Weekly Energy Update (November 13, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Positive news on a vaccine for COVID-19 led to a strong rally this week, taking prices to the upper end of the current trading range.

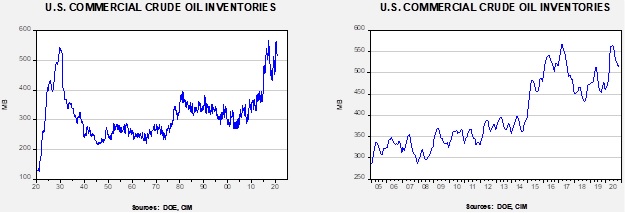

Commercial crude oil inventories rose 4.3 mb when a 2.0 mb draw was expected. The SPR declined 0.6 mb; since peaking at 656.1 mb in July, the SPR has drawn 17.3 mb. Given levels in April, we expect that another 5.1 mb will be withdrawn as this oil was placed in the SPR for temporary storage. Taking the SPR into account, storage rose 3.7 mb. The data was probably unaffected by tropical activity this week, but next week’s report could see international trade activity affected as Hurricane Eta moved across the Gulf of Mexico.

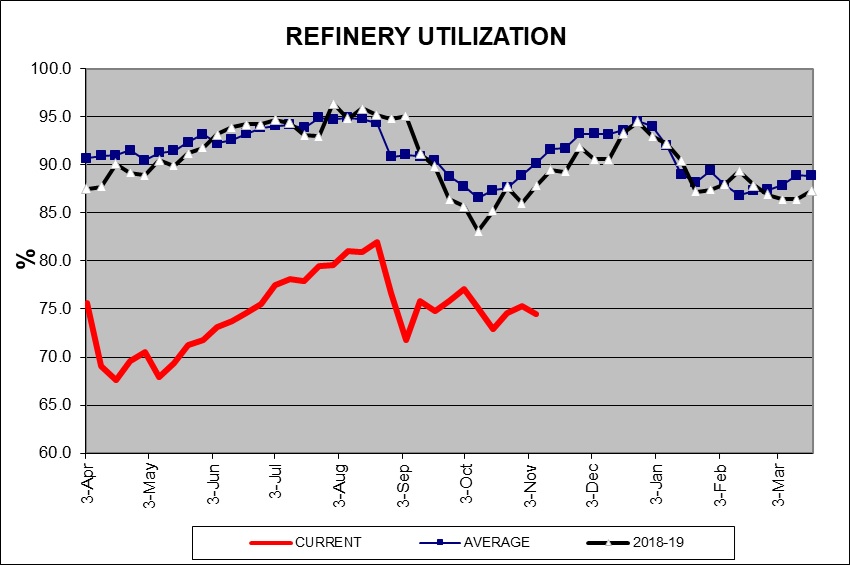

In the details, U.S. crude oil production was unchanged at 10.5 mbpd. Exports and imports both rose 0.5 mbpd. Refining activity fell 0.8%.

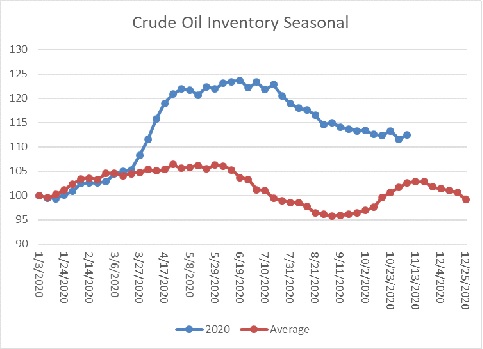

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed a rise in crude oil stockpiles, which is normal. Inventories are approaching their second seasonal peak. Thus, after next week, we would expect a steady slide in oil inventories.

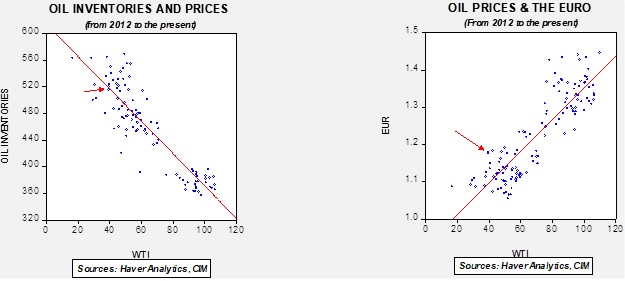

Based on our oil inventory/price model, fair value is $43.92; using the euro/price model, fair value is $62.37. The combined model, a broader analysis of the oil price, generates a fair value of $52.09. The wide divergence continues between the EUR and oil inventory models. However, current oil prices are below all three measures of fair value, suggesting that oil prices are likely undervalued.

