Weekly Energy Update (June 29, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices may be establishing a new trading range between $67 and $75 per barrel.

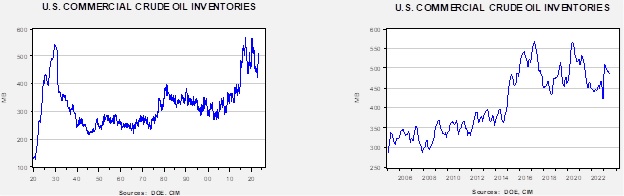

Commercial crude oil inventories fell 9.6 mb when compared to the forecast draw of 1.3 mb. The SPR fell 1.4 mb, putting the total draw at 11.0 mb.

In the details, U.S. crude oil production was steady at 12.2 mbpd. Exports rose 0.8 mbpd, while imports rose 0.4 mbpd. Refining activity declined 0.9% to 92.2% of capacity.

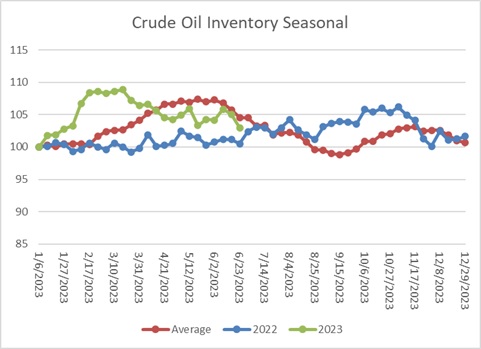

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s draw is consistent with seasonal norms. The seasonal pattern would suggest that stocks should fall in the coming weeks, but this pattern has become less reliable due to export flows.

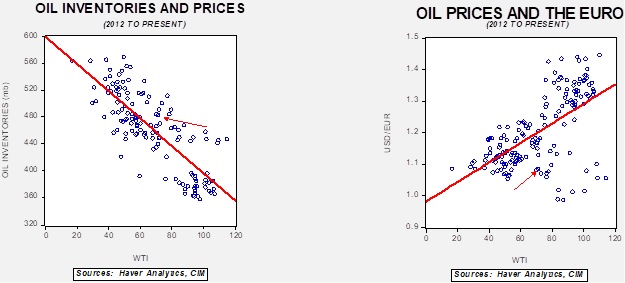

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $61.31. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

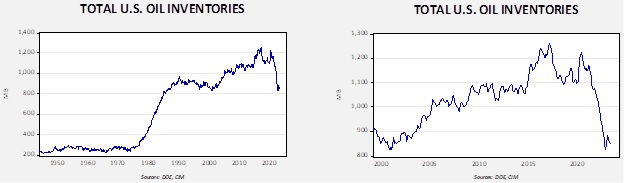

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.62.

Market News:

- The Dallas Fed data shows slowing activity in shale drilling. Rig counts have been falling and firms are reducing investment in production.

- OPEC+ is trying to woo Guyana into the cartel. So far, the South American nation has fended off the invitation. The government argues that with oil demand set to decline over time, the country needs to maximize revenue in the short run; thus, producing to a quota may harm that effort.

- From the 1970s into the late 1990s, the Kingdom of Saudi Arabia’s (KSA) rank as foreign supplier of oil to the U.S. was a reliable signal for the market. If the Saudis’ position fell below second place, within a few months, the Saudis would tend to flood the market with oil to maintain dominance of the U.S. oil market. The shale revolution ended that relationship, but we are watching closely to see if a similar pattern develops with the China market. It will be more difficult to establish the foreign rank given China’s tendency to control information, but we would not be surprised to see foreign oil producers try to become the largest supplier to China. Thus, we note with interest the reports that Russia is gaining share in China. This development could end the KSA’s recent thrust to raise oil prices via unilateral production cuts.

- As a heat wave develops in the Pacific Northwest, a county in Oregon is suing fossil fuel companies. Although we doubt this action will have any effect, it does suggest a vulnerability for energy producers.

- The DOE says that the majority of the lower 48 will be at risk of electricity disruptions due to high temperatures.

- China is aggressively expanding its petrochemical capacity, leading to a glut of product on global markets. Meanwhile, there is new investment in this industry in the KSA as well.

Geopolitical News:

- News of the Russian “coup” dominated last weekend, but for the oil markets, it’s not obvious if it will make much difference. Although there are many articles suggesting Putin is finished, we will wait and see. Chaos in Russia would be bullish for oil prices but, in the short run, not much has changed for oil flows.

- New research shows how geopolitical insecurity is leading China to stockpile oil and expand relations with oil and gas producers. The research suggests that insecurity of supply is driving policy.

- There is increasing evidence that the KSA is engaging in energy policies designed to harm the U.S. For example, the U.S. will see the largest export reductions tied to the KSA’s decision to cut oil production.

- The KSA is sending high-ranking officials to China’s “Summer Davos,” or formally, the Annual Meeting of New Champions. The decision highlights the Saudis’ close relations with Beijing.

- The latest on the Nord Stream sabotage is that Ukrainian operatives based this action in Poland. If true, it complicates inter-EU relations with Germany.

- Russian product sales are being facilitated by European trading firms.

Alternative Energy/Policy News:

- Ford (F, $14.12) has won a $9.2 billion DOE loan to build three EV battery factories. The UAW is unhappy with the development as the factories will be in non-union states and will likely not be manned with union labor.

- Synthetic fuels could replace traditional fossil fuels and, if created by nuclear power, they could be nearly carbon-free or carbon-negative if captured CO2 is used in the process.

- Oil and gas firms are expanding into lithium.

- China and Sweden have had political spats over the years, mostly over human rights issues. China has unofficially banned graphite sales to Sweden; the metal is a key component in EV batteries. Although it’s possible that China’s refusal to sell to Sweden is political, it’s more likely that Beijing wants to cripple Sweden’s battery industry.

- Sales of EVs continue to climb. China continues to dominate EV exports.