Daily Comment (September 25, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good Morning. Global equity markets are under pressure this morning on sentiment concerns. Here is what we are watching:

A volatile day: Yesterday was a volatile day in the financial markets as two issues dominated.

- The U.N. speech: President Trump’s address to the U.N. was hawkish. He reiterated his “America First” stance, criticized China for its intellectual property acquisition tactics and defended his use of tariffs. His remarks on China were quite strong, suggesting that the country’s economic development policies were unfair to the U.S. and the rest of the world, and that America’s trade policy was designed to force China to change those policies. China is continuing to make what appears to be good-will gestures on trade; today, for example, they purchased pork. However, we note that China’s pork supply situation is precarious; it is quite likely that China is framing these purchases as good-will gestures when, in reality, it really needs the “other white meat” due to supply shortages caused by the African Swine Fever virus. We also note that China wants tariffs removed as preconditions for a broader deal, which isn’t likely. Financial markets want a deal with China; it may not occur. The president also singled out Iran for its repressive regime and its threat to Middle East peace. He also argued for the defense of borders. Overall, the talk suggested that the administration was not likely to ease its stance on China, and that deglobalization remains the likely path of policy.

- Impeachment: Speaker Pelosi indicated she would support an impeachment inquiry against President Trump over the Ukraine issue. Impeachment proceedings raise market uncertainty. We have only had three such events in American history, and only two in an era of modern financial markets. The events really don’t tell us much about how equity markets will behave during impeachment proceedings.

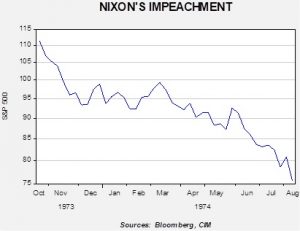

This chart shows the weekly S&P 500 Friday close. We measure the Nixon impeachment from October 9, 1973, the Friday before the “Saturday Night Massacre,” until his resignation. The Nixon impeachment event (it’s important to remember that he resigned before the articles of impeachment were sent to the Senate) occurred in a major bear market for equities. Although the political actions likely played a role in the drop, it’s important to note that the impeachment nearly coincided with a recession (the downturn began in November 1973 and continued into March 1975) and oil prices rose 235% from October 1973 to January 1974. Thus, the impeachment probably played a role in the market decline, but other factors were also important.

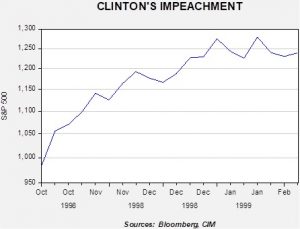

Same data as above. We time Clinton’s impeachment from the House of Representatives vote to conduct an impeachment inquiry until the president was acquitted by the Senate. The economic environment was generally positive, and equity markets were in a strong bull market. We do note that equities had declined during impeachment due to the collapse of Long-Term Capital Management, and the Russian debt default. Thus, some of the gain is exaggerated. Still, this shows that if economic and market conditions are favorable, the bearish impact of impeachment is probably muted.

So, what should we think about with this impeachment issue? Here are our preliminary thoughts:

- Impeachment is not a judicial process, but a political one. Barring a revelation that is egregious, it is highly unlikely the Senate, by a two-thirds majority, will vote to enforce impeachment. In fact, it is possible that majority leader McConnell might not even hold a vote on the articles. We don’t expect the president to actually be impeached.

- It will have an impact. Legislative activity will grind to a halt. USMCA probably won’t get passed this year. Congress is funding the government with short-term spending bills making the odds of a temporary closure elevated. The White House will be distracted, and due to the constant turmoil, may not have the “bench” to deal with impeachment and all the other issues the nation faces. Fortunately, the White House does have strong figures involved in the China and Europe trade negotiations. However, the bad news is that they are not always unified, and the president may struggle to act as an arbiter between the two sides if he is consumed with impeachment.

