by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] Welcome to Super Thursday!

Today, there is a slew of geopolitical events that may have an impact on global markets. In Europe, the ECB will hold a press conference about current and future policy decisions. In the U.S., former FBI Director James Comey testifies to the Senate Committee about Trump’s influence in the Russia investigation. In the U.K., there are parliamentary elections to decide the prime minister.

The ECB has decided to hold rates at their current levels and maintain the current level of quantitative easing. Prior to the press conference, the ECB released a statement that left out the mention of possibly lowering interest rates in the future. The market has interpreted this as a signal that the ECB is willing to exit the stimulus program. As mentioned yesterday, the ECB has cut its inflation forecast and revised its GDP forecast higher. During the press conference, Mario Draghi added that he expects monetary policy to remain the same for an extended period of time, even after the stimulus program ends. He went on to say that increased momentum in the Eurozone economy shows that risks to the global outlook were broadly balanced, but the momentum has not translated into stronger inflation dynamics. Draghi warned that global macroeconomic developments still present downside risk and that the ECB is prepared to increase asset purchases if the outlook were to become less favorable or financial conditions become inconsistent. After the press conference, the euro depreciated against the dollar.

With the release of former FBI Director Comey’s statement that Trump asked him to “lift the cloud” of the investigation by publically stating that Trump was not personally under investigation, Comey’s testimony today could prove to be a bit anti-climactic. The primary market worry would be that enough information will emerge to further distract the Trump administration from other goals. We do note that Senate GOP leaders are looking at a health care bill; reports suggest that McConnell will give it a few weeks and, if nothing is done, tax issues will be taken up. Tax cuts are what the market is mostly concerned over so if the Senate can move forward then it probably means equities will at least hold at current levels.

The other major item today is the British election. Polls are scattered, with some late polls showing a dead heat, while others show a 10% lead for the Tories. Our expectation is a Conservative win but no major pickup in seats and thus no expanded mandate. This isn’t a great outcome but it probably doesn’t move the financial markets.

U.S. crude oil inventories unexpectedly rose 3.3 mb compared to market expectations of a 3.5 mb draw.

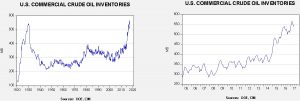

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have been declining. We note that, as part of an Obama era agreement, there was a 1.7 mb sale of oil out of the Strategic Petroleum Reserve. This is part of a $375.4 mm sale (or 8.0 mb) done, in part, to pay for modernization of the SPR facilities. International agreements require that OECD nations hold 90 days of imports in storage. Due to falling imports, the current coverage is near 140 days. Taking that into account, the build was a less ominous 1.7 mb.

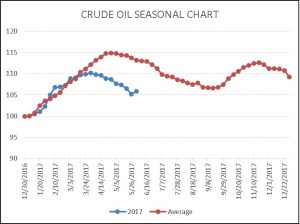

As the seasonal chart below shows, inventories are usually well into the seasonal withdrawal period. This year, that process began early. Although the actual level of stockpiles remains quite high, we are seeing stock declines at a rather rapid pace. Assuming a similar drop from this year’s peak of 566.5 mb at the end of March, we will end up at 505 mb by late September. In fact, current inventory levels have already declined more than the seasonal trough, which is supportive. As a result, last week’s rise is something of an anomaly; we would not be surprised to see declines resume next week.

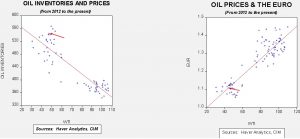

Based on inventories alone, oil prices are overvalued with the fair value price of $37.17. Meanwhile, the EUR/WTI model generates a fair value of $53.24. Together (which is a more sound methodology), fair value is $47.34, meaning that current prices are below fair value. Inventory levels remain a drag on prices but the oil market seems to be ignoring the impact of dollar weakness. Our position has been that oil prices are in a range between $45 and $55 per barrel and, accordingly, oil is attractive at current levels. The worries about OPEC shattering over Qatar appear to us to be misplaced. The cartel has managed to maintain relations with members at war before. A bigger risk is that a conflict develops that disrupts flows. It’s not highly likely, but it is more likely than OPEC expanding output based on tensions with Qatar.