Weekly Energy Update (March 16, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil decisively broke its recent $72-$82 per barrel trading range. Fears of recession, exacerbated by widespread banking problems, weighed heavily on oil prices.

(Source: Barchart.com)

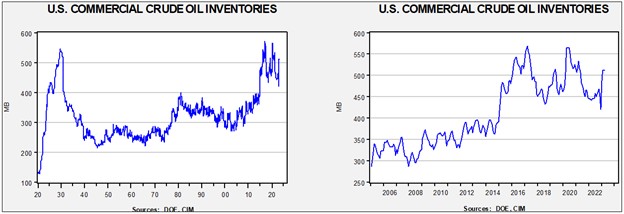

Crude oil inventories rose 1.6 mb on forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.2 mbpd. Exports rose 1.7 mbpd, while imports fell 0.1 mbpd. Refining activity rose 2.2% to 88.2% of capacity.

(Sources: DOE, CIM)

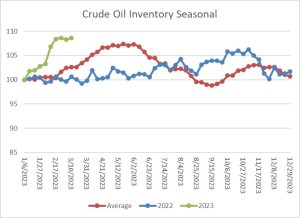

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections have slowed. Levels remain above seasonal norms, but with refinery activity starting to ramp up for summer, we should see some declines in the coming weeks.

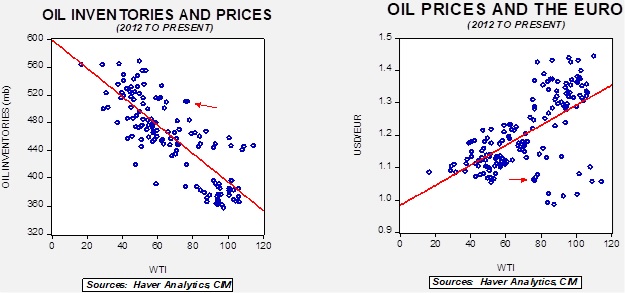

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $52.32. Although we think there is enough geopolitical risk in the world to prevent a decline to this level, it does suggest the oil market is dealing with rather weak fundamentals.

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $92.96.

Market News:

- The Biden administration announced that it approved the Willow oil project on Alaska’s North Slope, which is expected to produce 180 kbpd. ConocoPhillips (COP, $101.99) has had three drilling pads approved; the company had asked for five. The administration is facing political tensions over the approval. On the one hand, high oil/gasoline prices are never politically popular, but on the other, the Democratic Party coalition has a large environmental wing that has consistently opposed North Slope projects. The White House is trying to “thread the needle” by arguing that the project is smaller than initially projected, but that will be of little comfort to environmentalists. In addition, the administration is expected to limit offshore oil drilling in the Arctic Ocean.

- The IEA report confirmed a large jump in global inventories, which mirrors the increase seen in the U.S. (see chart above). Rising production offset a less robust lift in consumption. Although Russian oil exports did decline, production remains higher than expected.

- The CERA conference, which was held last week in Houston, featured oil industry execs suggesting that oil and gas production will rise, while climate change advocates continue to point out that temperature goals won’t be met if the oil execs turn out to be right. To some extent, this is a timing issue. Shifting to a new energy source takes time and often requires an exogenous catalyst; for example, the shift to oil from coal was bolstered by WWI and the naval transition away from coal. So far, we have yet to see that catalyst.

- As we noted last week, there is increasing evidence that the shale boom may have peaked. If so, attempts by the U.S. to withdraw from the Middle East may be premature.

- Lower oil prices are supporting global growth.

- Overall, winters appear to be getting warmer, and that trend will tend to depress natural gas demand. We note that European steel mills are reopening due to lower energy prices and higher steel prices. In addition, a plethora of LNG projects could reduce natural gas prices in the future. More nations are building regassification facilities, but there is risk of overinvestment on both the supply and demand side.

- China may take advantage of lower LNG prices, but Japan is buying less.

- The EU plans to end the sales of internal combustion engines by 2035, but Germany and others are pushing back. France, which supports the measure, is working to undercut Germany on this issue.

- Oil tanker rates are rising substantially, and market reports suggest that China’s reopening is the key factor.

- OPEC+ has seen mostly steady demand this year as falling Western demand is offset by China’s reopening.

- The House GOP is putting together a major energy bill designed to boost fossil fuel production. It is unlikely to pass the Senate, but even if it does, the president will likely veto it. However, it does create a “marker” for the future. The House is also trying to reverse the Biden administration’s decision to suspend tariffs on imported solar panels.

