Weekly Energy Update (November 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(N.B. Due to the Thanksgiving Day holiday, the next report will be published on December 2.)

Oil prices have been struggling this week, testing support $79.50.

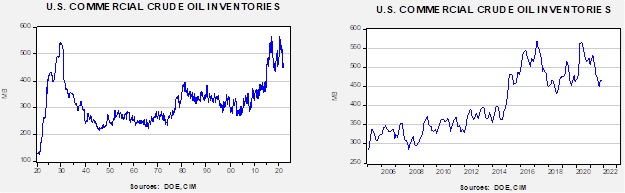

Crude oil inventories unexpectedly fell 2.1 mb compared to a 1.2 mb build forecast. The SPR declined 3.2 mb, meaning the net draw was 5.3 mb.

In the details, U.S. crude oil production was unchanged at 11.5 mbpd. Exports rose 0.1 mbpd, while imports fell 0.1 mbpd. Refining activity rose 0.4%. This build season usually ends in mid-November.

(Sources: DOE, CIM)

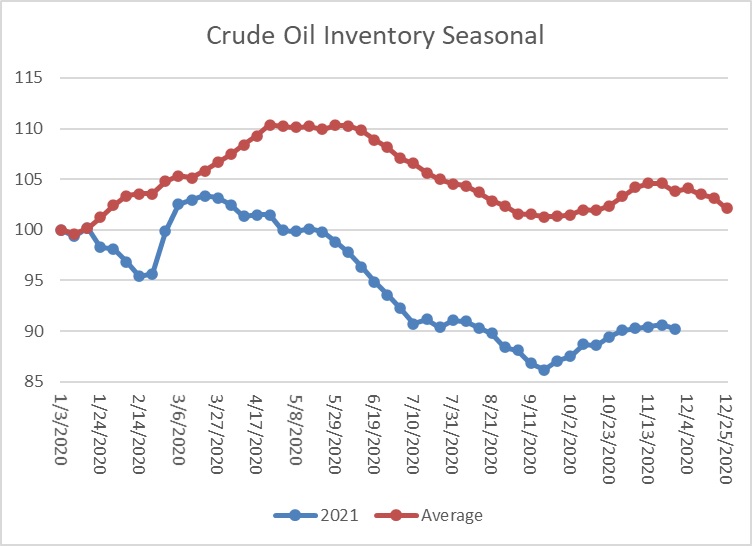

This chart shows the seasonal pattern for crude oil inventories. We are nearing the end of the autumn build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 70.0 mb.

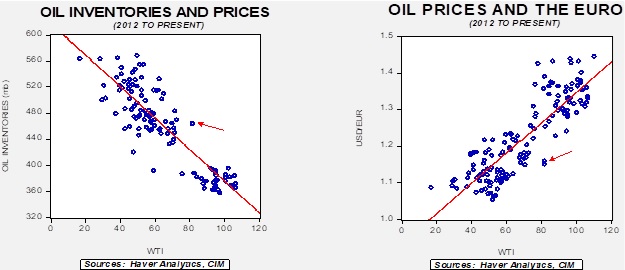

Based on our oil inventory/price model, fair value is $63.80; using the euro/price model, fair value is $56.63. The combined model, a broader analysis of the oil price, generates a fair value of $59.77. Across all models, the current price of oil is overvalued. The biggest concern has been dollar weakness, which is creating a serious divergence in the model. Although we have been bearish about the dollar because of purchasing power parity factors, we suspect foreign governments prefer dollar strength and are taking advantage of the benign neglect of U.S. dollar policy.

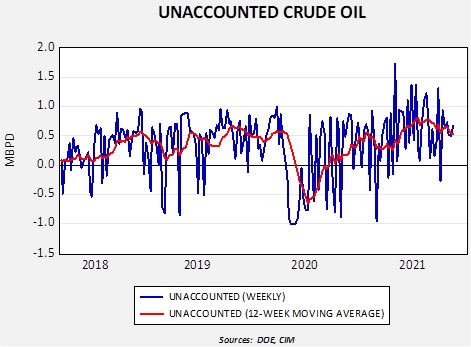

One factor we are watching is that the trend in unaccounted for crude oil is elevated. The most likely reason is that production levels are being underestimated, and, if so, the 12-week average would suggest that production is +0.5 mbpd higher than being reported.

Market news:

- The Biden administration faces political pressure from high oil prices and is trying to craft a response. There has been talk of a larger SPR release, curtailing oil exports, and easing ethanol blending requirements. All these proposals carry risks. A larger SPR release could leave the nation vulnerable to a crisis in the Middle East. Although the U.S. has an ample reserve, the goal of SPRs is to reduce hoarding, so it has to be large enough to overcome that psychological hurdle. Curtailing exports to a world in shortage isn’t how a superpower behaves and would undermine the “America is back” policy of this administration. Reducing biofuel blending would anger the farm sector. So far, the administration is using the “round up the usual suspects” approach by claiming market manipulation. We have covered energy markets since 1989, and, to our knowledge, there has never been a demonstrated case of market manipulation. At the same time, numerous presidents have pressed the FTC to conduct investigations.

- It should be noted that the administration wants a methane tax designed to punish drillers, pipelines, and processors over natural gas leaks. Unfortunately, the tax will likely lift natural gas prices at a time when supply concerns have boosted price levels.

- The IEA is upbeat about higher supplies in the coming months. The U.S. is holding a large offshore permit sale soon. It will be interesting to see the level of interest in projects that may not provide new supplies until early 2030. Meanwhile, Permian Basin production is set to rise next month to a new record.

Geopolitical news:

- Although Iran and the U.S. continue to signal a return to JCPOA, the reality is that neither side has a singular vision on what that means. Iran wants assurances that a new administration would not exit again. It isn’t possible unless the U.S. makes a treaty, and there is no way the Senate would support a full treaty. Iran also wants the U.S. to admit fault in leaving, which isn’t likely either. Meanwhile, Iran continues to make progress in nuclear technology and won’t likely give that up in a new arrangement.

- Recent elections in Iraq are leading to rising tensions among Shiite groups. Some of these groups are aligned with Iran, others are not, and the two sides are increasingly prone to conflict.

- The Iranian Revolutionary Guard Corps is increasingly encroaching on the Kurdish areas of Iraq.

- Iran has been a staunch ally of the Assad regime in Syria, backing the family during its civil conflict. The Arab states in the region would have preferred to see the Assad family ousted, but as it becomes increasingly evident the regime is going to survive, Arab states are making tentative overtures to Damascus. Syria has been a crossroads of the region; Syrians are used to managing relationships with states in conflict. Syria would likely support normalization with the Arab nations to assist in rebuilding, but it isn’t likely Tehran will look kindly on this development.

- Turkey is systematically constraining water supplies to Syrian Kurds. The Erdogan regime views the Syrian Kurds as supporting Kurdish separatism.

Alternative energy/policy news:

- COP26 ended on a disappointing note, as China and India prevented a proposal to reduce coal consumption more rapidly. Both nations rely heavily on coal for electricity production, and the recent energy shortages in China have highlighted how dependent the country is on coal. As we noted last week, these arrangements are prone to free-rider problems, so the promises made were generally compromised.

- Politically, there is a risk if the burden of adjustment to the curtailment of fossil fuels falls on lower-income households.

- This report discusses the progress being made on alternative energy.

- Opinion about nuclear power appears to be shifting towards the power source.

- A natural gas plant in Texas has used carbon capture technology to generate emission-free electricity from natural gas.

- Alternative energy is mostly about moving from fossil fuels to metals.