Weekly Energy Update (March 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

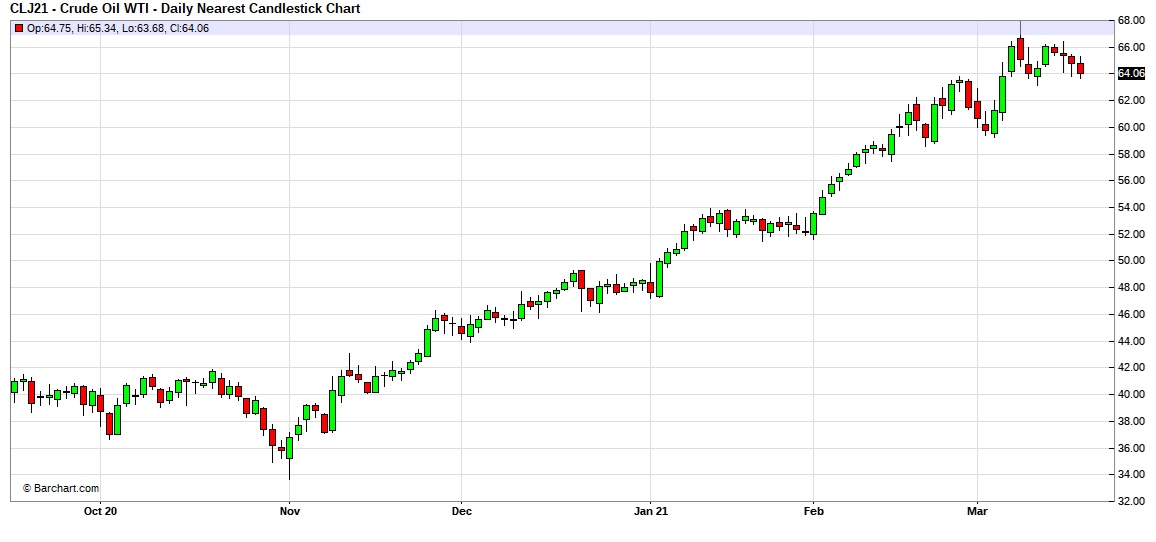

Here is an updated crude oil price chart. Prices are consolidating in the low $60s.

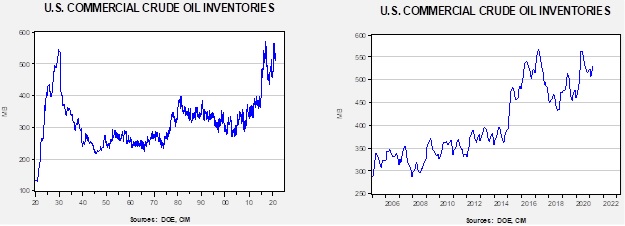

Crude oil inventories rose 2.4 mb which was in line with forecast. There was no change in the SPR. We did see a recovery in refinery operations but not enough to prevent the rise in inventories.

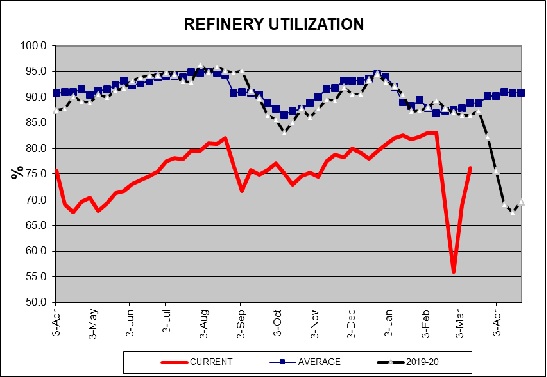

In the details, U.S. crude oil production was unchanged at 10.9 mbpd. Exports fell 0.1 mbpd, while imports fell 0.3 mbpd. Refining activity rose 7.1%.

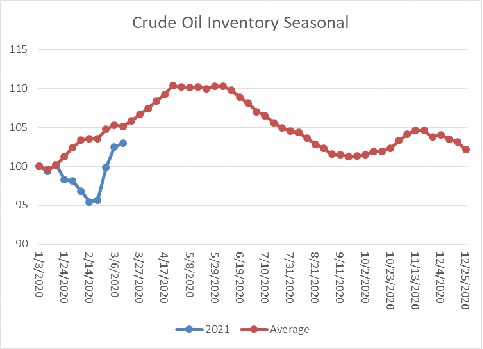

The above chart shows the annual seasonal pattern for crude oil inventories. Inventories remain at a seasonal deficit, but the gap is narrowing, mostly due to disruptions surrounding the recent cold snap. If we were following the normal seasonal pattern, oil inventories would be 13.5 mb higher.

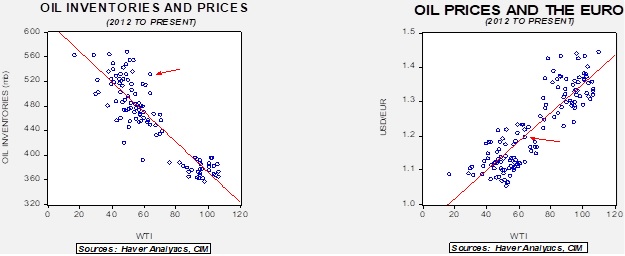

Based on our oil inventory/price model, fair value is $40.87; using the euro/price model, fair value is $66.01. The combined model, a broader analysis of the oil price, generates a fair value of $51.98. The divergence continues between the EUR and oil inventory models, widening due to the distortions caused by the February cold snap.

Refinery operations jumped last week but still remain well below recovery levels and pre-Texas freeze levels.

Market news:

- Although it’s a bit wonky, Platts (SPGI, USD, 348.61), the company that creates pricing benchmarks for energy and other commodities, was considering making a change to freight pricing as part of a change to include WTI in its international benchmarks. WTI was generally not considered an international price because it wasn’t exported until a few years ago. The industry has pushed back hard on the change, meaning Platts will likely return to the drawing board to rethink its freight price position.

- The IEA issued its forecasts for supply and demand through 2026. Demand will likely return to previous peaks by early 2023 and reach 104.1 mbpd by 2026. This forecast is remarkably optimistic, but, if accurate, would suggest that fossil fuels are still viable.

- We continue to deal with the fallout from the February cold snap. The latest problem is that the freeze shut down petrochemical plants in the Lone Star State, which is now causing a global plastics shortage. Polypropylene and polyvinyl chloride are used in a variety of products, leading to supply problems in several industries. Rising costs of inputs are raising inflation concerns across numerous markets.

Geopolitical news:

- So far, despite attempts to restart talks with Iran, little progress has been made. We doubt anything will occur before Iran holds presidential elections in June.

Alternative energy/policy news:

- Hydrogen continues to attract interest. The Financial Times is running a series on hydrogen. The most promising areas are using the fuel for steel production, airplane fuel (batteries are probably too heavy for planes), and centralized fleets. For cars, batteries look to be the winner.

- Battery metals are seeing a surge in demand. Essentially, the electrification of automobiles is a swap of hydrocarbons for metals. This rise in demand is affecting prices of these metals.

- The supermajor oil companies are trying to adapt to an ESG world. Chevron (CVX, USD, 107.61) is facing criticism from environmental groups for “greenwashing,” which is the charge that the company’s environmental announcements are inadequate. A complaint has been filed with the FTC.