by Bill O’Grady | PDF

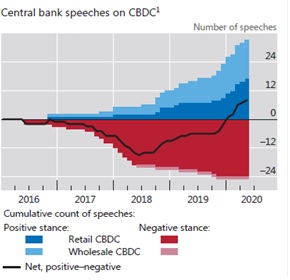

This week, we conclude our series on CBDC with market ramifications.

Ramifications

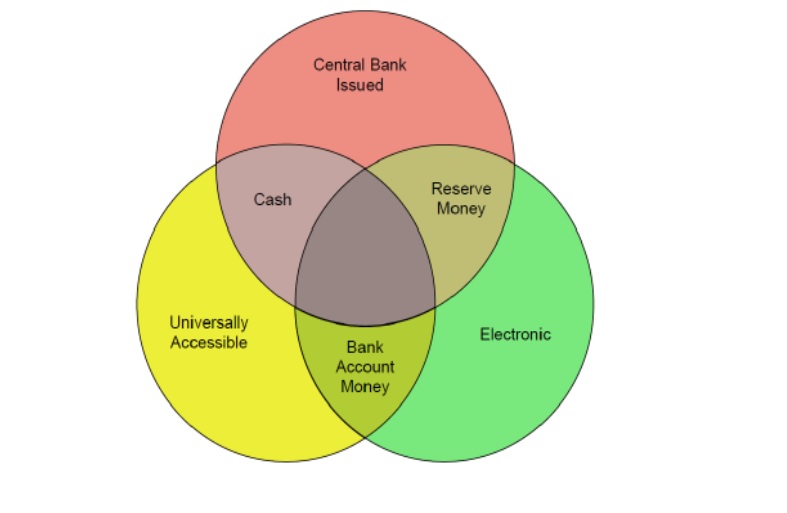

Money is a seminal good. As our metaphysical discussion examined, economics has tended to avoid forays into the being of money.[1] Accordingly, for the past 150 years, there have been steady changes to the use of money, from a gold standard, to a dollar standard, to full fiat currencies, and floating exchange rates. We have seen credit money dwarf state and commodity money. There have been discrete changes; the failure of the gold standard to hold in the interwar years was one, while Nixon’s closing of the gold window, effectively ending the Bretton Woods Agreement, was another. Most of the other changes were less dramatic. The development of the Eurodollar market undermined the Great Depression regulatory regime, as did the creation of the money market fund. The steady expansion of derivatives and the non-bank financial system played a role as well.

CBDC would also be a significant event on a global scale. And, any time there is a change in how money works, the potential for unexpected outcomes is high.

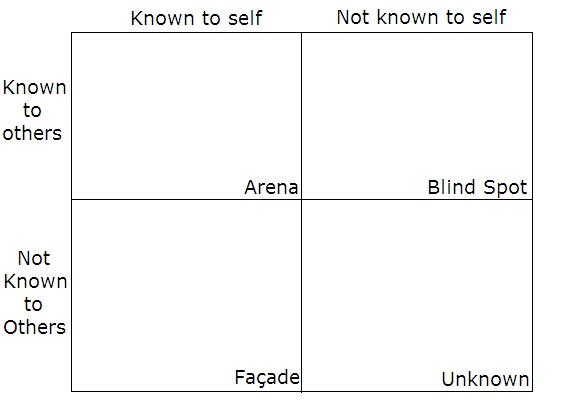

One way to develop a framework about CBDC and the challenges it brings is to use a Johari Window. A Johari Window is a psychological concept to compare what we know to what is known by others. We adapt it for our use by not having two “players” and instead use it to describe the risks of introducing CBDC.[2]

[1] For a deeper dive into this topic, we recommend: Bjerg, Ole. (2014). Making Money: The Philosophy of Crisis Capitalism. London, U.K.: Verso Publishers.

[2] The Johari Window is the basis for Donald Rumsfeld’s famous “known/unknown” comment.