Weekly Energy Update (February 2, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices appear to have based but so far have failed to break above resistance at around $80-$82 per barrel.

(Source: Barchart.com)

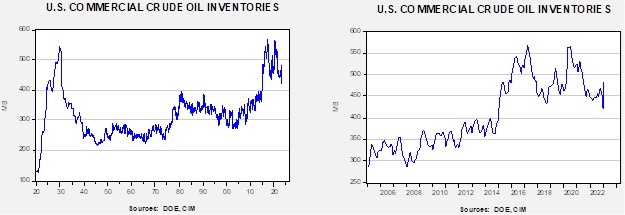

Crude oil inventories rose 4.1 mb compared to a 1.0 mb draw forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.2 mbpd. Exports fell 1.2 mbpd, while imports rose 1.4 mbpd. Refining activity declined 0.4% to 85.7% of capacity.

(Sources: DOE, CIM)

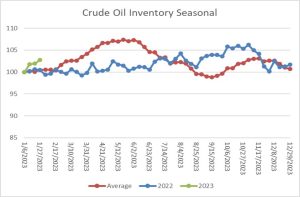

The above chart shows the seasonal pattern for crude oil inventories. Last week’s increase was contra-seasonal. Generally, we expect this year to follow last year, meaning that the usual rise in inventories isn’t likely.

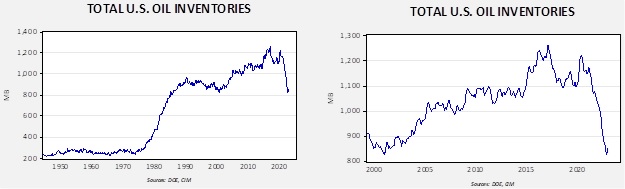

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. For the next few months, we expect the SPR level to remain steady, so changes in total stockpiles will be driven solely by commercial adjustments.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $107.01.

Market News:

- BP (BP, $36.31), has released its annual energy outlook. The research indicates that peak demand for fossil fuels will occur by 2035 at the latest but could occur by 2030 if policy leans against carbon emissions. There are a number of factors behind the expected peak, but one of the most overlooked areas is improved consumption efficiency. Research such as this makes it more difficult to argue for aggressive investment into future production.

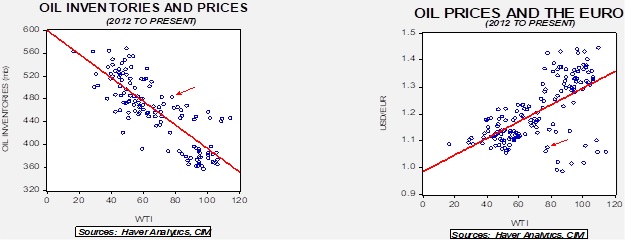

- A normal response to supply shortages is hoarding since insecurity over supply leads consumers to build stockpiles to protect against future outages. Paradoxically, this activity can cause its own supply problems as this stockpiling becomes a source of additional demand. We note that there are periods when U.S. commercial crude oil inventories are positively correlated to price. If inventory is simply a residual of supply and demand, then a positive correlation would not be expected. On this note, the German natural gas inventory manager says it intends to maintain a “buffer,” which we suspect means keeping a higher level of inventory than it would otherwise maintain. Also, the German government is considering a “strategic” natural gas reserve, which would be another source of demand. We have postulated, for some time, that as American hegemony wanes, one of the consequences would be insecurity of commodity supply, which would boost prices. These reports from Germany provide evidence of such activity.

- The White House criticized Chevron (CVX, $187.30) for its decision to repurchase shares. The administration would prefer the company expand production, but once an environment is created that calls for the replacement of fossil fuels, rewarding shareholders rather than boosting output is a rational outcome.

- Whenever the price of an important commodity rises, politicians usually charge firms in those industries with “price gouging.” Although further investigation rarely confirms that suspicion, it persists. Recently, Italian PM Meloni criticized gas station owners by accusing them of price gouging. In response, they held a one-day strike. Although closures of stations are rare, this event does highlight the potential for unrest due to high oil prices.

- One of the consequences of the war in Ukraine has been a restructuring of global oil flows. We also note that the EU is placing a ban on Russian product imports on February 5. It is not obvious if the markets are ready for this action.

- Local governments in China have exhausted their funds in the battle against COVID and now find they lack the resources to buy natural gas.

- One of the side effects of fracking is earthquakes. Although none of these earthquakes are of a high magnitude,[1] they are enough to be felt and raise fears among homeowners that the quakes will trigger structural damage. Tremors have been reported in Oklahoma and also now in Texas. It is thought that the primary culprit is fracking wastewater. Sand, water, and other chemicals are injected into the ground when a well is fracked. The water usually surfaces and needs to be disposed of, and a cheap solution is to reinject it into the depleted well. The water is thought to act as a catalyst for these earthquakes. The solution is to force energy companies to dispose of the wastewater in another fashion, and although possible, changing the regulations would lift costs and eventually raise energy prices.

