by Israel. In sum, there seems to be an increasing risk of a broader, more intense conflict in the region that could draw in the US and other regional powers and be highly destabilizing.

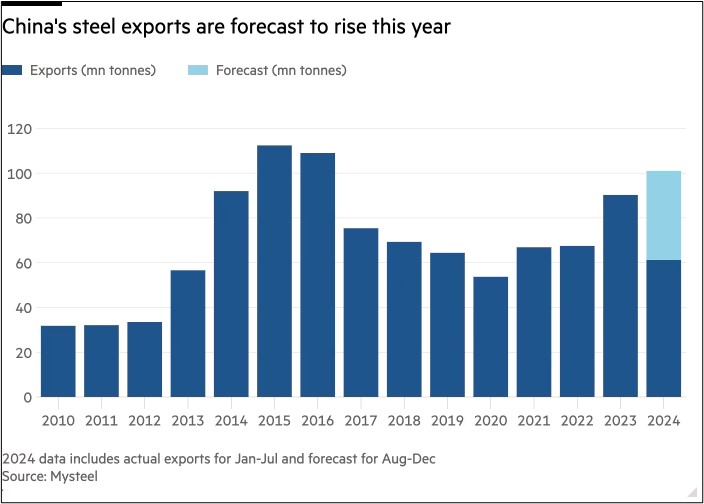

European Union-China: As the EU considers serious antidumping tariffs against the growing flood of Chinese electric vehicles, an EU industry group representing steelmakers has appealed for protection against a growing wave of metal imports from China. If the appeal results in a new antidumping investigation by the EU or eventual tariffs, it would signal further EU-China trade tensions and increased risk of a trade war that could hurt companies on each side.

Eurozone-Italy-German: Italian lender UniCredit said it has lifted its position in Germany’s Commerzbank to 21%, up from the 9% that unsettled the German government when it was announced two weeks ago. UniCredit has also applied to the European Central Bank to increase its holding in Commerzbank to 29.9%. The moves signal that UniCredit may be prepping a hostile takeover, which, if successful, could spur a new round of bank consolidation in the eurozone.

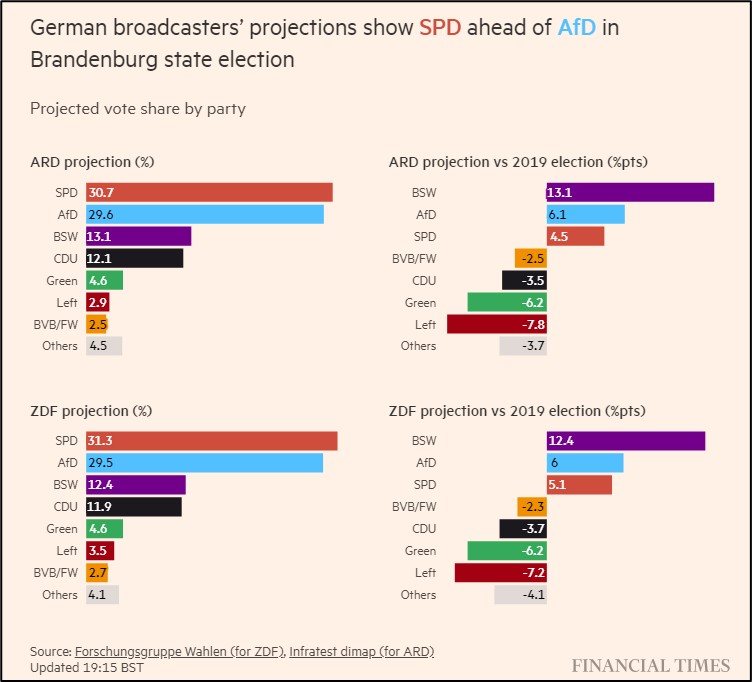

Germany: In Brandenburg’s state elections yesterday, the ruling center-left Social Democratic Party (SPD) is on track to eke out a win, with a projected 31% of the ballots, just ahead of the right-wing populist Alternative for Germany (AfD) with 30%. The far-left BSW party appears to have jumped to 13% of the vote. If the SPD’s win is ultimately confirmed, it would provide a reprieve for Chancellor Scholz and at least postpone new elections in the country.

Sri Lanka: In yesterday’s general election, Marxist candidate Anura Kumara Dissanayake won the presidency with about 42% of the vote, versus 33% for his closest rival. Dissanayake’s win marks a major turnaround from his dismal showing in the 2019 election, partly reflecting the electorate’s anger at traditional politicians who sparked an economic crisis in recent years. Going forward, however, the new president may have trouble pushing a fully leftist agenda, as he is required to name his cabinet from members of parliament, where his party has very few seats.

US Fiscal Policy: Republican and Democratic leaders in Congress yesterday agreed to a stopgap spending bill to fund the federal government from the end of the current fiscal year next Monday to December 20. If passed into law as planned later this week, the deal would avert the risk of a partial government shutdown right before the November election and give lawmakers more time to hash out spending plans for the remainder of Fiscal Year 2025.

US Nuclear Energy Industry: In a report Friday, Constellation Energy and Microsoft reached a deal in which Constellation will invest $1.6 billion to bring its Three Mile Island nuclear plant back on-line in return for Microsoft committing to a 20-year electricity purchase commitment to serve its artificial-intelligence efforts. The deal illustrates both the growing attractiveness of nuclear energy as a clean source of electricity and the rising electricity demands for AI.

- Those forces have already driven up electric utility stocks, and they could well continue doing so in the near term.

- After news of the deal, Constellation’s share price jumped 22.3% to close at $254.98.