Weekly Energy Update (December 14, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(N.B. The Weekly Energy Update is going on indefinite hiatus. Next year, look for a new report format.)

Crude oil prices are continuing to break down despite OPEC+ efforts to restrain supply.

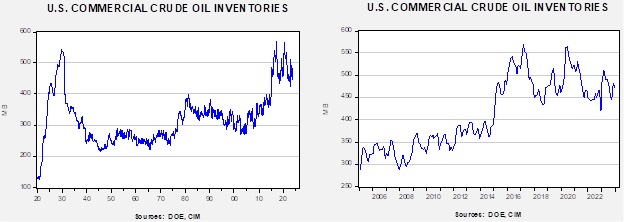

Commercial crude oil inventories fell 4.3 mb compared to forecasts of a 2.0 mb draw. The SPR was unchanged, which puts the net draw at 4.3 mb.

In the details, U.S. crude oil production was steady at 13.1 mbpd. Exports fell 0.4 mbpd, while imports declined 0.6 mbpd. Refining activity fell 0.3% to 90.2% of capacity.

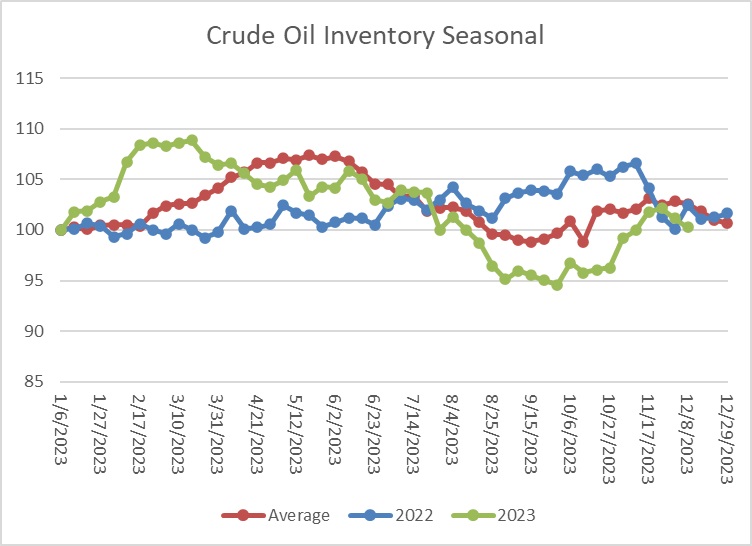

The above chart shows the seasonal pattern for crude oil inventories. Inventories are below seasonal norms but are following a similar pattern.

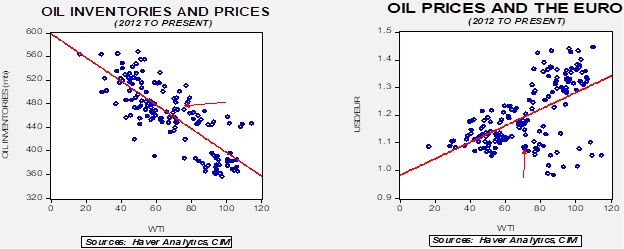

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $66.88. The recent drop in oil prices indicates that the geopolitical risk premium has mostly been priced out of the market.

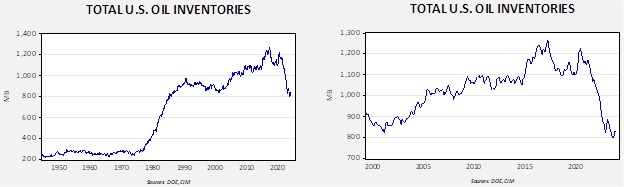

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $90.16.

Market News:

- COP28 is coming to a close with an agreement. Earlier in the week, it appeared that hopes of ending fossil fuel production had been scotched. The draft agreement didn’t contain commentary on phasing out fossil fuel fuels, mostly on pressure from Saudi Arabia. However, as is often the case, Satan lives in the details. Oil producers signed off after the language surrounding fossil fuels was softened to a “shift” from the energy source as opposed to a “phasing out.” The loopholes have been described as “cavernous.” As we noted earlier, we really don’t think these meetings will bring a serious change in policy. There is no international enforcement mechanism and the temptation to “free ride” the restrictions of other nations is too great.

- The IEA estimates that the current pledges to reduce fossil fuels will not limit global warning to 1.5oC, meaning that even current promises won’t be enough to limit projected risks from climate change.

- The DOE’s short-term energy outlook is calling for mostly steady prices for crude oil next year but lower gasoline prices.

- Foreign oil companies are exiting Nigeria. This could increase the odds that future production declines.

- Low water levels in the Panama Canal are causing shippers to reroute fuel shipments.

Geopolitical News:

- As we have noted in earlier reports, the plan to limit Russia’s revenue from oil sales has floundered, mostly because Moscow has worked around the insurance ban by building a fleet of old oil tankers. Over 70% of Russian oil sales is not using Western insurance. It will be interesting to see what happens when/if there is an accident involving one of these vessels.

- India paid $84.20 for Russian crude oil in October, well above the $60 cap.

- Although Venezuela continues to threaten Guyana, we doubt Maduro would actually invade. We suspect he will use the threat as a bargaining chip to get sanctions eased. Reports that Venezuela is contacting major oil firms to revive offshore projects is evidence that this may be his plan.

- The presidents of Guyana and Venezuela are set to meet on December 14, with Brazilian President Lula as mediator. Guyana has stated it will defend itself if Venezuela invades.

- So far, the Hamas/Israel conflict has remained contained. We do note that Israel has been making threats to Hezbollah (see below) in Lebanon and the Houthis are continuing to attack Red Sea shipping. Shippers are starting to avoid the area. There is still a chance that the war expands but, so far, Iran seems to prefer to keep it contained.

- The covert conflict between Israel and Iran is said to be continuing unabated.

- Israel is also facing increasing attacks on its northern border. Although they have not escalated to the point where Israel is moving to invade, the Netanyahu government might conclude that since it is already at war it might as well build wider buffers on its borders.

Alternative Energy/Policy News:

- Last week, we noted that COP28 included a nuclear energy push, supported by the U.S. But, once again, China appears to be dominating the effort. China has unveiled a fourth generation reactor, making it the leader in this technology. Perhaps even more troubling is that China is apparently trying to hoard uranium. The country’s buying behavior has sent uranium prices up 70% this year.

- The House has passed a bill banning the import of Russian uranium for nuclear power. However, the bill has an “out” clause that will allow for imports if other viable sources aren’t available.

- Nuclear startups are facing increased difficulty in raising funding and managing the thicket of regulation surrounding nuclear power.

- It is becoming increasingly clear that the U.S. will forego using Chinese EV components, which will slow the adoption of EVs but allow for a domestic industry to develop.

- Additional evidence of weakening EV demand comes from Ford (F, $10.98), which is cutting production of its F-150 Lightening truck.