Geopolitical News:

- In a blockbuster development, the Kingdom of Saudi Arabia (KSA) and Iran have agreed to resume diplomatic relations in a deal brokered by China. Beijing has gained international stature with the deal, something the U.S. would not have been able to accomplish due to the severing of relations with Iran in 1979. Here are our key takeaways:

- This is a major win for China. Foreign powers have tried to play the role of “fair broker” in the Middle East, but eventually, all who tried have ended up choosing sides. China isn’t at that stage yet, although we doubt it will be able to maintain neutrality indefinitely. Nevertheless, if China can use its clout to stabilize the region, it will boost China’s influence at the expense of the U.S.

- An important reason for China’s success is that both sides are fatigued by the status quo. Iran has been isolated by U.S. sanctions and internal unrest. Its economy has been hit by protests and a sharp depreciation in the IRR. The KSA would like to end the conflict in Yemen. Improving relations could allow Iran to more easily circumvent sanctions, and Tehran may be able to stabilize the conflict in Yemen by reducing support for the Houthis. Once both sides regain their footing, it may be hard to maintain this thaw.

- One motivation behind the KSA’s agreement to the deal (seemingly something it was considering even before China got involved) was to use the thaw as leverage against the U.S. The Saudis have already indicated what the cost of continued U.S. support will be: Riyadh wants a civilian nuclear power program, official security assurances, and less scrutiny of arms purchases.

- U.S. relations with the KSA have been shaky for some time. The Saudis were furious with Washington after the attack on Ras Tanura in 2019. The U.S. seemed to signal that it would retaliate, but then did nothing, thus undermining the security guarantee. President Biden calling MBS a “pariah” hasn’t helped either. The Saudis appear to be moving in the direction of being less aligned with the U.S.

- Other Persian Gulf states will likely be willing to deal with Iran if the KSA is on board.

- At the same time, we doubt Iran will reduce its support for proxy forces in the region. It won’t abandon Hezbollah, for example. At some point, diplomatic progress will likely cease.

- Also, if there is an event in the region, the KSA will likely find that China isn’t much help. On the other hand, we note that China, Russia, and Iran are holding naval drills in the Gulf of Oman, suggesting China is at least trying to show that it can project power in the region.

- For Israel, this announcement is a problem. Israel always wants to keep the possibility open of using military force against Iran, which would entail overflying KSA airspace. That might not be possible now. There are elements in Israel upset with the Biden administration for not being “harder” on Tehran.

- Overall, we don’t expect this agreement to affect OPEC+ discussions or policy. Most members are near capacity anyway and the world will need more, not less, oil from the cartel.

- In other Iran news, the government announced it has pardoned 22k protestors.

- One of the features of war is miscalculation. Since war is difficult, nations entering a conflict often underestimate the costs and overestimate the strengths of their positions. With the war in Ukraine, Russia assumed European nations were so dependent on Russian oil and gas that they would capitulate and not support Ukraine. The West assumed that the combination of sanctions and the lack of Western oil technology would lead Russian energy production to collapse, forcing Russia to end the conflict with Ukraine. So far, neither has occurred. And so, it looks more like we are in a war of attrition. Russia does face a long-term issue with oil production due to the lack of Western technology, but that degradation will likely take some time to become clear. Moreover, Europe has discovered new sources of oil and gas, but at higher prices, and if the shale boom has peaked, then Europe may have only found a short-term solution to its supply problem.

- During the Obama administration, the policy aims of the U.S. and Israel regarding Iran diverged. The U.S. was trying to reduce tensions with Tehran, which Israel vehemently opposed. However, as Iran continues to enrich uranium, policy differences have begun to narrow significantly.

- The U.S. Treasury implemented additional sanctions on Iran due to human rights abuses.

- Russian President Putin rejects the narrative that Ukraine sabotaged the Nord Stream pipelines.

Alternative Energy/Policy News:

- Tesla (TSLA, $181.65) is vowing to eliminate rare earths in its autos. The report caused rare earth companies’ equity values to drop. As we have noted before, China dominates rare earth processing and mining. The West is trying to create additional supply but faces daunting permitting constraints.

- China is limiting access to cobalt as prices fall to a 32-month low.

- President Biden and European Commission President von der Leyen met in Washington in an attempt to structure a very narrow “free trade deal” that would allow European companies to extract Inflation Reduction Act subsidies without moving operations to the U.S.

- The collapse of Silicon Valley Bank has raised concerns about climate tech funding.

- As we noted last week, Volkswagen (VWAPY, $13.00) is aggressively investing in EV production.

- China has actually built enough solar capacity that electricity prices have turned negative in some areas.

- One topic that was widely discussed at CERA was moving to hydrogen.