Daily Comment (September 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including an update on how Russia is responding to Ukraine’s recent battlefield gains. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, along with some additional commentary on yesterday’s disappointing inflation data and the resulting big drop in stock prices.

Russia-Ukraine: As Ukrainian forces continue to consolidate their hold on recently retaken territories in the northern Kharkiv region and around Kherson in the south, the Russian government finally acknowledged its defeat in those areas. The acknowledgement has focused on failures by the Ministry of Defense and the uniformed military leadership, likely to deflect the blame from President Putin himself. With the Kremlin’s propaganda machine in disarray, some politicians are calling for a formal declaration of war, a full mobilization, or even a partial mobilization, although we continue to believe a full mobilization would be hard to pull off and remains Putin’s last resort, given how politically risky it would be. Finally, in new evidence of how Ukraine’s recent successes have impacted Russian resolve and morale, reports indicate that some Russian officials in occupied Crimea are sending their families back to Russia in case the Ukrainians are able to retake the peninsula.

- The Ukrainian success in recapturing northern transportation hubs like Izyum will likely prevent Russia from achieving its goal of seizing the entirety of Ukraine’s eastern Donbas region. Meanwhile, Ukrainian forces continue to push eastward into the Donbas, even as they slow their advance to consolidate their control over the recently retaken territories. In a telephone call yesterday, German Chancellor Scholz told President Putin his position in Ukraine was hopeless and urged him to withdraw his forces completely.

- Following on the summer’s Russia-Ukraine-Turkey deal to allow safe passage of Ukrainian grain shipments through the Black Sea, the UN is pressing for a similar deal that would allow the export of key fertilizer chemicals from Ukraine’s coast. The deal would help erase the current global shortage of fertilizer, which has further weighed on food supplies and boosted agriculture commodity prices.

- We’ve mentioned before how Russia’s invasion has scared Western democracies into what is likely to be a multi-year effort to rebuild their defense capabilities and boost their defense spending. One example is offered by the U.S.-supplied High-Mobility Artillery Rocket System (HIMARS) that Ukraine has used to such great effect in its recent counteroffensives. Now that the system has proven so effective in real-life combat, the U.S. Army has asked defense contractors how they could produce up to 500 additional HIMARS over the next five years – an amount that would essentially double the number of existing HIMARS. Other countries seeking to boost their HIMARS arsenals include Romania, Singapore, and Taiwan.

Global Oil Market: In its monthly crude oil report, the International Energy Agency cut its forecast of global oil demand this year to 99.7 million barrels per day (bpd), largely because of slowing economic growth in the developed countries and continued COVID-19 lockdowns in China.

- The IEA’s reduced demand forecasts are consistent with the fall in energy prices since early summer. If continued high inflation prompts the major central banks to keep hiking interest rates and China keeps imposing pandemic lockdowns, oil demand could skid further and put even more downward pressure on prices.

- The IEA now sees global oil demand only surpassing its pre-pandemic high next year when it is expected to total 101.8 million bpd.

European Union Energy Crisis: European Commission President von der Leyen detailed her proposal for a windfall profit tax on electricity producers that don’t rely on natural gas. With the Russian gas shutoff boosting prices for that fuel, the non-gas producers have been boosting prices in tandem and raking in profits. Von der Leyen’s proposal would raise €140 billion from an EU-wide levy on those companies and use the funds to soften the blow of record high prices this winter on consumers and businesses. EU member states will meet to discuss the proposal on September 30.

Armenia-Azerbaijan: Yesterday, both Armenia and Azerbaijan claimed that the other side had fired on their border communities, sparking a crisis that could potentially reignite their 2020 war. Moscow has already brokered a ceasefire, but the violence illustrates how Russia’s military failures and political isolation in the Ukraine war have weakened its sway over the countries in its region.

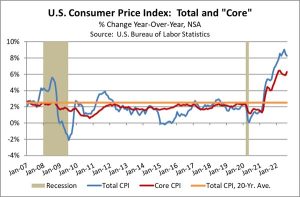

U.S. Inflation and Monetary Policy: Following up on our initial take on the August consumer price index in our Comment yesterday, we think what was most disconcerting to the market was the unexpected acceleration in the “core” CPI, which excludes the often-volatile food and energy components of the overall CPI. The August core CPI was up 0.6% from the previous month, which was double its rate of increase in July. Much of that acceleration reflected faster cost increases for housing, but that wasn’t the whole story. The acceleration in core inflation reflected faster price hikes in a wide range of non-energy and non-food products.

- The acceleration in prices for non-energy and non-food products suggests inflation pressures continue to broaden despite the Federal Reserve’s long string of aggressive rate hikes. To date, the Fed’s rate hikes haven’t seemed to do much to tighten financial conditions and bring down inflation pressures.

- The continued broadening in inflation pressures undoubtedly will encourage the Fed to keep raising rates aggressively. As we mentioned in our Comment yesterday, the August data probably guarantee at least a 75 bps hike in the benchmark fed funds interest rate at the Fed’s policy meeting next week.

- In addition, we note that the Fed’s accelerated quantitative tightening also seems to be putting strain on the market for U.S. Treasury securities. Bid-ask spreads in that market have widened considerably, and price swings have expanded to levels unseen since the beginning of the pandemic in early 2020. The market action is a reminder that the Fed’s tightened monetary policy could spark a crisis in some sector of the financial markets at some point.

- The prospect of continued aggressive rate hikes, tighter monetary policy, and a potentially deep recession goes far toward explaining the sharp drop in stock prices yesterday, in which the S&P 500 price index dropped 4.2%. Meanwhile, gold prices fell 1.6% and crude oil prices fell 0.4%. The yield on the 10-year Treasury note jumped to 3.422%, almost matching its cycle high in mid-June.

- In turn, that gave an additional boost to the U.S. dollar, while driving down other major foreign currencies.

- The Japanese yen fell approximately 2% to 144.95 per dollar, prompting the Bank of Japan to check in with traders on market conditions (a move that has often presaged a market intervention in the past).

- As investors price in further big interest-rate hikes, it would not be surprising to see these trends continue in the coming days.

U.S. Railroad Strike: As the major railroads and their unions remain at an impasse in their contract negotiations, the risk of an economically damaging strike on Friday continues to increase. The threat has prompted a number of major businesses to appeal to Congress to take action to prevent a shutdown. The White House has also launched an effort to coordinate alternate transportation providers such as trucking firms and ship companies.