Daily Comment (September 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets remain cautious amid lingering concerns about a potential recession. In sports news, Taylor Fritz advanced to his first Grand Slam semifinal at the US Open by defeating Alexander Zverev. Today’s Comment will delve into why recent manufacturing data has not dampened our economic outlook, explain why setbacks have not hindered the development of semiconductor factories, and provide insights on the impact that the Bank of Japan’s monetary tightening is having on financial markets. As always, our report will conclude with a summary of key international and domestic data releases.

Market Jitters: Weaker-than-expected purchasing manager reports weighed on equities on Tuesday as investors grew concerned about the economic outlook.

- The August purchasing managers’ indexes (PMI) from ISM and S&P Global both confirmed a sustained contraction in the manufacturing sector for the second month in a row. Although the ISM index, which is weighted toward larger companies, showed a slight increase, both indexes remained below the expansion threshold of 50. These weak reports were further supported by evidence of declining demand. The ISM index indicated a deeper contraction in new orders and a pickup in inventory levels. Meanwhile, S&P Global reported a seventh consecutive month of declining sales.

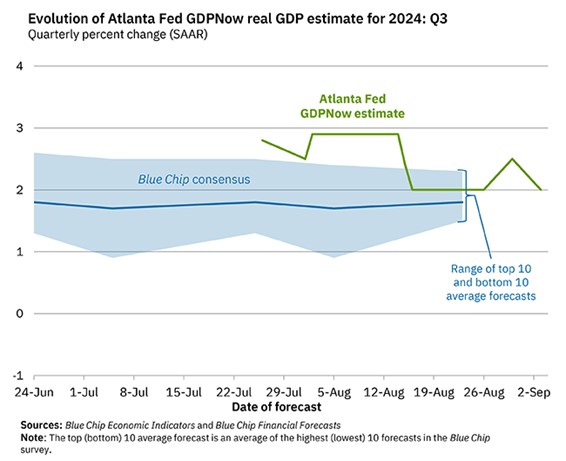

- Despite ongoing challenges in the manufacturing sector, the overall economy remains resilient. The service industry, which constitutes nearly half of economic output, continues to drive growth. Meanwhile, goods consumption accounts for approximately a fifth of the economy. Moreover, the labor market remains relatively insulated from the industrial downturn, with over 80% of private sector jobs being service oriented. As a result, the latest Atlanta GDPNow forecast indicates a projected annualized growth rate of 2.0% for the third quarter of 2024, down slightly from the previous forecast of 2.5%.

- Market volatility is expected in the coming weeks as investors await the Federal Reserve’s next policy decision. Although the Fed has hinted at a possible rate cut this month, uncertainty persists regarding the extent of cuts this year. The Fed’s recent economic projections suggest a more cautious approach with just one cut, which contrasts with the market expectations of three to four cuts. In our view, the Fed’s strategy will largely depend on Friday’s jobs report. A strong report could prompt a moderate rate reduction, while a weaker report might lead to strong policy measures to prevent a hard landing.

The Construction Goes On: Semiconductor factory construction spending continues to skyrocket even as firms face roadblocks.

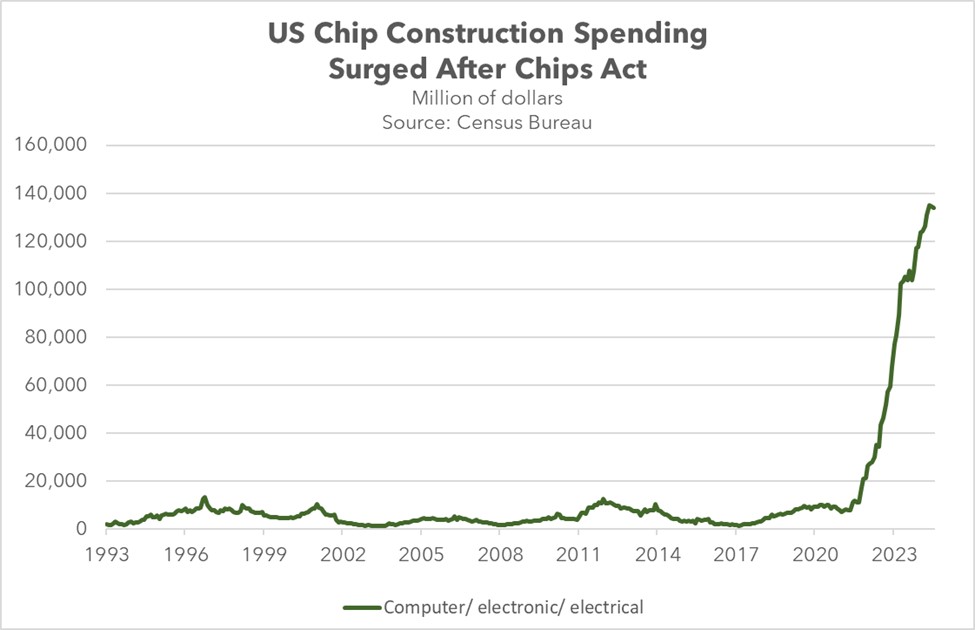

- Concerns are mounting that not all CHIPS Act projects will be fully realized. Intel, in particular, faces significant challenges. The company reported a $1.61 billion net loss last quarter and is exploring the sale or spin-off of its manufacturing division. This setback has raised concerns about the company’s ability to meet production targets necessary for securing CHIPS Act funding. Additionally, companies across the semiconductor industry have encountered opposition from local community groups due to environmental concerns, potentially delaying permit approvals.

