Weekly Energy Update (June 24, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are moving steadily higher in an orderly fashion.

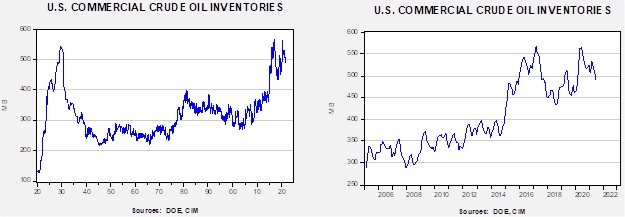

Crude oil inventories fell 7.6 mb compared to the 3.5 mb draw expected. The SPR fell 1.7 mb, meaning without the addition from the reserve, commercial inventories would have declined 9.3 mb. We note the SPR is at its lowest level since October 2003.

In the details, U.S. crude oil production fell 0.2 mbpd to 11.0 mbpd. Exports fell 0.2 mbpd, while imports rose 0.2 mb. Refining activity fell 0.4%.

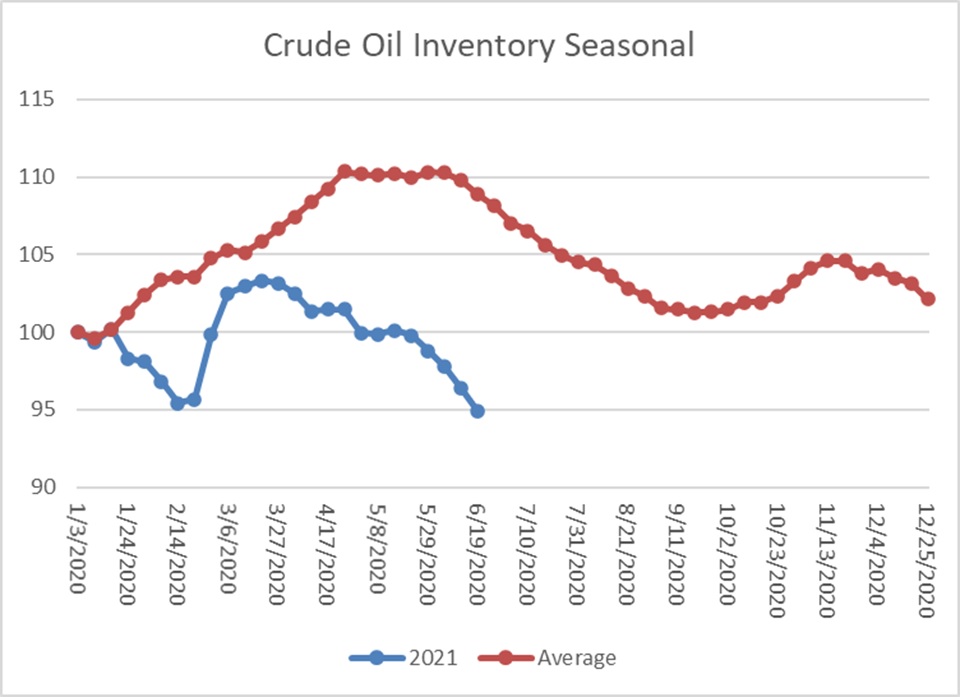

This chart shows the seasonal pattern for crude oil inventories. We are beginning the summer withdrawal season. Note that stocks are already below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 465 mb. Our seasonal deficit is 72.2 mb. At present, inventories are falling faster than normal.

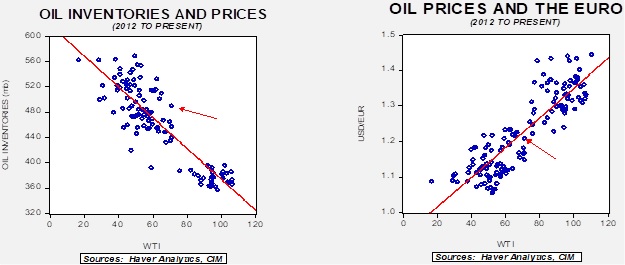

Based on our oil inventory/price model, fair value is $55.05; using the euro/price model, fair value is $68.47. The combined model, a broader analysis of the oil price, generates a fair value of $61.47. Oil prices are still “rich” relative to inventory levels; recent dollar strength caused by uncertainty surrounding Fed policy has also reduced the dollar model’s fair value.

