Weekly Energy Update (March 4, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices are consolidating in the high $50s to the mid-$60s.

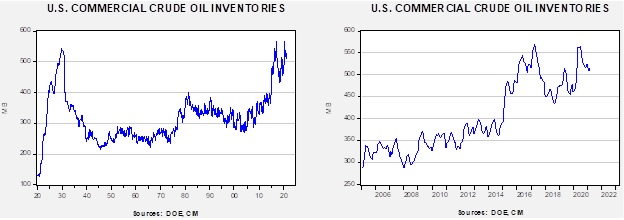

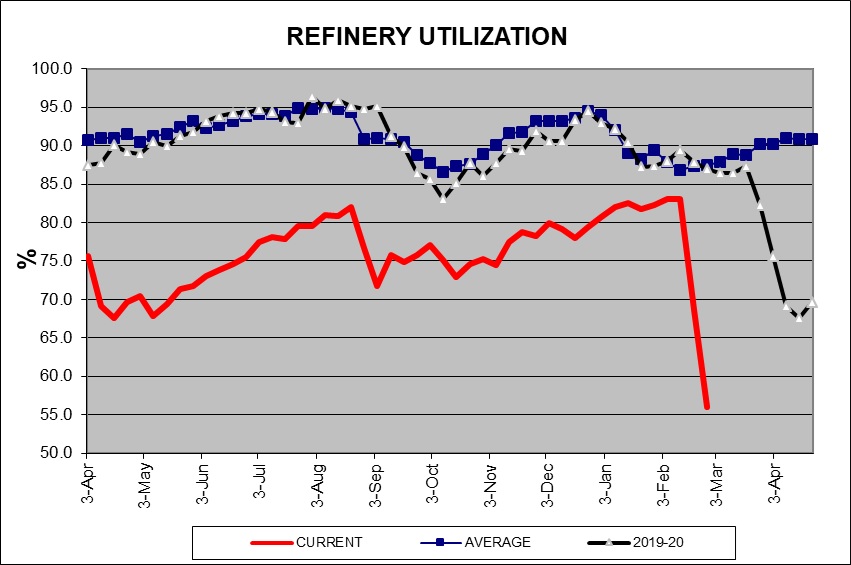

Crude oil inventories jumped 21.6 mb when a draw of 4.0 mb was forecast. There was no change in the SPR. The build in stockpiles was offset by declines in product but the report outlier was the 12.6% drop in refinery operations which prompted the rise in inventories.

In the details, U.S. crude oil production rose 0.3 mbpd to 10.0 mbpd. Exports were unchanged, while imports rose 1.7 mbpd. Refining activity plunged 12.6%. The second week of falling refining activity led to the unanticipated rise in inventories.

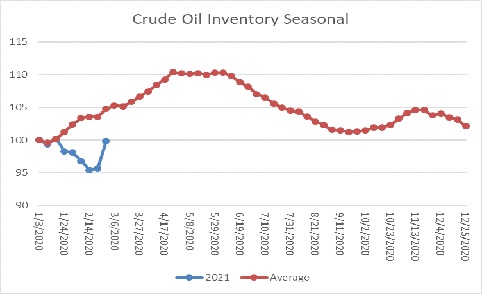

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s rise is seasonally normal but clearly outsized. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 34.5 mb higher.

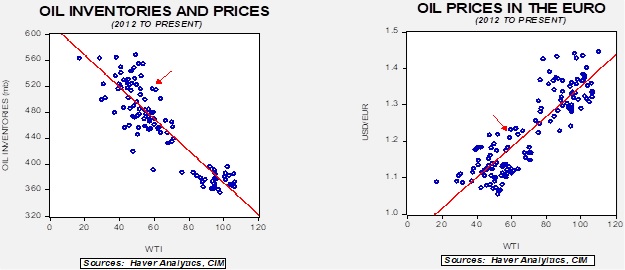

Based on our oil inventory/price model, fair value is $45.63; using the euro/price model, fair value is $68.88. The combined model, a broader analysis of the oil price, generates a fair value of $59.83. The divergence continues between the EUR and oil inventory models, although it is narrowing.

As we noted above, refinery utilization plunged last week. This is the lowest weekly utilization on record dating back to 1986.

Market news: As the data show, the oil markets are still adjusting to the February cold snap. We would expect normalization to begin with next week’s report. Sadly, the financial fallout will likely last much longer.

- ExxonMobil (XOM, USD, 57.25) has divested of its North Sea assets.

- Bakken oil producers are concerned that the Dakota Access pipeline may be closed.

- At press time, OPEC+ had not decided on further production increases, which is bullish for crude oil.

Geopolitical news:

- Iran continues to try to improve its negotiating position with the U.S. The key unknown for Tehran is how badly does Biden want a deal with Iran? Given Iran’s behavior, it would appear it believes Washington really wants an agreement. We suspect this is a mistake; the administration would like to return to the nuclear deal struck under President Obama but it isn’t as high of a priority as the Iranians seem to think. We doubt the U.S. will meet Iran’s demands to end sanctions as a precondition for talks. If so, it is likely that nothing happens.

- Former KSA oil minister Zaki Yamani has died. Perhaps this is his most famous quote: “The stone age did not end because the world ran out of stone,” Yamani said, “and the oil age will end long before the world runs out of oil.”

- The Biden administration is considering “green tariffs” for carbon adjustment fees on imports. This measure would apply tariffs to equalize the price between higher cost “green” commodities and lower cost “dirty” ones.

- China is dominating the supply chain for clean energy.

Alternative energy/policy news:

- The API is endorsing carbon prices, an acknowledgement that the trend for greener energy is in place. Carbon pricing is critical to using market forces to adjust to a lower carbon energy system. The Biden administration has reverted to Obama era carbon prices but refrained from lifting the estimated cost further.

- Midstream energy firms are preparing to better control methane and CO2 emissions.

- Europe has become the world’s largest consumer of EVs, mostly due to government subsidies.

- Growing worries about sourcing metals are encouraging the development of battery recycling.

- Despite interest in modular reactors, the industrialized world remains skeptical over nuclear power. That isn’t the case with China.