- Despite significant funding challenges, the trajectory of domestic semiconductor facility construction remains robust. The development of semiconductor manufacturing hubs has reached its highest level in nearly half a century, with investments in facilities specifically for computer, electronics, and electrical manufacturing accounting for nearly 60% of the total spending as of July. This represents a substantial increase compared to a decade ago, when such investments accounted for approximately 8%. The sharp uptick suggests that firms may be willing to take a chance in hopes that it will pay off in the future.

- The development of domestic semiconductor fabrication plants (fabs) is likely to continue for national security reasons, but their long-term viability may be a concern if firms cannot significantly reduce costs. It has been widely speculated that firms may rely heavily on automation in these new facilities to maintain profitability. However, this could lead to push back from lawmakers who want the firms that have received funding to increase hiring for manufacturing workers. While we do not currently see this as a significant issue, it could become a potential problem in the future.

BOJ Hawkish Turn: Despite growing recessionary concerns in Japan, the central bank remains committed to its ongoing interest rate hike cycle.

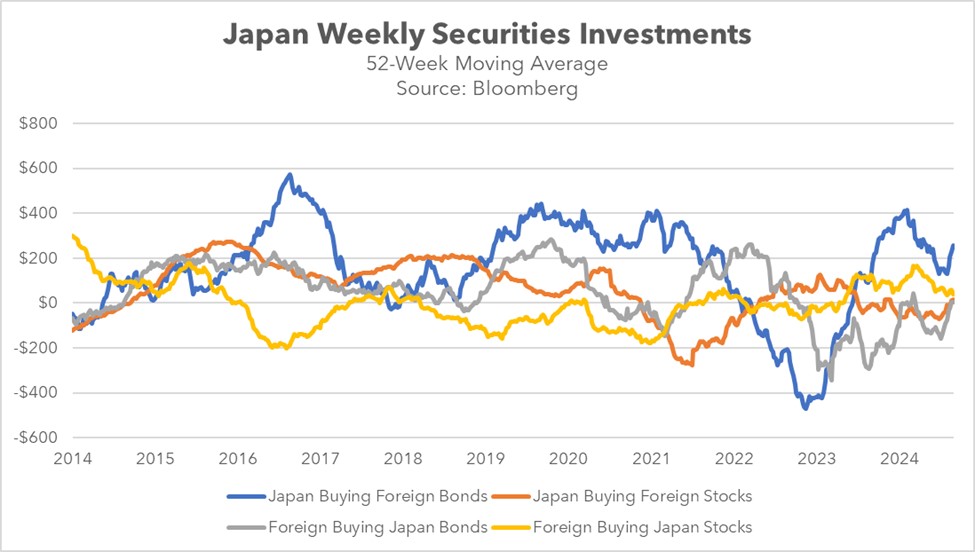

- Bank of Japan (BOJ) Governor Kazuo Ueda reaffirmed that the central bank will raise rates if the economy and inflation evolve as expected. His comments come after the market sell-off in early August, partly triggered by the bank’s unexpected decision to raise interest rates. Following this move to tighten monetary policy, the central bank cited the weakness of the country’s currency as one of the reasons for the increase, adding that it believes the decision could support, rather than hinder, economic growth. Following the comments from Ueda, the JPY strengthened against the USD.

- Despite recent market volatility, Japanese investors continue to show a strong appetite for foreign assets. Over the last few years, the BOJ’s historically low rates have encouraged them to seek higher yields abroad, fueling demand for foreign bonds and equities. This foreign investment has helped lower borrowing costs for governments worldwide, especially the United States, and has supported global equity markets. As interest rates rise and the yen strengthens, some foreign capital may be repatriated to Japan, but the overall trend currently remains supportive of overseas investment.

- Although concerns about a more aggressive Bank of Japan have unnerved global investors, it’s crucial to note that Japanese bond yields remain exceptionally low relative to their G-10 peers. Despite hawkish rhetoric, the central bank is still likely to implement a gradual tightening cycle as the world adapts to post-pandemic conditions. While the possibility of another carry-trade driven market panic cannot be entirely dismissed, the market seems to be accepting that ultra-easy monetary policy is nearing its end. This shift should temper the market’s reaction for the BOJ’s next hike which is expected in January.

In Other News: The Department of Justice has subpoenaed Nvidia over allegations of antitrust violations, signaling a tougher government stance on tech firms. Meanwhile, a former aide to New York Governor Kathy Hochul has been arrested on charges of working on behalf of the Chinese government. Additionally, the People’s Bank of China is considering a policy adjustment that could result in an 80 basis point rate cut for mortgages, indicating a willingness to adopt more aggressive measures to stimulate growth.