Weekly Energy Update (May 26, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices have been mostly holding steady this week.

(Source: Barchart.com)

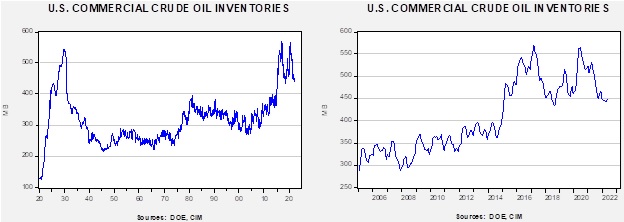

Crude oil inventories fell 1.0 mb compared to a 2.1 mb draw forecast. The SPR declined 6.0 mb, meaning the net draw was 7.0 mb.

In the details, U.S. crude oil production was unchanged at 11.9 mbpd. Exports rose 0.8 mbpd, while imports fell 0.1 mbpd. Refining activity rose 1.4% to 93.2% of capacity.

(Sources: DOE, CIM)

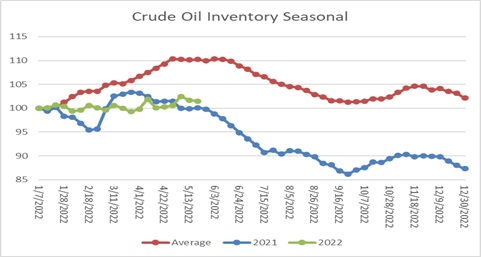

The above chart shows the seasonal pattern for crude oil inventories. This week’s report is consistent, showing a partial reversal of last week’s rise, with rising crude oil exports and increased refinery activity offsetting the continued draw from the SPR. Seasonally, the draw begins in earnest in June.

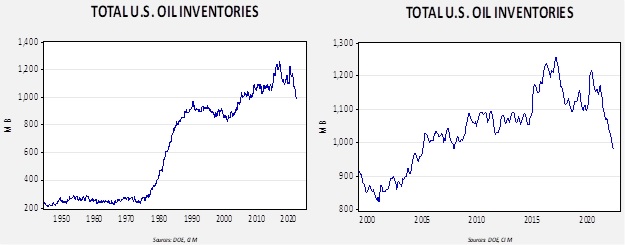

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $90.65.

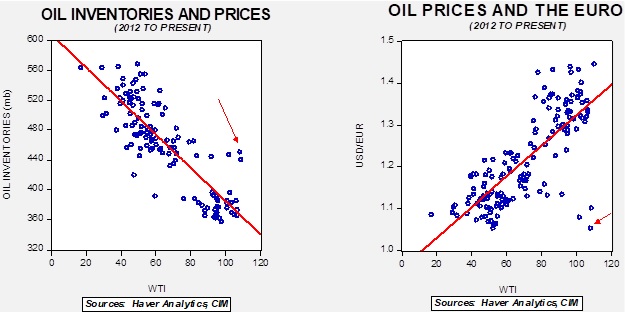

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

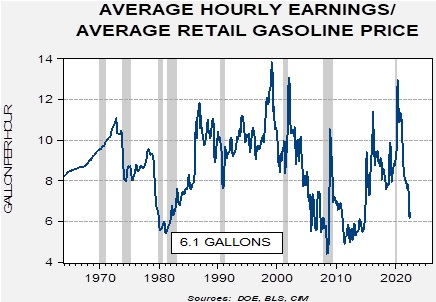

To scale the impact of high gasoline prices, we calculate the number of gallons a non-supervisory worker can purchase with one hour of work at the average national retail price of gasoline.

As the chart shows, we are approaching six gallons, which isn’t the all-time low but getting close to that level. In general, low readings tend to track consumer confidence and presidential approval ratings.

Market news:

- Coastal diesel fuel prices have moved above $6.00 per gallon, new highs for this product. Although there has been a focus on crude oil inventories, perhaps the real story all along was tight diesel supplies. In response, the administration is considering a release of inventory from the Northeast Heating Oil Reserve. This is more of a symbolic measure; the reserve isn’t large, holding only 1.0 mb. It was designed to provide emergency heating fuel for the Northeast, which uses the fuel for home heating.

- Washington state is reporting gasoline station outages.

- There are increasing fears of even higher gasoline and diesel prices this summer.

- One potential problem from reduced flows of Russian oil is that as Russian storage facilities fill up. Oil producers will have no option other than to start shutting in production. Rosneft (NK Rosneft’ PAO, RUB, 366.15) reported a decline of 0.56 mbpd, two-thirds of the overall Russian decline in output. Much of the company’s production comes from Siberia, which is considered an area requiring geophysical expertise, something that may be lacking as western oil service firms have evacuated Russia.

- There are reports that some 62 mb of oil Russian crude oil is floating on the high seas, about three times normal. It may be that selling this oil has become difficult due to financial sanctions, or it’s on its way to Asia and simply hasn’t made the trip yet.

- Increased Russian oil sales to Asia are displacing Iranian crude.

- Record temperatures have been seen in Pakistan and India recently. Studies suggest that climate change was a factor in the record heat and raises the concern that higher temperatures will boost the demand for air conditioning and electricity.

- As LNG demand eases in Europe, flows are rising to Asia. However, China is reducing its imports of LNG due to weak demand.

- The WTI-Brent spread has narrowed recently.

This chart shows the long-term history of the Brent-WTI spread. Until the shale revolution, WTI regularly was priced higher than Brent. Restrictions on exports and the explosion of shale production led the spread to flip violently around 2011. As the U.S. increased oil exports, the spread narrowed, but Brent tended to hold its premium over WTI. The recent narrowing is likely signaling rising export demand from the U.S.

