Weekly Energy Update (December 10, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices are consolidating after the late November rally.

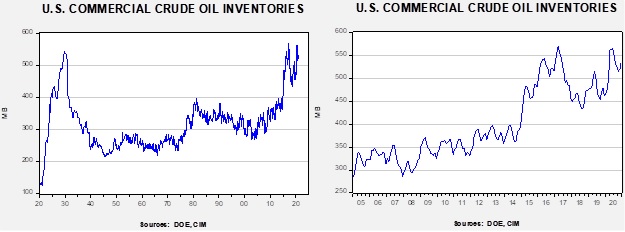

Commercial crude oil inventories unexpectedly jumped 15.2 mb when a 1.0 mb draw was expected. The SPR fell 0.1 mb; there is still 3.1 mb of storage in excess of the 635.0 mb that existed before the pandemic.

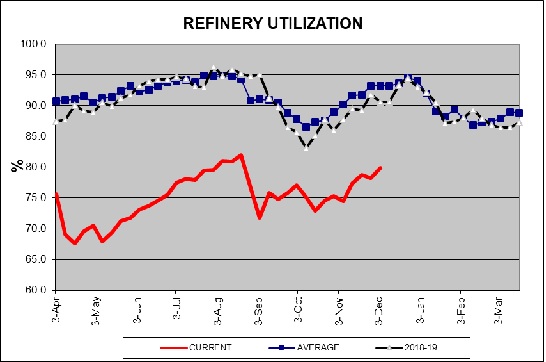

In the details, U.S. crude oil production was unchanged at 11.1 mbpd. Exports fell 1.6 mbpd, while imports rose 1.1 mbpd. Refining activity rose 1.7%. The unusual build appears to be a combination of rising imports and falling exports.

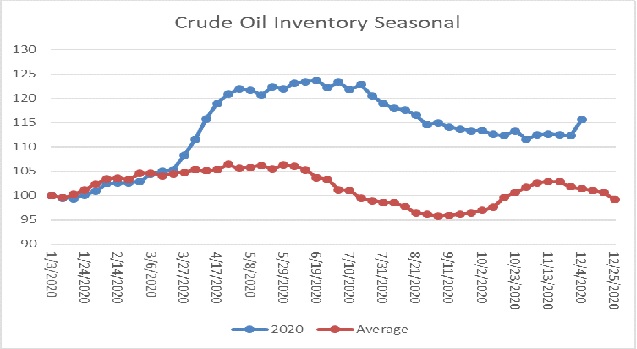

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data shows the large rise in crude oil stockpiles, which is clearly contraseasonal. Inventories are past their second seasonal peak and usually decline into year’s end.

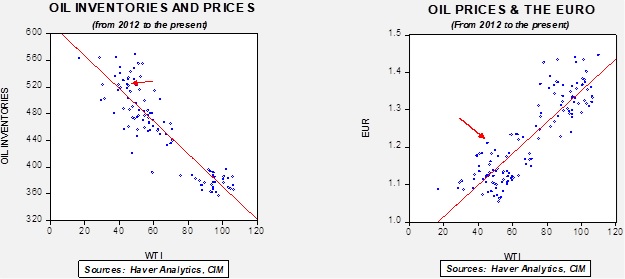

Based on our oil inventory/price model, fair value is $39.28; using the euro/price model, fair value is $69.41. The combined model, a broader analysis of the oil price, generates a fair value of $52.68. The wide divergence continues between the EUR and oil inventory models. This week’s jump in oil inventories led to a large decline in the oil model forecast, while the weaker dollar boosted the EUR model forecast. Overall, the dollar probably has a greater impact on oil prices and thus should keep the market elevated despite the increase in supply.

The above chart shows refinery utilization. Although run rates rose, they remain nearly 15 percentage points below average, reflecting weak demand.

In case you missed it, check out this interactive chart of U.S. energy consumption. Starting in 1800, it shows the shift from biomass to fossil fuels. It’s a chart you will want to keep. And, here is a primer on Cushing, OK, the delivery point for the NYMEX oil futures contract, a little town in Oklahoma that is a web of pipelines and a sea of storage facilities.

In Middle East news, two Iraqi oil wells in the Khabbaz field in Kirkuk were set ablaze by explosions carried out by Islamic State. Although the attack had only a modest effect on prices, Islamic State has been intensifying its efforts in this area, reflecting the lack of security in Iraq. Although Kuwait has an ample sovereign wealth fund, the emirate is facing a cash crunch as weak oil prices have reduced revenue and the economic slowdown has increased spending. Moody’s downgraded Kuwait’s debt in September over these concerns.

We have been documenting the decline in product demand due to the pandemic. Although recessions tend to be bearish for energy demand in general, this one has led to a sharp decline in mobility and has crimped gasoline demand. We are starting to see a ripple effect through the refining industry. Refiners have struggled with margins for years and the drop in demand has led to the closure of some refining operations. These closures have been especially pronounced in the West, where many of the facilities are small and old and thus more costly to operate. In Asia, there has been an increase in refining capacity and it is likely that, in the future, the West will be importing product from Asia.

On the alternative energy front:

- A potential battery breakthrough could have a significant impact on the electrification of vehicles. Although all are familiar with lithium batteries, the actual amount of lithium in these batteries is small because the metal is unstable. In practical terms, it has a tendency to catch fire if charged too quickly. This is why airlines are uncomfortable with lithium batteries in cargo holds. Specifically, lithium creates spikes called dendrites. Over time, these dendrites form on the anodes of a battery and can cause it to short circuit. A company called QuantumScape (QS, USD, 70.47) claims to have solved the problem by creating a solid state lithium battery. If true, it would dramatically shorten recharging times (it can reach an 80% recharge in 15 minutes), with more density and longer-lasting. If this battery works as advertised and is affordable, it would be a significant leap and likely improve adoption of EVs.

- Oil majors are facing increasing pressure to decarbonize. Shell (RDS.A USD, 37.46) had several clean energy executives leave over a disagreement on the pace of change at the company. The company says it wants to be at “net zero” by 2050. Meanwhile, Exxon (XOM, USD, 43.35) is facing pressure to replace board members with ones more amenable to climate mitigation. We also note the company has been slow to roll out its carbon capture program.

- Tom Vilsack has been chosen for Ag secretary. He has had that role before; one thing we will be watching for is growing interest among farmers to participate in carbon sequester. It may be possible for CO2 to be captured by cover crops, which would bring additional revenue to farmers. We will be watching to see if Vilsack becomes a proponent of this idea.

- Toyota (TM, USD, 140.70) is planning a new set of EVs. It is also offering its second generation of fuel cell vehicles.