Weekly Energy Update (November 2, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices are off their recent highs on expectations that the Hamas crisis will remain contained.

(Source: Barchart.com)

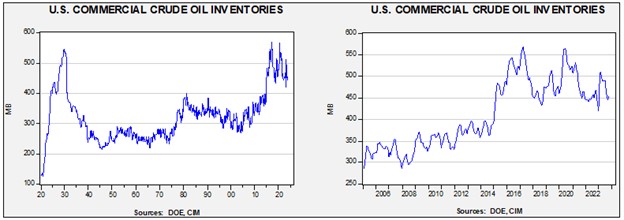

Commercial crude oil inventories rose 0.8 mb compared to forecasts of a 2.0 mb build. The SPR was unchanged, which puts the net build at 0.8 mb.

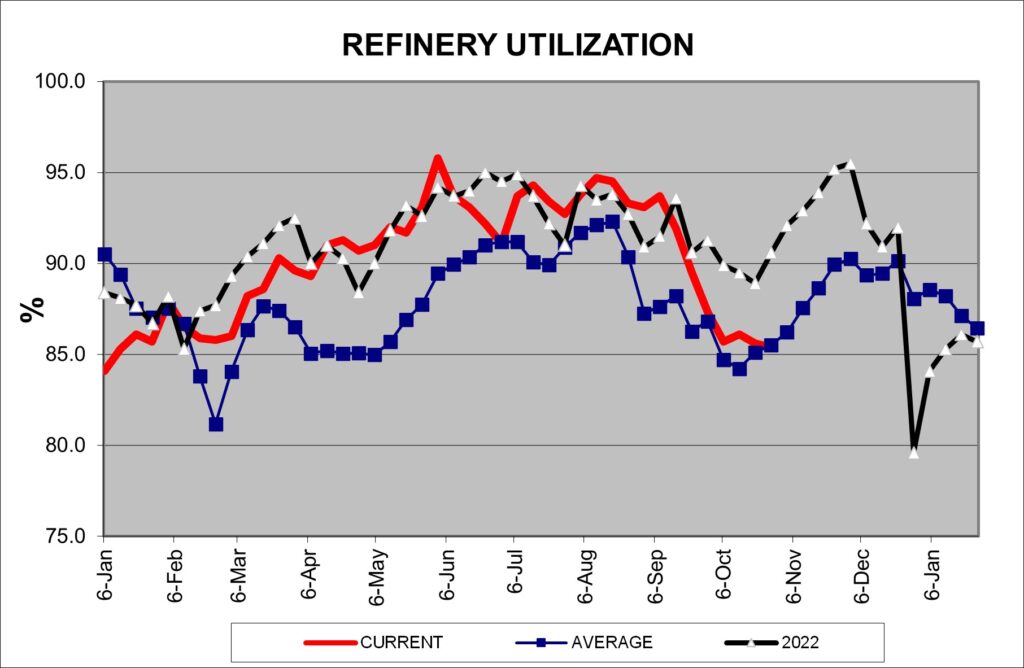

In the details, U.S. crude oil production was steady at 13.2 mbpd. Exports rose 0.1 mbpd, while imports increased 0.4 mbpd. Refining activity fell 0.2% to 85.4% of capacity. Refinery activity remains low but is in line with seasonal norms.

(Sources: DOE, CIM)