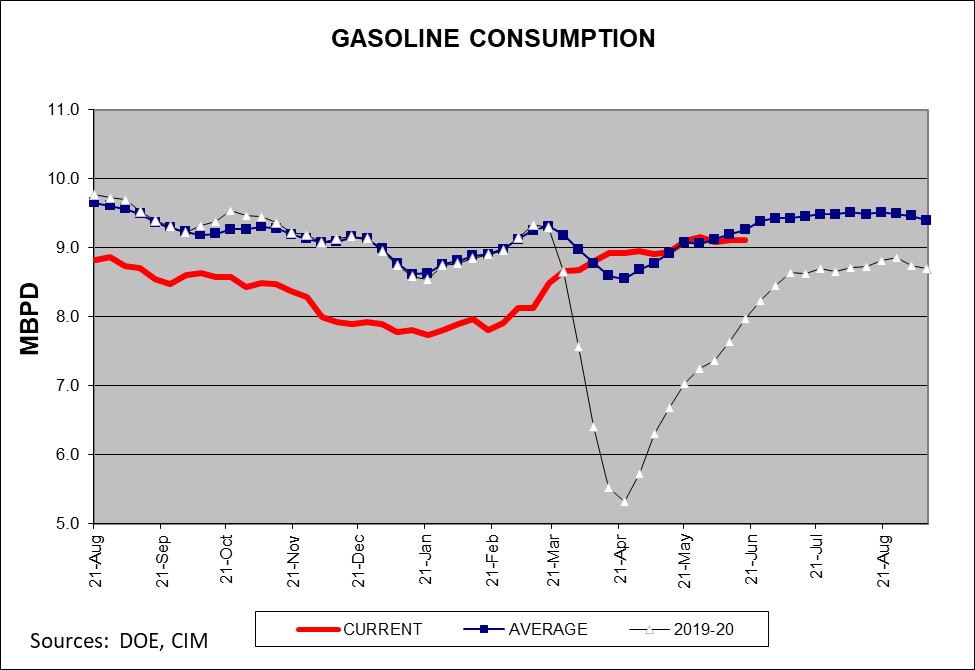

Although the economy is reopening, gasoline demand does not reflect any sort of “pent-up” demand. Consumption is running in line with the five-year average.

Market news:

- It is well known that China dominates rare earths. As relations deteriorate, western nations are looking to rebuild rare earth mining and processing. However, China didn’t achieve its current status because such activities are not possible elsewhere; China was willing to accept the environmental costs associated with the industry when the West was not. Now, as the West tries to diversify its sources of these critical metals, it must decide where the burden of the environmental costs will fall.

- The SEC is pressing firms to make environmental risk disclosures. Businesses are pushing back.

- The natural gas market has been tightening, and prices have been rising as a consequence. As natural gas prices lift, coal demand has been increasing.

- A recent study by the San Francisco FRB suggests firms begin to factor in environmental changes even before regulations or laws change. Although regulations tend to change from administration to administration, firms must make investment decisions based on some sort of future equilibrium. This report shows that they do.

Geopolitical news:

- The U.S. has started withdrawing military resources from the Middle East. Specifically, America is removing anti-missile systems and air assets. We expect that the U.S. wants to focus less on this region so it can concentrate on the threat from China.

- As expected, Ebrahim Raisi won the recent presidential elections in Iran. We do expect Iran and the U.S. to agree to return to the 2015 Iran nuclear deal, but little other progress is likely. Raisi has indicated he won’t curtail missile development or stop supporting Iran’s proxies in the region. And, he has no interest in meeting with President Biden (and we can’t imagine Biden would want to meet with him either).

- Meanwhile, the U.S. has closed websites tied to Iran that they accused of spreading disinformation.

Alternative energy/policy news:

- The shift from fossil fuels is really about the electrification of the economy. This report is a good roundup of the challenges.

- Through aggressive subsidies, China has come to dominate the solar panel industry. First Solar (FSLR, USD, 79.84) is investing in a new U.S. panel factory, banking on support from Washington to make the project viable.

- Russia’s state-run atomic energy firm, Rosatom, is embarking on green energy projects.

- Renewable energy is being purchased aggressively by tech companies.

- Carbon sequestering is one way that fossil fuels can reduce their impact on climate change. The most common use of CO2 is through enhanced oil recovery, where the gas is injected into wells to boost their pressure and improve productivity. With that method, the gas remains in the ground. Unfortunately, most of the CO2 currently used for this process comes from underground instead of from refining and drilling. To change this, the oil industry would need to build a pipeline infrastructure.

- This report offers a primer on hydrogen.

- As the shipping industry looks to reduce its carbon footprint, ships are investigating an old propulsion system, sails.