Daily Comment (September 25, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

It’s Friday and we are closing another week. Equity markets continue to struggle. We lead off with policy news from around the world (including the U.S.). China news is next. We update the pandemic news followed by international news. As promised, a bonus chart is presented. And, being Friday, a new Asset Allocation Weekly report, podcast, and chart book are available. Here are the details:

Policy news: There are a number of developments worldwide as the Northern Hemisphere prepares for winter under pandemic conditions.

- House Democrats are putting together a new aid proposal. The fact that this is going out is not good news. Some Democratic representatives in “purple” districts want to approve some form of help, even the “skinny” bill offered by the GOP. The Speaker does not want to accept the GOP offer for two reasons. First, she thinks it’s inadequate, and second, she thinks she has leverage and can get more of what her party wants. To placate the uncomfortable representatives, she is offering a compromise bill that has spending levels well above that which the GOP has suggested it will accept. If she thought she had a chance of a deal, she wouldn’t bring this bill to the floor. She is likely bringing this bill to provide political cover for the purple district reps. We do not expect additional aid to be available until after the election. Although the economy is in recovery, there is evidence in the high-frequency data that the pace of growth is slowing. Given the reporting lag, if a slowdown is coming, it won’t be until well into Q4.

- U. K. lawmakers are shifting to a wage subsidy program, similar to Germany’s, and ending direct wage replacement. The new program shifts the burden of incidence to employers. The risk of the new program is that employers won’t keep workers on payrolls, but the government likes the lower cost. One interesting theme of the U.K. policy response is that it looks like the Johnson government is starting to prepare the country for a post-pandemic economy that will be fundamentally changed. There has been an underlying assumption in the West that the pandemic will fade, and everything will return to the pre-pandemic conditions. That assumption is slowly being replaced with the idea that even with a vaccine, the future world will not be the same.

- The IRS is moving to improve tax reporting on cryptocurrencies. This action may force Congress and regulators to actually define what these “things” are. Although proponents want them classified as currencies, they look to us more like securities, and capital gains on securities are taxable. Interestingly enough, capital gains on cash are not. If we have deflation, the gains from cash are not taxed.

- Europe is becoming more aggressive with member states that give companies special tax treatment. Such actions will exacerbate the constant tension between the EU and the sovereign nations within the union.

- With the Turkish lira in a near freefall, the central bank finally moved to raise interest rates. President Erdogan tends to oppose such measures, so we will be watching to see if any members of the central bank “resign” in the near future.

China news:

- FTSE/Russell has added Chinese sovereign debt to its bond indices, a move that will require passive managers to add some $100 billion of Chinese bonds to their portfolios. This action is further evidence of China’s growing inclusion into the global financial system.

- The Evergrande Group (EGRNF, $2.05), China’s second-largest property developer, is reportedly facing a cash shortage. The company is heavily indebted and is working on restructuring. A reported leak of a letter suggests the company is lobbying the government for help in its restructuring. The firm is probably too big to fail, and thus will get government aid; however, the leadership of the company may not be spared.

- The TikTok saga continues. It appears Trump administration officials are divided on the current arrangement. Meanwhile, the courts have delayed the implementation of a ban on the app, and the court seems inclined to give the company an injunction against the government’s plans to force the app off American phones.

- The SoS is warning states that China is attempting to woo them and divide the U.S. response against China.

- Germany will not impose a full ban on Huawei (002502, CNY 2.71), further evidence that the Merkel administration is not willing to fully commit to the U.S. policy on China.

- Further evidence that the Xi government is deepening its hold on private business in China is that the government has released a strategic emerging industries plan to further its goals of technological independence.

COVID-19: The number of reported cases is 32,273,914 with 983,720 deaths and 22,261,136 recoveries. In the U.S., there are 6,979,973 confirmed cases with 202,827 deaths and 2,710,183 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The R0 data show 19 states with falling cases, and 31 with a rising trend. Ohio has the lowest infection rate, while Washington has the highest.

Virology:

- Novavax (NVAX, 102.44) has begun the final testing phase of its vaccine, the 11th candidate in the final stage. In the early testing, the company’s vaccine appeared to generate a robust immune response, raising hope that it may be particularly strong.

- As cases rise in Europe and surrounding areas, Israel has expanded its lockdown to bring a flare-up under control.

- COVID-19 has ravaged Tunisia’s economy. In response, an increasing number of Tunisians are trying to emigrate to Europe. As the emerging world suffers from the virus, a secondary effect may be a wave of emigration to the West.

- The Pac-12 will resume football.

International news:

- The U.S. no longer officially recognizes Belarus President Lukashenko as the legitimate head of state. This news comes after Lukashenko was sworn in as president in a secret ceremony.

- Alexei Navalny has been discharged from the hospital. He is expected to return to Russia. When he gets there, he will have trouble getting money; the government has frozen his financial accounts.

- The EU wants to create a new policy for dealing with refugees. The plan is to distribute them across the union rather than housing them in the nation where the refugee disembarks. This is unpopular with the central European nations; in return, the EU is offering cash to encourage them to accept more foreigners.

- Earlier this week, a South Korean official, apparently attempting to defect to North Korea, was captured by border control agents who killed the man and burned his remains. In a rare apology, Kim Jong Un said he was “very sorry” about the incident.

- Mexico is no stranger to political corruption. Transparency International puts Mexico in the same league as Myanmar and Laos. It ranks 130 out of 191 countries. Ukraine is marginally less corrupt. Mexican presidents serve a single six-year term, and their successors usually don’t prosecute them for their corrupt actions during office. When the PRI dominated Mexico, the outgoing president selected his successor, ensuring the outgoing leader would be left to a quiet retirement. AMLO is ending this tradition, accusing five former presidents of corruption with the goal of bringing them to justice. It isn’t clear whether any of them will actually face prison time, but the move is politically popular.

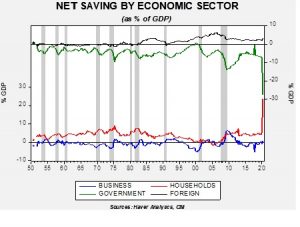

Bonus Chart: In macroeconomic accounting, all saving has to net to zero. That’s because the process is a sort of balance sheet. The reason we look at net saving is to determine where the flows are moving. We have just received the data for Q2, and they are remarkable.

Due to the CARES Act, we saw massive dissaving from the government sector; another way of saying this is the deficit widened. Note that the bulk of the saving is being held by households, although the rise in the current account, which includes foreign saving, also rose. This data indicates that households are holding large saving balances that will eventually flow back into the economy as spending.