Weekly Energy Update (July 6, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Despite OPEC+ promises to cut production, oil remains in a $67 to $74 per barrel trading range.

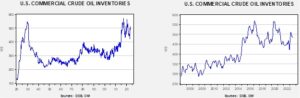

Commercial crude oil inventories fell 1.5 mb, which was on forecast. The SPR fell 1.5 mb, putting the total draw at 3.0 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 12.4 mbpd. Exports fell 1.4 mbpd, while imports rose 0.5 mbpd. Refining activity declined 1.1% to 91.1% of capacity.

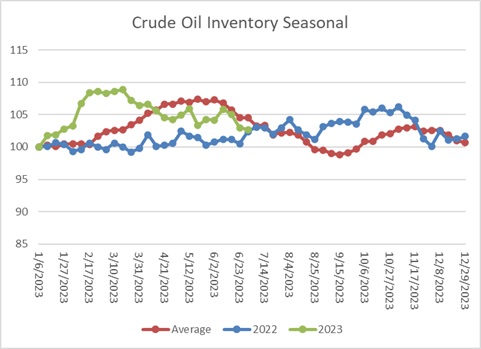

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s draw is consistent with seasonal norms. The seasonal pattern would suggest that stocks should fall in the coming weeks, but this pattern has become less reliable due to export flows.

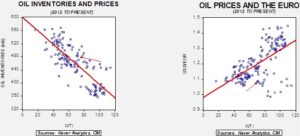

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $61.81. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

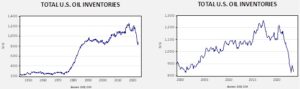

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.69.

Market News:

- This week’s big news was the decision by OPEC+ to extend voluntary production cuts. The Kingdom of Saudi Arabia (KSA) agreed to extend its 1.0 mbpd cut another month and Russia promised to cut its production by 0.5 mbpd. The action by the cartel’s two largest oil producers did lift prices, but the rise has been rather modest given the size of the reduction. Why has the market mostly shrugged off the cuts? There are a few reasons to account for the lackluster response.

- It’s a simple fact that production cuts are usually seen as temporary. Production cuts mean that OPEC+ excess capacity rises. Bullish market positions are based on confidence that the cuts will be maintained. History shows there is always a risk that the cuts will either be violated or eventually reversed. Given that the dollar now tends to rise when oil prices rise, the temptation to cheat on announced cuts is even higher.

- World economic growth is cutting into oil demand. The forward curve for crude oil suggests traders don’t see a near-term supply issue.

- Other producers within OPEC+ are still producing and could take market share. This is especially true of Iran; the sanctions regime is coming under pressure and thus more Iranian oil will likely be on the market.

- As interest rates around the world rise, the cost of storing oil also rises. If the oil market is in contango, the higher price for deferred barrels can offset the increases in interest rate costs. But the spread doesn’t currently compensate for higher borrowing costs. Overall, higher interest rates will tend to depress oil inventories, which could lead to higher prices if there is a disruption in flows.

- Argentina’s oil production is rising due to investment in shale fields at the Vaca Muerta project.

- Climate change policies are likely to lead to falling oil demand. This factor makes long-term production forecasting problematic for oil companies.

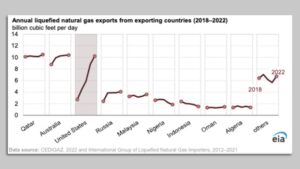

- The U.S. is rapidly building out its LNG export capacity, which has led to a sharp rise in exports. As this chart shows, this expansion has been rapid compared to the rest of the world. And, the U.S. number was adversely affected by the outage at Freeport. Despite the rapid increase, Europe and China are scrambling to secure U.S. LNG, which is adversely affecting smaller buyers in Asia.

Geopolitical News:

- The whole “decoupling/derisking” discussion with China is ongoing. The issue affects numerous industries, with technology and clean energy getting most of the attention. However, it should be noted that China imports significant levels of LNG from the U.S. So far, those flows have not been affected by the debate.

- The U.S. has released frozen funds to Iran in a bid to improve relations enough to make a modest nuclear deal and garner the release of Americans held by the regime. This thaw happened at the same time the U.S. Navy prevented Iran from seizing oil tankers near the Strait of Hormuz.

- Russia’s continued problems are prompting Central Asian oil producers to build new logistical channels to avoid the country. Increasingly, the war in Ukraine is causing Russia to lose its grip on its former near-abroad.

- Due to constraints within the Indian refinery system, we may be at the peak of Russian oil sales to New Delhi.

Alternative Energy/Policy News:

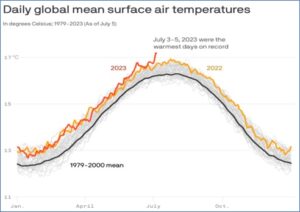

- Hot weather continues across the South and Midwest. According to researchers at the University of Maine, global temps may have set a record recently.

- In Texas, electricity demand hit a new record on June 27 due to high temperatures. It turns out that solar power in Texas has been a reliable source of power, helping Texas avoid service interruptions.

- These hot temperatures are not unique to the U.S. The world is seeing record temperatures.

- Solar panel production is creating tight supplies for silver.

- Electric vehicle (EV) news:

- As cobalt prices decline, China is stockpiling the metal. High prices last year led to higher production; as supply rose, prices fell. Cobalt is used in EV batteries. China is also the world’s primary source for finished nickel, which is also part of EV batteries. Meanwhile, Indonesia may be poised to further increase nickel output but perhaps at high environmental cost.

- Car companies around the world are taking an interest in acquiring key battery minerals. BYD (BYDDY, $67.21) announced a lithium processing project in Chile. As foreign interest rises, nations with the deposits are driving harder bargains to access these key resources. On a related note, the recent phosphate deposits discovered in Norway appear to be very large.

- China’s announcement of export licenses for rare earth metals is triggering a global scramble to secure these resources.

- In China, firms are creating subsidiaries to capture EV government funding.

- As we have been noting recently, China is targeting Europe for EV exports. China also announced groundbreaking on a new EV battery factory in Thailand and a lithium processing plant in Zimbabwe.

- Nations around the world have been subsidizing elements of their domestic EV industries. India announced subsidies for batteries this week.

- Toyota (TM, $161.99) announced a solid-state battery that would cut the weight of current batteries by 50% and reduce charging times to 10 minutes. The company hopes to commercialize the product by 2027. Solid-state batteries would likely tip the balance toward EVs because they would provide longer-range vehicles with recharging speeds near gasoline refills. However, it has been the promise for a long time.

- Recent surveys show that the public is open to EVs but only about 40% are in favor of totally eliminating ICE vehicles. Generally speaking, Republicans are less open to alternative energy than Democrats, although there is still some support for the transition even among the former.

- China is rapidly expanding its solar and wind energy capacity. In fact, it has hit its existing targets five years earlier than expected. However, progress has been slower than expected in rural regions.

- The Inflation Reduction Act is prompting European nations to build hydrogen production in the U.S.

- Siemens Energy (SMNEY, $16.46) wind turbines are developing cracks that are expected to cost at least €1.0 billion to address.

- Ocean shippers are experimenting with large kites to aid in propulsion. Using kites could reduce fuel consumption by up to 30%.