Insights from the Value Equities Investment Committee | PDF

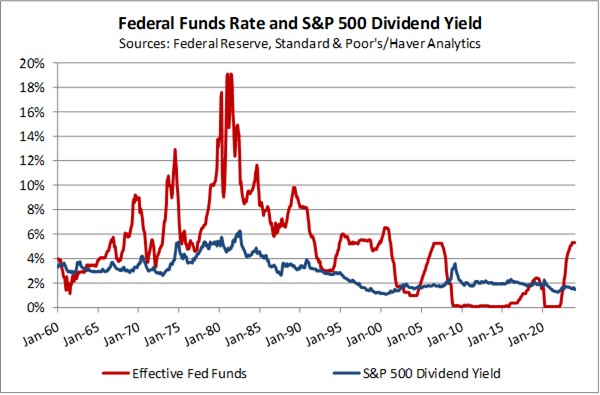

Over the past 15 years, dividend income has often exceeded what could be earned in a money market account. But as seen in the chart below, with the fed funds rate now at 5.5%, the relationship between dividend income and interest income has gone back to what was common before 2008 — where the S&P 500 dividend yield (the blue line) is 2-3% below what could be earned in a money market account invested in U.S. Treasury bills (the red line).

This begs the question:

Why should an income-oriented client still invest in a dividend income-focused stock portfolio yielding 3% when they can now earn 5% in a low-risk money market account?

Higher inflation is causing interest rates to rise on short-term fixed income and money market instruments, and now investors have more choices in generating income returns. While current yields are appealing, we believe it would be short-sighted for long-term investors to abandon the compounding benefits of a growing income stream that can protect purchasing power while also providing for growth of principal.

In this Value Equity Insights report, we highlight some of the potential advantages of growing dividend income through a portfolio of quality, growing businesses — factors which might be underappreciated in the current environment.