Weekly Energy Update (July 22, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

The OPEC+ agreement led to a deep selloff in oil prices, but the decline has attracted new buyers.

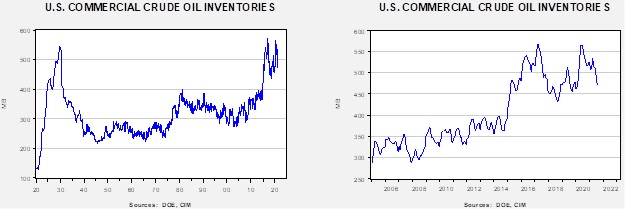

Crude oil inventories unexpectedly rose 2.1 mb compared to the 4.5 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production was unchanged at 11.4 mbpd. Exports declined 1.6 mbpd, while imports rose 0.9 mb. Refining activity fell 0.4%.

(Sources: DOE, CIM)

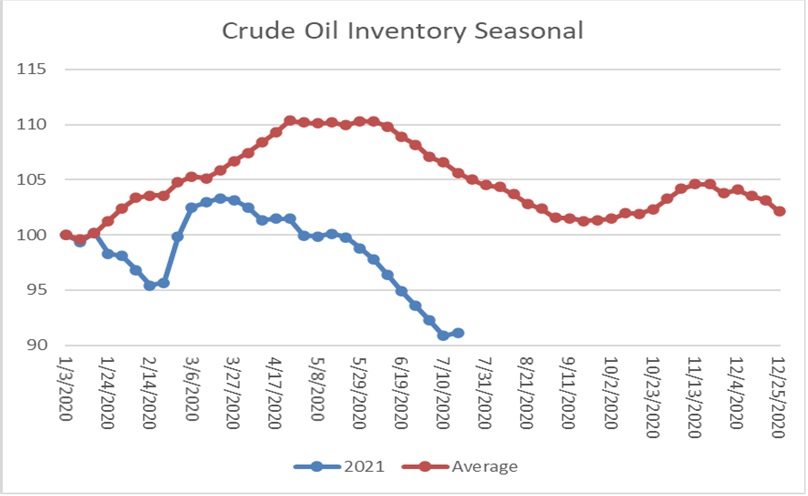

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are well below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 79.6 mb. At present, inventories are falling faster than normal.

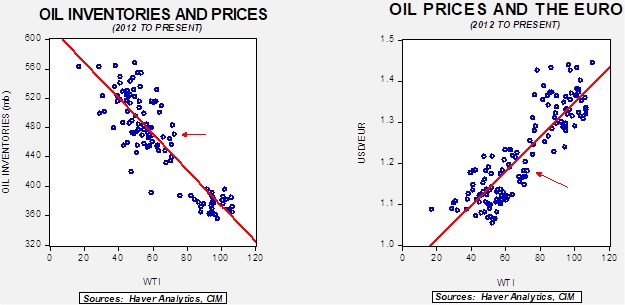

Based on our oil inventory/price model, fair value is $61.31; using the euro/price model, fair value is $63.07. The combined model, a broader analysis of the oil price, generates a fair value of $61.89. Even with this week’s pullback, oil prices are well above fair value for all the models. The ability for oil to maintain current levels is dependent on sentiment towards OPEC and issues surrounding the pandemic.

Market news:

- OPEC+ made it official this week; starting next month, it will increase production quotas by 0.4 mbpd each month into next year. Although this news already was signaled, as we note in the opening chart, oil prices slumped on the news. The fear is that the cartel is adding supplies to the market while it is being adversely affected by the Delta variant of COVID-19. Based on our modeling work, the market has been overvalued, so a pullback isn’t a complete surprise, and using the production news created a narrative for longs to take profits. Supplies will remain relatively tight, and we don’t expect prices to fall too much from here.

- Financial firms are increasing the financing for the oil and gas industry, but the firms are not using the loans for drilling. They are focusing on balance sheet repair. This behavior isn’t surprising given the likely path of future demand.

Geopolitical news:

- Although the Biden administration wants to revive the 2015 nuclear deal with Iran, Tehran is making it just about politically impossible to bring this about.

- In an audacious move, Iranian operatives plotted the abduction of Masih Alinejad, a journalist living in New York. Alinejad, an Iranian, has been critical of the Iranian regime. Four Iranians were charged with conspiracy in the incident. Iran has a long history of luring dissidents back to Iran for arrest, but it is rare that they would try such a scheme in the U.S.