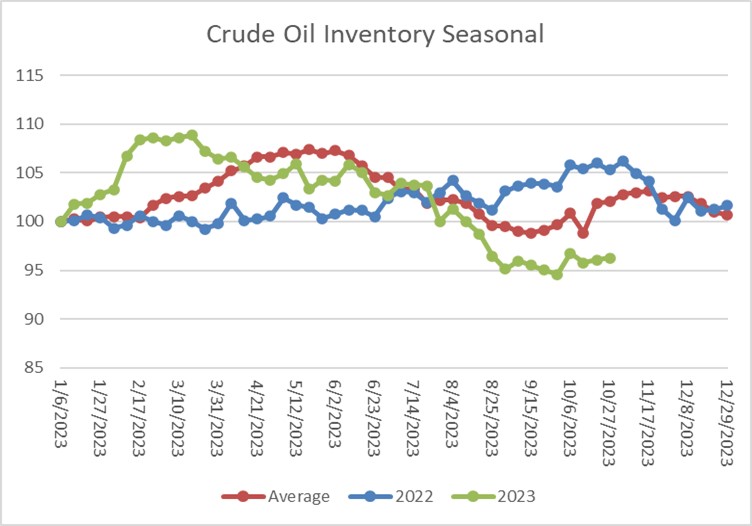

The above chart shows the seasonal pattern for crude oil inventories. We continue to see lower-than-normal inventory accumulation.

(Sources: DOE, CIM)

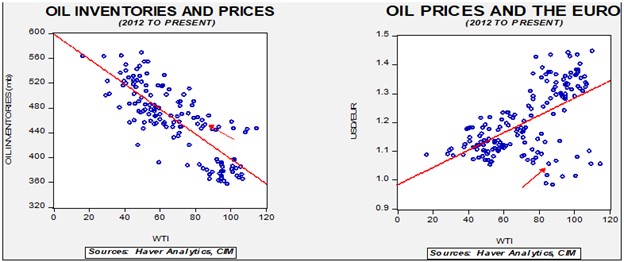

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $73.61. However, given the level of geopolitical risk in the market, we are not surprised that oil prices are well above this model’s fair value.

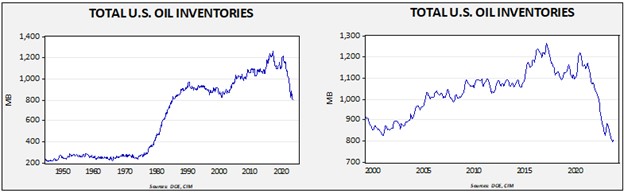

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $94.20.

Market News:

- The preliminary meetings for the COP28 meeting in Dubai are underway. Reports suggest the talks are strained. In general, the issue is who will pay for the energy transition. We note that President Biden has declined to attend, suggesting the meeting won’t attract decision makers.

- One of the challenges for energy companies, regardless of whether they are in the fossil fuel or alternatives industry, is policy volatility. In other words, changes in administrations can lead to wide shifts in policy, making investing difficult. Already we are hearing that an element of the GOP wants to scale back Biden-era policies on alternative energy investments. Even if the GOP does win in 2024, there’s no guarantee that the party will prevail in 2028, meaning that investment policy could change again in a few years. Thus, structuring long-term investments is becoming an increasing problem.

- The DOE is warning that the U.S. is behind on expanding the grid to handle increased electrification.

- Another issue is that policy goals can occasionally conflict. The administration is considering banking policies that would require banks to increase their capital, which may cause banks to curtail lending on alternative energy projects that are considered risky.

- An aging oil tanker anchored about 15 miles off the cost of Nigeria exploded earlier this year, a reminder that the fleet Russia is using to evade sanctions could be creating similar risks.

- As we have noted in recent issues, EU natural gas storage is essentially full. As gas flows continue, operators are increasingly storing gas in Ukraine despite the obvious risks.

- Low water levels may lead to higher propane prices this winter. Because of these water levels, large vessels can’t pass through the Panama Canal, forcing operators to use smaller vessels which increase costs.

Geopolitical News:

- We continue to closely monitor the situation in Gaza; so far, the conflict remains contained, although the recent Israeli incursion does show signs of expanding. However, we note that the U.S. has warned Iran against targeting American troops in the region. There is also legislation being drafted to further punish Iran, and it appears to have bipartisan support. If Iran faces a crackdown, it may lead to a drop in oil supplies. Although we expect the war to be contained, history does show examples of such conflicts unexpectedly widening. Thus, some degree of war premium should remain in oil prices.