- Despite high oil prices, U.S. production growth has been slow. Although there are many reasons for this lack of output (e.g., high input costs, labor shortages, unfriendly regulatory environment), one particular reason is that oil executives are being paid based upon profitability and less on production.

- Meanwhile, U.S. natural gas prices are elevated in a period where prices are usually weaker. Seasonal demand usually weakens in the spring and falls as temperatures moderate. This year, prices are elevated, in part, due to LNG exports. The LNG isn’t quite as global as oil, but it continues to expand.

- The North American Electric Reliability Corporation released its Summer Reliability Assessment. The risks of outages this summer are elevated.

- Another factor limiting energy supplies is the skyrocketing cost of transportation.

Geopolitical news:

- The U.S. is facilitating talks between Egypt, the KSA, and Israel over the sovereignty of two small islands near the Gulf of Aqaba. The islands are controlled by Egypt but would be returned to their original owner, Saudi Arabia. But, for this action to occur, Israel would have to approve. The thinking is that if Israel signs off, it will create a framework for normalizing relations between Israel and the KSA. Such an event would further expand the Abraham Accords.

- This may be part of an attempt by the administration to heal relations with the KSA.

- UAE President Sheikh Khalifa bin Zayed Al Nahyan died earlier this month. The leader is credited with the UAE’s economic development but has been mostly a figurehead since his stroke in 2014. Crown Prince Mohammed bin Zayed Al Nahyan will take over as president. Like the KSA, the founder of the UAE intended to pass leadership through his sons. However, as this first generation ages, there is increasing speculation that MBZ, as he is known, will pass power to his son, one of the grandsons of the founder. Like in KSA, this generational transition is fraught with risk, because the pool of potential leaders is large, and thus, there are many who will be disappointed. This worry isn’t imminent; MBZ is only 40 and could easily rule for three decades.

- Despite high oil prices and fears of insufficient supply, the KSA signaled it would not increase production beyond the current plan. The KSA also reiterated support for Russia, highlighting the growing rift between the U.S. and the KSA.

- The KSA plans to use the increased cash flows from high oil prices to increase its sovereign wealth fund.

- Finland’s decision to apply for NATO membership has prompted Russia to halt natural gas flows to the Nordic nation.

- China is said to be increasing its purchases of Russian crude to build its strategic reserve by “quietly” buying Russian crude oil at deep discounts. These purchases would seem to violate sanctions, but the S. is giving Beijing a pass, perhaps wanting to avoid a confrontation with China.

- China has also halted work on the Russian Arctic LNG project, worried about violating sanctions.

- We consider the negotiations to revive the Iran nuclear deal as dead, much like the Monty Python skit, yet talks, mostly fostered by the EU, continue. Even the Europeans acknowledge the talks are nearing their end. The Iranians deny they have made any concessions, increasing the odds the deal isn’t going to happen.

- Hassan Sayad Khodayari, an officer of the Iranian Revolutionary Guard Corps, was assassinated at his home in Tehran over the weekend. Although no one has claimed responsibility, the general suspicion is that this is the work of the Israelis. Israeli media is reporting that Khodayari was involved in planning attacks against Israelis, including kidnappings.

- Yet another CEO of Petrobras (PBR, USD, 14.51) has been sacked, the third in recent months. Jose Mauro Ferreira Coelho has been replaced by Caio Mario Paes de Andrade. Why is President Bolsonaro so angry with the company? Because fuel prices keep rising and he wants the company to fix prices and lose money.

- Even though the U.S. has been in talks with the Venezuelan regime, Caracas continues to work with Iran. In fact, the Iranians are working to repair Venezuela’s largest refinery. The Paraguana refinery complex, which has a capacity of 955 kbpd) is only producing at 17% of capacity; it is unclear if Tehran has the expertise or the funds to fully restore production.

- The EU is struggling to build a consensus on embargoing Russian oil, with Hungary being the major stumbling block. However, there are reports that the state oil firm MOL (MOL, USD, 4.14) is taking at least initial steps to process non-Russian oil.

- Germany and Italy plan to pay for Russian energy with RUB after getting approval from the EU.

- German industrial firms are preparing for natural gas rationing.

- The U.S. is making it clear that one of its policy goals is to “cripple” Russia’s oil industry. As part of this goal, the U.S. is considering secondary sanctions on buyers of Russian oil. The Russian economy continues to struggle.

Alternative energy/policy news:

- The incumbent automakers are banding together to build a robust supply chain for batteries. From its description, much of the initial effort appears to be in lobbying.

- Another group, mostly NGOs, is looking to coordinate efforts on direct carbon capture. Pulling CO2 out of the atmosphere will likely be necessary to bring greenhouse gasses to acceptable levels.

- The Abu Dhabi National Oil Company (ADNOCDIST, AED, 4.00) and BP (BP, USD, 32.28) are partnering on a project to make green hydrogen.

- Interest in EVs is growing around the world, far exceeding interest in the U.S. This difference may be due to higher fuel prices abroad.

- The shift to EVs could be a problem for Central Europe, which has become a key part of the supply chain for EU automakers. As the transition occurs, these supplies will need to adapt.

- Although higher oil and natural gas prices are leading to calls for increased output, it is also encouraging increased investment in energy alternatives.

- A lithium mine auction in China drew an extraordinary number of bids.

- China has been increasing its use of coal, and it is also boosting its investment in solar, doing an “all of the above” approach.

- The EU has plans to reduce carbon emissions but admits it will burn more coal as it reduces flows of Russian natural gas.