Weekly Energy Update (April 27, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After gapping two weeks ago, oil prices have filled the gap on worries about the global economy.

(Source: Barchart.com)

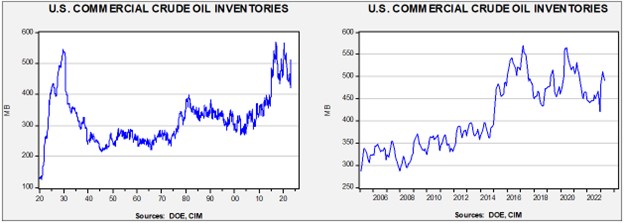

Commercial crude oil inventories fell 5.1 mb compared to the forecast draw of 1.5 mb. The SPR fell 1.0 mb, putting the total draw at 6.1 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.2 mbpd. Exports rose 0.2 mbpd, while imports rose 0.1 mbpd. Refining activity rose 0.5% to 91.3% of capacity.

(Sources: DOE, CIM)

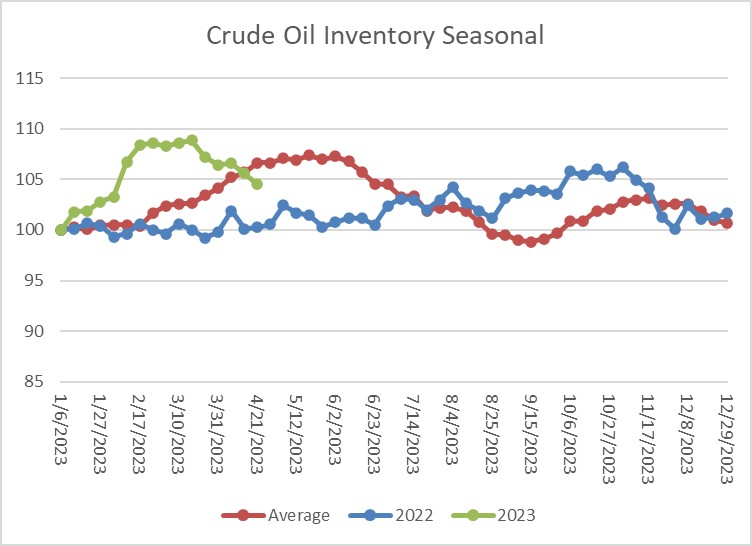

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and have since declined, putting storage levels below seasonal norms.

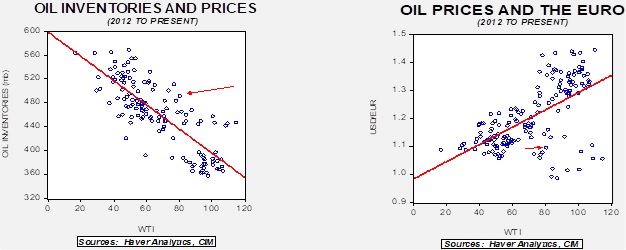

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $58.47. The recent actions of OPEC+ are clearly designed to prevent this sort of price from emerging.

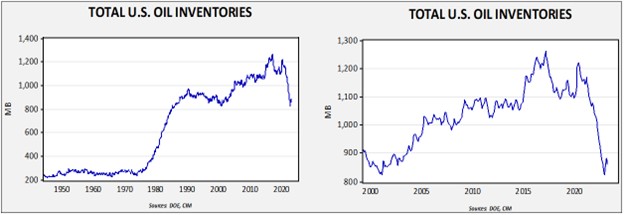

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.82.

Market News:

- As U.S. oil production rises, associated natural gas production is also rising steadily, leading to a glut. This supply situation is keeping U.S. prices low and is encouraging the expansion of American LNG capacity. However, higher interest rates and permitting issues are acting to constrain projects, thus leading to persistently low prices of natural gas.

- China’s large SOE refiners are getting privileged access to cheap Russian crude oil.

- Natural gas finds in the eastern Mediterranean raised hopes that nations in that region could profit from these discoveries. In addition, there was optimism that this gas could pave the way for improving previously fraught relations between states. However, on the latter front, only modest changes have emerged.

Geopolitical News:

- Last summer, there was a great fear that high natural gas prices would lead to economic turmoil in Europe. Luckily, winter temperatures were unusually mild. Lower demand coupled with ample LNG flows (partly helped by China’s COVID-19 lockdowns) led to a sharp drop in prices. At the end of the winter heating season, Europe’s natural gas storage was at 56% of capacity compared to 34% in a typical winter. Although these high levels do reduce the impact of the loss of Russian natural gas, a cold winter will put Europe at risk regardless of inventory levels. As we discussed recently, the oncoming El Niño event increases the odds of a cold northern European winter.

