Tag: election

Asset Allocation Bi-Weekly – Bonds and the Post-Election Environment (November 25, 2024)

by the Asset Allocation Committee | PDF

The election results are in and, contrary to expectations, voters rendered a quick and clear outcome, with Donald Trump set to return to the White House. The central case prior to the election was that the outcome would be drawn out and contentious — an outcome that would tend to support flight-to-safety assets, such as long-dated Treasurys. However, in the wake of the actual outcome, a reassessment is in order.

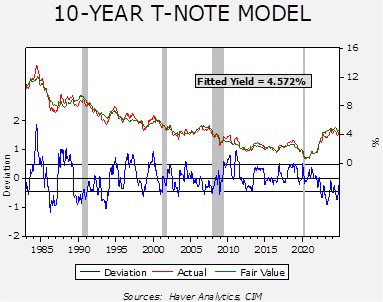

Our analysis of the long end of the yield curve starts with our yield model.

The model’s independent variables include the level of fed funds, the 15-year average of CPI yearly inflation, the five-year standard deviation of inflation, WTI oil prices, the yields on German and Japanese 10-year sovereign bonds, the yen/dollar exchange rate, the fiscal deficit scaled to GDP, and a binary variable for government control. As the model shows, yields are running below fair value but are within the expected range of outcomes.

As the election approached, despite the general consensus of a close race among the political pundits, the markets began to expect a GOP presidential win with a strong possibility of legislative control as well. In mid-September, the constant maturity 10-year T-note yield was 3.63%; it has increased to 4.45% in the wake of the election results.

A key issue is whether the yields will continue to rise in the coming weeks. Here are the factors we are watching:

- Our model’s government binary variable adds 30 bps to the fair value yield when there is a unified government. Since 1983, a situation where a single party controls both the executive and legislative branches usually results in greater spending and potentially higher deficits. We don’t apply that variable until the new legislature is seated, so we have not activated that variable quite yet. This variable will be in effect in January, though, which suggests there will be a bias toward higher yields.

- When yields peaked above 5% in late October 2023, the Treasury and the Federal Reserve acted in concert to bring yields lower. The Treasury adjusted its borrowing to the short end of the yield curve and Chair Powell signaled that the policy rate had peaked and was poised to decline. These actions sent yields lower to around 3.8% by late December 2023. Given that the current government is in “lame duck” status, we doubt that the Treasury will engage in similar behavior now. Thus, there will likely be greater tolerance for rising 10-year yields. In other words, although the Fed and the Treasury had signaled earlier that a 10-year yield above 5% was intolerable, that likely isn’t the case now.

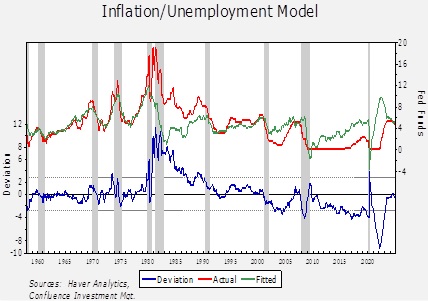

- Since the recent FOMC decision to cut 25 bps, another similar cut at the mid-December meeting is mostly expected by the markets. The unknown is what future policy will look like in the wake of recent political developments. A model based on the difference between overall yearly CPI and unemployment (an approximation of the Phillips curve) would suggest that the current policy rate is near neutral.

Anything beyond the anticipated 50 bps of cuts before year’s end will begin to move monetary policy into easing mode, which will be difficult to justify without a rapid weakening of the labor market or a drop in inflation. Without further cuts, it will be difficult for long-term yields to decline significantly.

Once President-elect Trump assembles his team at the Treasury, we could see action similar to what occurred in October 2023 to bring down long-duration Treasury yields. However, until then, there is a window where yields could rise to uncomfortable (e.g., >5%) levels. Thus, we believe investors should exercise care in extending on the yield curve into next year.

Asset Allocation Weekly – #19 (Posted 11/13/20)

Confluence of Ideas – #18 “Foreign Policy Under a Biden or Trump Presidency” (Posted 10/27/20)

Asset Allocation Weekly – #13 (Posted 10/2/20)

Asset Allocation Weekly (October 2, 2020)

by Asset Allocation Committee | PDF

The death of Ruth Bader Ginsburg was yet another political shock for 2020 in a year rife with unusual events. The year began with the first official case of COVID-19 in Washington State on January 20. The pandemic and subsequent measures to contain the virus have led to unprecedented levels of economic volatility. President Trump was acquitted of impeachment on February 5. Relations with China have deteriorated.

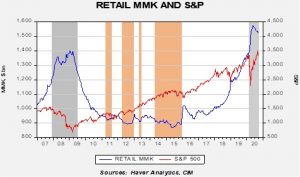

As we head into the election, investors’ fears are high. For example, retail money market funds (RMMK) remain elevated, though off their earlier peaks.

Our political cycle monitor suggests that a Biden win could result in a decline in equities into October.

Barring an unexpected landslide, it is quite possible that this election could be disputed. The last time this occurred, in 2000, the election wasn’t decided until December 12, when the Supreme Court effectively ended the recount. George Bush won a narrow victory in Florida and in the Electoral College (271/266). The financial markets were affected by the outcome; in the period from the election on November 7 until the Supreme Court decision, the S&P 500 range from high (made on November 8) to low (made on December 1) was 9.9%. A decline of this magnitude would probably not be enough to warrant substantial portfolio adjustments.

Voter attitudes were not nearly as hardened then as they are now. A Pew survey suggested that 45% of voters thought that the winner really mattered, while 49% believed “things would remain about the same.” Currently, 83% of voters think it really matters who wins and only 16% believe that “things would remain about the same.” The Pew survey suggests that this election is being viewed as zero-sum; losing is perceived as devastating, so both sides are primed to contest a close election.

Although equity markets have performed quite well from their March lows, the recent weakness does appear to be starting the process of discounting a Biden victory. Although we would not necessarily expect a decline to the 90% level implied on the above chart,[1] a period of weakness in the next few weeks is likely.

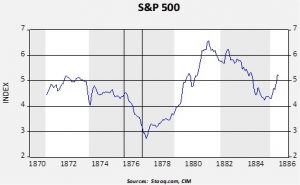

Is there a precedent for the current election? The best analog is the 1876 election, which was won by Rutherford B. Hayes in the electoral college by a single vote, 185-184 over Samuel J. Tilden. And, that result only occurred weeks after the November ballot. Hayes was given the presidency in return for ending Reconstruction. An analysis of this election will be the subject of an upcoming WGR, but the following chart offers some idea of the impact of an uncertain election outcome when it is perceived as zero-sum.

From March 1876 to March 1877 (when Hayes was inaugurated), the index, on a monthly average basis, fell 29.7%. Although the recovery from the lows was robust, the March 1876 level was not exceeded until October 1879. As we will discuss in the upcoming WGR, the 1876 election occurred during the long depression that began with the Panic of 1873, which was considered the worst economic downturn until the Great Depression. Thus, the disputed election cannot be blamed for the entire decline, but it likely contributed. Increased tensions in the November election is a factor the Asset Allocation Committee will grapple with in the upcoming portfolio rebalance.

[1] To quote Ned Davis, a famous market analyst, cycle analysis shown above should be used more for direction and less for level.