Refinery operations fell 0.8%, which was better than the -1.6% expected. However, the seasonal pattern usually shows rising utilization by now. The lack of a recovery in utilization is bearish news for crude oil prices and is reflected in the falling crude oil demand forecasts discussed below.

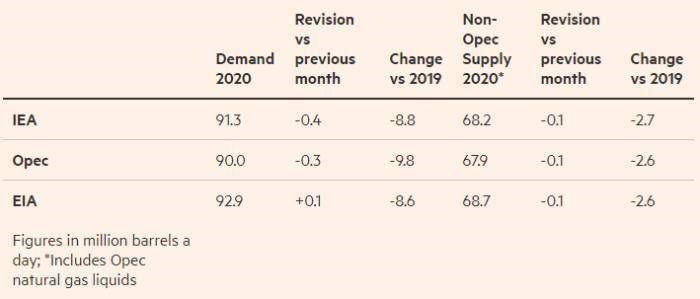

OPEC has lowered its demand forecast again, now projecting that demand will fall by 9.8 mbpd in 2020, another reduction of 0.3 mbpd. Given this decline, it is more likely that the cartel will not increase production quotas anytime soon. The IEA lowered its demand forecast as well, cutting its consumption expectations by 0.4 mbpd to an 8.8 mbpd reduction for this year. Both of these declines are tied to concerns about the rise in COVID-19 cases and expectations that the distribution of a vaccine will be globally slow.

As the table above shows, OPEC is the most pessimistic about global demand but expects a larger drop in non-OPEC supply.

One of the most potentially bearish factors for oil would be a reduction in sanctions on Iran. Candidate Biden has suggested he would like to return to the Iran nuclear deal, but there are a number of complications. First, this would require Iran to return to compliance to the earlier pact. Given that Iran’s enrichment activity has accelerated, it is hard to see how Tehran could be accommodated on this issue. Would Iran have to send that fuel to another nation? Would it allow foreign observers to check compliance? Second, it appears to us that the deal the Obama administration made with Iran was likely thought to be a first step in a broader agreement on missiles and militia activity. The assumption was that the future Clinton administration would have pursued these goals. But the Trump administration took a far different stance. Still, these other issues are important and are stumbling blocks to future relations. Finally, we find it hard to believe that Iran would be open to any agreement with the U.S. It is clear that the U.S. is politically divided, and had it not been for the pandemic, President Trump would have likely gotten a second term. Any agreement made with a Biden administration could just as easily be reversed in 2024. Thus, there is a risk to oil prices from a return of Iran, but the likelihood is probably rather small.

In Middle East news, we are seeing a rise in terrorist activity in Saudi Arabia. There was a bombing at a WWI commemoration ceremony in Jeddah yesterday, a meeting that was attended by Western diplomats. This follows a fatal knife attack by a Saudi national on a security guard at the French consulate in Jeddah. It appears that France is the target of these attacks due to recent unrest tied to the Macron government’s Islamic policy. In Bahrain, PM Prince Khalifa bin Salman Al Khalifa died at the age of 84. He has held the office since Bahrain’s independence in 1971. He was considered a hardliner and his replacement, Crown Prince Salman bin Hamad Al Khalifa, is thought to be more of a moderate. Bahrain is the home of the U.S. 5th Fleet and Navy Central Command. Thus, this change in power does have potential ramifications.

The oil majors are moving to diversify their energy sources in order to prepare for the seemingly inevitable shift away from hydrocarbons. BP (BP, USD, 19.10) has announced a joint program with Orsted (OMX, DKK, 1125.50) to use wind energy to create hydrogen. The plan is to separate hydrogen from water using electricity from Orsted’s wind farms.

Rolls Royce (RYCEY, USD 3.05) announced it will build 16 modular nuclear power plants in the U.K. The idea is to build smaller, repeatable plants that will give the U.K. an edge in this technology and help the country reach its greenhouse gas targets.

Although coal consumption has been falling for several years, the recent lift in natural gas prices will likely foster a lift in consumption. Although we suspect the trend in place of falling coal usage is likely to continue, we may see a bounce in coal activity into spring.