- Russia is receiving increasing levels of oil payments in CNY and RUB. Avoiding the USD for settlement makes it easier for Russia to circumvent Western sanctions.

- An Indian tanker company has lost insurance coverage by agreeing to ship Russian oil at a price above the G-7 cap.

- Despite efforts to evade sanctions, there is evidence that the oil price cap has reduced Russian oil revenue.

- As Russia increases oil sales to China and Asia, West African producers are losing market share. This is allowing them to move oil to Europe.

- There are reports of additional, broader sanctions on Russia. However, we are doubtful these will be implemented.

- Due to insider bid-rigging, Venezuela has potentially lost billions in the oil trade.

Alternative Energy/Policy News:

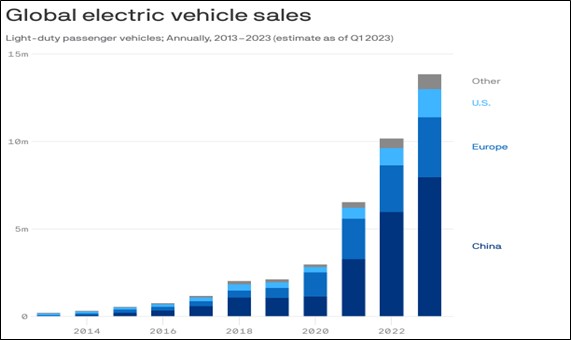

- EV sales are starting to accelerate, and the industry is increasingly showing its dependence on China for both sales of the vehicles and their key components. First, sales:

(Source: IEA)

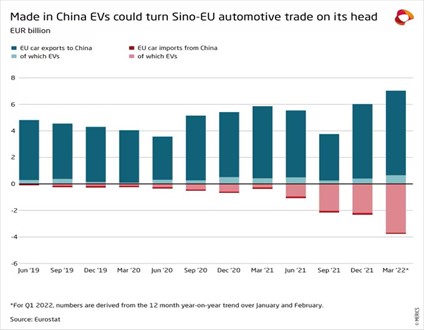

- As the chart shows, sales are lifting, with the bulk of those occurring in China. The IEA reports that 20% of car sales this year will be EVs. Second, China is beginning to export EVs which could roil global car markets.

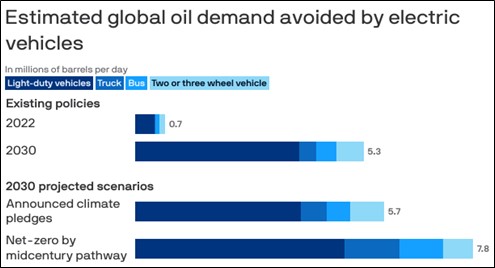

- The expansion of EV sales will begin to destroy oil demand by the end of the decade.

(Source: IEA)

- Even under existing policies, 5.3 mbpd of demand will be lost to electrics. This sort of information will tend to dampen oil investment, and, paradoxically, could be bullish for crude oil.

- Chile is planning on nationalizing its lithium industry. The country has the world’s largest lithium reserves, but nationalization raises fears that supplies will become constrained.

- Abandoned oil wells could become a source of lithium. Often, brine exists in oil wells, and once evaporated, this product can be used for extracting lithium.

- On the other hand, lithium may be replaced by sodium. Chinese EV manufacturers are planning on rolling out sodium-battery-powered cars this year. As lithium prices rise, firms are looking for alternatives to the metal, and sodium is chemically similar. As we have noted before, the current state of sodium batteries is that they lack the range of lithium. However, they appear to have longer charge/discharge cycles (meaning they last longer) and perform better at low temperatures.

- Another emerging battery technology is solid state batteries. These batteries would have a longer range and a faster rate of recharge than what is currently available. If this technology becomes scalable for autos, it could lead to rapid electrification of transportation. Even with current lithium technology, improvements are emerging.

- A battery is stored energy. We are used to thinking about batteries as a chemical process, but in reality any sort of energy storage that can be used later is technically a battery. That energy can also be kinetic. Renewable energy sources are notorious for creating excess electricity as particularly sunny or windy days can create more energy than is needed at any given time. The startup Energy Vault is building facilities in Texas and Shanghai that will lift 24-ton blocks of dirt during periods of excess electricity, and then lower them to spin turbines to generate electricity when it is needed.

- We continue to note news reports on geoengineering. Although controversial, as climate problems emerge, the use of this technology to address them will become attractive.

- The EU is adjusting rules to encourage the use of sustainable fuels in aviation.