- Iran may take advantage of this turmoil. The Mullahs likely believe the chances of getting a favorable deal with the U.S. improve with a different president. Thus, Iran may be emboldened to escalate tensions in the region. Under impeachment, if the president decides to attack Iran in response to an escalation, he could be accused of a “wag the dog” tactic. This accusation would not be unprecedented. President Clinton launched bombing raids on al Qaeda targets in August and December of 1998; the first occurred when Monica Lewinsky was about to testify on the scandal, and the latter as the House was about to vote on articles of impeachment. Clinton had defensible reasons for the bombing, but the timing did look suspicious. At the same time, one does not need to be a Ph.D. economist to know the global economy is weak and the U.S. economy is approaching stall speed. An event that drives oil to $100+ per barrel would probably be enough to tip the world and the U.S. into a full-blown recession. History shows that re-election during a recession is rare.

- It’s late in the political cycle. Andrew Johnson’s impeachment event was also near the end of his term. In some respects, the inquiry could cloud the president’s re-election campaign. It also might garner him sympathy. However, it’s important to note that the last two impeachment events occurred in second terms. Thus, they had a different impact on the subsequent election, compared to a president under the cloud of impeachment who is running for re-election. In addition, it makes it hard for Democratic party candidates to discuss plans and goals for office when the media’s focus is mostly on the impeachment proceedings. Thus, the impeachment will also affect the Democrats nominating process. (Our quick take? The Ukraine issue probably hurts Biden and helps Warren.)

- There are already warnings from commentators that this impeachment could “hurt the presidency.” If the U.S. is withdrawing from hegemony, the president’s powers, which expanded during the superpower period, will likely be curtailed over time. The Constitution has been “stretched out of shape” during America’s hegemony period mostly because a superpower has to make decisions quickly, and the weak executive envisioned by the founders doesn’t fit with hegemonic responsibilities. However, if the U.S. isn’t going to maintain its superpower role, there is less need for a strong executive. Thus, some reigning in of the executive would be expected, and this impeachment fits in that scenario.

- Our focus will remain on the economy and markets. Given the tumultuous nature of the Trump presidency, the sentiment impact may not be all that profound. Financial markets have become accustomed to constant political turmoil, and thus should be able to digest this situation too. However, as noted above, we do have two concerns. First, it may be difficult to manage relations with China in the midst of this turmoil; if Lighthizer becomes the dominant figure in the chaos, there will be no deal with China. Second, we fear the financial, but especially the oil, markets are underestimating the risk of further Iranian escalation. As a result, these two areas will be where we most closely monitor events.

Boris: PM Johnson returns to the U.K. today to face a hostile Parliament. The Supreme Court ruling was a serious blow. Under normal circumstances, the poor management that Johnson has delivered (lost his majority, had his own brother leave the party, humiliated by Luxembourg, rebuked by the Supreme Court) would have led to his ouster by now. However, these are not normal times, to say the least. What happens now? In mid-October, the EU has meetings where the U.K. either must have a plan to leave the EU or, based on recent legislation, Johnson must ask for an extension to the end of January. Assuming that there is no plan to offer (and it doesn’t look likely), we will probably see an extension and new elections. At this point, the most likely outcome from the elections is a hung Parliament, with the potential for a caretaker government and perhaps a second referendum. However, the odds of a hard Brexit are less likely.

Wealth Tax: Presidential candidate Bernie Sanders has joined Elizabeth Warren in endorsing a tax on assets for individuals that have a net worth of more than $16 million, and married couples with a net worth of over $32 million. The revenue for the proposed tax would be used to promote government programs such as universal healthcare. In addition to its appeal to labor, the idea has become increasingly popular with members of the capital class, with Bill Gates stating that he “wouldn’t be against the tax.” Moreover, although a wealth tax makes conceptual sense, it doesn’t appear to be all that practical. The primary issue is that the value of one’s assets is somewhat subjective; therefore, there is a strong incentive for people to undervalue their assets on their tax returns. Even though the government could just send auditors to value these assets, it would likely prove overly burdensome. Another proposed solution to the problem would be for the government to have the right to buy assets at the listed price, but even that seems burdensome. However, as we have mentioned in the past, this wealth tax is just another example of the country moving away from an efficiency cycle, and into an equity cycle. We have doubts that a wealth tax will ever be enacted; other nations that have tried to implement them tended to abandon the effort because of the difficulty in processing the levy. However, the mere threat tends to have a dampening effect on asset prices.

Magnets: The U.S. is importing rare earth magnets at the fastest pace since 2016. Most likely, firms are concerned that the supply will be curtailed if the U.S. and China can’t reach a trade agreement, so they are stockpiling the materials.