Daily Comment (September 6, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, with a focus on Ukraine’s ongoing counteroffensive in the south of the country and the latest fallout for the world’s energy markets. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today.

Russia-Ukraine: Ukrainian forces continue to press their counteroffensive to retake the Russian-occupied city of Kherson in the country’s south, although their focus is still on degrading Russian logistics points and command centers with precision missile and artillery strikes rather than trying to seize large swaths of territory. This carefully calibrated strategy appears to be working so far, although it’s still not clear how far it can take the Ukrainians. In the meantime, Russian President Putin yesterday expressed his frustration with the war as he heaped praise on the ethnic Russian sympathizers who make up the forces raised in the Donbas provinces of Luhansk and Donetsk themselves, suggesting they were fighting better than Russia’s own forces. At the same time, new reporting suggests the Russians are desperately seeking ways to import advanced computer chips to replenish their stockpiles of military equipment, after many more than anticipated have been destroyed in the war.

- In another sign of Ukraine’s success in its southern counteroffensive so far, Russia-allied separatists in occupied Kherson said they would delay their sham referendum on having the region join Russia due to the new fighting to retake the territory. However, the officials have not provided a specific date when the vote will be held.

- Kremlin Press Secretary Dmitry Peskov said Russia will not resume natural gas shipments to Western Europe through the Nord Stream 1 pipeline until the “collective West” lifts its sanctions on Russia due to its invasion of Ukraine. The statement confirms what many political leaders and analysts have long suspected, i.e., that the recent “maintenance” shutdowns of the pipeline have been a ruse to put pressure on the West and force it to acquiesce to the invasion.

- To deal with the shut-off of Russian gas supplies and the resulting price spike, the European Commission is set to propose an emergency cap on wholesale gas prices in the EU, with two potential options for implementing it. One option involves putting a limit on what can be paid for gas imported from Russia. The second would introduce a capping system that would differ from country to country depending on their energy mix.

- To provide for backup energy supplies in case of a crunch this winter, the German government said two of the country’s three remaining nuclear generating plants will be kept on standby through April, rather than being shut down permanently at the end of the year as previously planned. The decision highlights the rebounding global interest in nuclear power due to the war and the associated high energy prices around the world.

- In yet another response to Europe’s impending energy crunch as winter approaches, a number of major European utility firms have secured big state-backed credit lines to help them weather the crisis.

Global Oil Supply: The Organization of the Petroleum Exporting Countries and its Russia-led partners yesterday agreed to cut their collective oil production by 100,000 barrels per day beginning next month, reversing an increase President Biden secured last month in a visit to Saudi Arabia. Although the cut is small compared with the overall global scale of the oil market, it nevertheless represents a potent political statement that OPEC+ is willing to thwart U.S. preferences in order to buoy oil prices and push back against the West’s sanctions on Russia.

- Nevertheless, global oil prices continue to soften today, largely on concerns about yet another wave of coronavirus lockdowns in major cities in China. Of course, broader concerns about rising interest rates and recessions in the major developed countries also continue to weigh on oil prices.

- At this writing, Brent crude is trading down approximately 2.6% on the day at $93.43 per barrel. Prices also continue to soften for a range of other industrial commodities on concerns about Chinese lockdowns and recession in major developed countries.

United Kingdom: Over the long weekend, Foreign Minister Liz Truss was finally declared the winner of the race to succeed Boris Johnson as Conservative Party leader, setting her to become prime minister today. After naming her cabinet, Truss’s first order of business will be to finalize a plan to shield households and businesses from a doubling of energy prices in October if current rules remain in place.

- At a cost of almost £100 billion, the energy-price relief plan would freeze gas and electricity bills at the current typical annual cost of £1,971, while other measures would aim to protect businesses from catastrophic price rises.

- The rest of Truss’s economic agenda focuses on tax cuts and deregulation aimed at unleashing more energy development and industrial investment.

- In foreign policy, Truss has struck a tough position on Russia and vowed to stand up to Brussels in a row over post-Brexit trading arrangements in Northern Ireland.

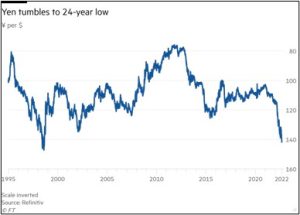

Japan: The yen’s recent weakness has accelerated sharply today, as the currency plunged 1.0% to a 24-year low of about 141.99 per dollar. Traders ascribe today’s drop to an aggressive interest-rate hike by the Reserve Bank of Australia. While the RBA and other major central banks hike interest rates to combat inflation, the Bank of Japan remains the outlier in its insistence on holding its policy extremely loose.

- Since the yen’s current weakening phase took hold in early 2021, the currency has lost approximately 26.9% of its value against the U.S. dollar. The yen’s decline in 2022 to date now amounts to 19.8%

- As long as the Fed and other major central banks are hiking rates and the BoJ is holding its policy steady, the yen will remain at risk of further depreciation.

China: An earthquake rating 6.8 on the Richter scale struck the southwestern province of Sichuan today, killing dozens and injuring hundreds. The quake will compound the economic challenges facing Sichuan as it continues to deal with a major heatwave, drought, energy shortages, and COVID-19 lockdowns.

Chile: Over the weekend, voters overwhelmingly rejected the country’s proposed new leftist constitution, with 62% voting against the law and 38% voting in favor of it. The result is likely to buoy Chilean stocks in the near term, although left-wing President Boric has vowed to make a new effort at re-writing the constitution.

U.S. Bond Market: According to Fitch Ratings, defaults on leveraged loans to below-investment-grade companies spiked to $6 billion in August, reaching their highest level since the midst of the pandemic in October 2020. Since interest rates on the loans typically fluctuate with the market, the spike in defaults suggests that the Fed’s rate-hiking crusade is beginning to have a noticeable negative effect on junk issuers. As the Fed continues to hike rates, we remain concerned that it will spark a bigger and broader bout of defaults among junk issuers.