- The Kingdom of Saudi Arabia has put its forces on high alert after border clashes and missile incursions from the Houthis in Yemen. The Houthis are an Iranian-sponsored group that has been a participant in the civil war in Yemen. As part of this conflict, it has attacked Saudi Arabia. It is unclear if these recent attacks are related to the Hamas issue in Israel, but it may signal a broadening of the conflict. We note the Houthis claim to have launched missile strikes against Israel.

- Another young Iranian woman has died in custody after security officers arrested her for hijab violations. A similar situation led to widespread protests last year, and there are reports of renewed protests.

- The World Bank’s baseline case for 2024 is for weaker energy prices, with the caveat that elevated geopolitical risks could trigger sharply higher prices.

- The U.S. is concerned that Iran or its proxies will attack U.S. troops in the Middle East. This report discusses where these troops are domiciled.

- Qatar has sentenced eight former Indian naval officers to death on allegations they were spying for Israel. Qatar is a major natural gas producer and is the largest LNG supplier to India. The allegations appear to have caught India by surprise, and so if diplomatic efforts fail, it could affect the natural gas trade between the two nations.

- Russia is trying to redirect its piped natural gas sales to China despite most of its infrastructure being directed toward Europe. There is one large pipeline to China—the Power of Siberia. Russia has a second pipeline on the drawing board, but China has been reluctant to invest in the project for a number of reasons. First, it has been improving relations with Central Asian nations that can also supply natural gas. Second, because it also gets LNG, it may not need the Russian natural gas…unless the terms are very attractive. And so, Beijing is driving a hard bargain with Moscow.

- China announced new export controls on graphite, a key mineral in the energy transition. Although we haven’t heard of actual restrictions yet, the fear is that Beijing has created the bureaucratic infrastructure to restrict it in the future.

- Washington has been in talks to further ease sanctions on Venezuela in return for open elections. However, recent actions by Venezuelan courts to thwart the opposition’s ability to choose its candidates is raising concerns that the Maduro government may not uphold its promises of free elections. If the Maduro government fails, it is less likely that Caracas will get much sanctions relief.

- In local Colombian elections, the leftist Petro administration suffered serious losses. If these elections portend a change in government in the national elections scheduled for 2026, it could bring a return of right-wing governments, which have traditionally supported Colombia’s fossil fuel industry.

Alternative Energy/Policy News:

- As the UAW strikes wind down, it appears the union was able to get concessions on unionizing battery plants. The union had been afraid that these plants would be built in non-union states to reduce costs. If these reports are accurate, it’s a big win for the UAW, but it might make EVs more costly.

- As we have been reporting, solid state batteries offer the promise of rapid recharging and extended range. In fact, such batteries might be necessary to encourage drivers to switch away from gasoline engines. This report is a primer on these batteries.

- Automakers are reporting slower sales of EVs. It is possible we have reached the point where the committed buyers have acquired a vehicle and new buyers will be purchasing based on perceived value between EVs and gasoline vehicles.

- Toyota (TM, $175.140) announced a major investment in a North Carolina battery plant. In general, investment in EVs in North America has increased with the passage of the Inflation Reduction Act.

- Although metals will be critical to the energy transition, investors continue to shun the mining sector due to its “dirty” reputation. If this attitude doesn’t change, the energy transition won’t occur.

- Uranium demand has hit a 10-year high as nuclear power expands.

- Wind power projects have fallen into disfavor. Higher interest rates, increased costs of materials and labor, along with local opposition are leading to cancellations of projects.

- Carbon dioxide pipelines have run into significant opposition. Without pipelines, carbon capture projects are less likely to go forward.

- The U.S. is working to assure the EU that the Biden administration’s energy policy is not protectionist.

- Seattle is becoming a hotbed for the fusion industry.

Note: The DOE is making system upgrades and indicates it won’t publish data next week, meaning the next edition of this report will be published on November 16.