- It should be noted that oil activity is said to be in a “boom” in Texas and New Mexico. It is having ripple effects outside of the oil and gas industry by lifting salaries and employment in other sectors of the economy.

- One of the bright spots for oil production is Guyana, which is expected to steadily boost production.

- The Biden administration’s decision to aggressively sell oil out of the SPR has been controversial. Although it is arguable that there are still ample supplies, as the previous chart showed, combining both the SPR and commercial stockpiles indicates that inventory levels have notably declined. The House of Representatives has passed a bill that would limit the Department of Energy’s ability to tap the SPR. While it has no chance of passage, it does reflect the current level of concern.

- Warm weather has not just lowered natural gas prices in Europe, but it has also taken U.S. prices below $3.00 per MMBTU. Although inventory levels are rather close to their five-year average, we are in the period of the year with the strongest drawdowns, but because of mild temperatures, we actually saw a build in U.S. stocks. Even if temperatures turn cold, it is likely we will begin the refill season in April with adequate stocks. We do look for prices to recover in the spring and summer as LNG exports increase to ensure Europe has adequate supplies.

- Despite low natural gas prices in Europe, ammonia producers on the continent have not responded with production increases. Ammonia is a critical element in fertilizers.

Geopolitical News:

- Over the weekend, Iran was hit with a series of aerial attacks. Oil refineries and defense infrastructure were reportedly hit by drones. The U.S. is suggesting that Israel was behind the widespread attacks, and apparently the U.S. was apprised of the operation. Iranian media reported that the damage was light, but the fact that the attacks occurred is notable for a few reasons. First, Israel has been reluctant to support Ukraine due to relations with Moscow (Russia and Israel cooperate in Syria); however, Iran is supplying arms to Russia so by attacking its defense infrastructure Israel could both help Ukraine and attack an avowed enemy. Second, Israel must believe that Iran has limited scope to retaliate, likely assuming that it probably can’t do much in response between the protests and a weak economy. Third, although there isn’t evidence that the U.S. directly participated, Washington appears to have abandoned a return to the JCPOA and thus is working on other ways to contain Iran. This cooperation may include the actions Israel took over the weekend. Still, the attacks on Iran create conditions where the war in Ukraine could expand.

- Israel also attacked an arms convoy that was crossing from Iraq into Syria.

- Even with the lack of progress in Iran and the U.S.’s return to the JCPOA, diplomats haven’t completely cut off contact, mostly because they don’t perceive any other available options to restrain Iran’s nuclear program.

- Despite this hope, there have been numerous reports recently that Iran has enough fissile material to make several nuclear weapons.

- The EU is considering naming the Islamic Revolutionary Guard Corps as a supporter of terrorism. Iran is threatening the EU if it adopts that position.

- The U.S. has accused Iran of a “murder for hire” plot to assassinate an Iranian-American writer living in New York.

- Iraq is dealing with increased currency smuggling, which has led to the Iraqi dinar’s depreciation. It is suspected that Iran is using its allies in Iraq to acquire dollars and the drain is weakening the Iraqi currency.

- Although Russia and China have publicly declared their strong alliance, in reality, the two nations don’t necessarily align in certain areas. One of the more contentious areas is in central Asia. Since these regions were formerly part of the Soviet Union, Russia tends to think of the “stans” as part of its sphere of influence. However, China’s goal of building a Eurasian bloc, expressed by its “belt and road” project, means that China would like these nations to align with Beijing. China has been using its economic heft to build relations, and we note that Russia is also making overtures to the stans by offering to sell natural gas in return for influence. So far, the stans have been reluctant to fully sign on. The central Asian nations are open to joint ventures but are reluctant to give Russia control of infrastructure.

- The EU has agreed on a price cap for natural gas, while the Intercontinental Exchange is creating a parallel contract in London to match the TTF price in Amsterdam ostensibly to skirt the cap.

- As Venezuela begins to emerge from sanctions, it is attempting to normalize its trading relationships. While under sanctions, it had used middlemen trading firms, likely for selling oil and to evade U.S. sanctions. As conditions normalize, it is now demanding cash up front for exports in a sign that it is moving on from sanctions trading.

Alternative Energy/Policy News:

- Polls show that the German public now supports nuclear power. Former Chancellor Merkel tried to phase out nuclear power after the Fukushima disaster, but high natural gas prices have changed public sentiment.

- We are beginning to see price discounting of EVs. Tesla (TSLA, $169.34) started the process, and now Ford (F, $12.94) is following suit. Some of this action is due to rising inventories, especially at Tesla, but another factor is that the cars may simply be too expensive to compete against gasoline-fired vehicles.

- China is considering banning the exports of its solar technology. Since it dominates this industry, such an action would send up the cost of solar energy outside of China.

- Researchers at the University of Illinois Urbana-Champaign have taken an abandoned oil well and turned it into a geothermal energy storage system. The researchers injected 120oF water into the well, and it maintained the temperature, suggesting that other abandoned wells could be repurposed for similar uses.

- In response to U.S. subsidies in the Inflation Reduction Act, the EU is planning to use tax credits to offer European businesses support for green energy.

[1] Californians would not be impressed.