- Iran has continued to violate the provisions of the nuclear deal, expanding its work in nuclear technology that could eventually allow it to build a weapon. It is hard to see how that progress would be reversed if there was a return to the earlier arrangement.

- If the plan to return to the 2015 nuclear deal fails, Iranian sanctions will likely remain in place. Although some Iranian oil is getting to market, it is usually at a deeply discounted price. So, the lack of an agreement is modestly bullish for crude oil prices.

- Iran is suffering through a bout of COVID-19 infections caused by the Delta variant. The government has implemented a lockdown on Tehran as the Eid holiday approaches.

- Although much of Iran is ethnically Persian, the Azeris, who are Arab, also live in the country. They tend to congregate in Khuzestan province. Drought has struck this region, which is not only an oil-producing area but has an agricultural industry as well. Divisions over water rights have triggered protests which have killed at least four people.

- Iran has been suffering through a series of blackouts. Although the industry appears to have ample generating capacity, mispricing, the lack of maintenance, and the insistence on exports have led to outages, increasing dissatisfaction with the regime.

- Morocco has claimed Western Sahara as its own. Those living in the latter region have been pressing for independence. It is an ongoing situation that we discuss in a recent pair of WGRs. The European Court of Justice is preparing a ruling on whether a rebel group in Western Sahara, the Polisario Front, is the legitimate representative of Western Sahara. If it is, Morocco will be upset and may retaliate by cutting off natural gas pipelines to Europe.

- Relations between the KSA and Turkey deteriorated over the murder of Jamal Khashoggi, Turkey’s support of Qatar, and Turkey’s support of the Muslim Brotherhood. Despite these differences, it appears the two nations are trying to improve relations. We suspect Turkey wants to align itself with the Arab states in opposing Iranian expansionism.

- The recent hack of the Colonial Pipeline was a major news event. However, such activity has been going on for some time. The U.S. admitted that Chinese hackers had penetrated several U.S. pipelines over a decade ago.

Alternative energy/policy news:

- Much to the chagrin of its trading partners, the EU is proceeding on a carbon border adjustment tax. As we noted last week, the tax is part of a broader initiative to reduce greenhouse gases. To some extent, this policy is an attempt by Europe to remain relevant in the world. The EU no longer projects military power, and its economic growth has been modest for years. But by expanding regulation, it is forcing nations who want to trade with the EU to adopt its rules.

- The countries most affected by the new rules will be Russia, Turkey, and China. However, the U.K. will be as well. The U.S. is surprisingly far down the list. Needless to say, those adversely affected are crying foul and may take their case to the WTO.

- One area that could affect the U.S. is LNG exports. EU rules are cracking down on methane leaks and areas that would force U.S. producers to take steps to reduce these leaks.

- The U.S. is also looking at similar policies.

- The oil and gas industry continues to work on carbon capture to reduce its emissions of greenhouse gasses. One area of interest is the use of CO2 in enhanced oil recovery. The gas is injected into producing wells to increase oil output. Currently, CO2 for this process is sourced from natural CO2 wells; the goal of the industry is to capture the carbon from the drilling process or directly from the atmosphere. In that way, a closed loop is created that makes oil and gas carbon neutral.

- Chevron (CVX, USD, 99.98) is working on such a project in Australia, but so far, the results have been disappointing.

- Exxon (XOM, USD, 58.16) and Royal Dutch Shell (RDS.A, USD, 38.60) have agreed to join a carbon capture and storage project in Scotland.

- Although batteries continue to be the leading technology for automobiles, trucks and planes may end up using hydrogen as their primary alternative fuel.

- Politicians often promote industrial jobs as a way to improve the lot of semiskilled labor. However, this nostalgia tends to overlook the fact that these jobs were not always considered “good” jobs. The pay was poor, and the work was brutal. It was a series of policy decisions that made job conditions improve. These included trade and immigration barriers that allowed for unions to flourish. However, over time, industrial firms increased productivity, automated facilities in the developed world, and labor-intensive parts were moved offshore. We note that there is much political discussion about good “green” jobs; the reality is that, at this point, such jobs are low-skilled and don’t pay well. In addition, the jobs they are replacing in the energy sector tend to pay better. It will take policy decisions to change this factor, and since green energy is mostly a technology industry, it will be a policy battle of notable proportion.

- Bill Gates is funding a major effort to build small modular nuclear power facilities.