Weekly Energy Update (October 14, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain in a downtrend.

(Source: Barchart.com)

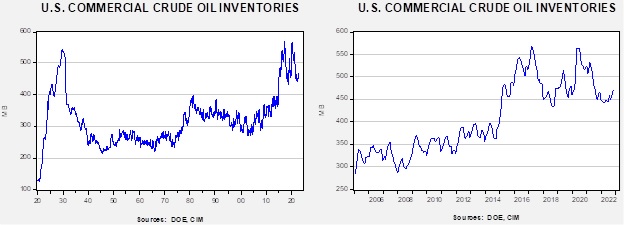

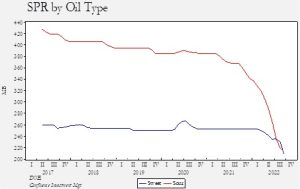

Crude oil inventories rose 9.9 mb compared to a 1.0 mb build forecast. The SPR declined 7.7 mb, meaning the net build was 2.2 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.9 mbpd. Exports fell 1.7 mbpd, while imports rose 0.1 mbpd. Refining activity fell 1.4% to 89.9% of capacity. We are clearly in the period of autumn refinery maintenance, so falling refining activity should be expected for the next few weeks.

(Sources: DOE, CIM)

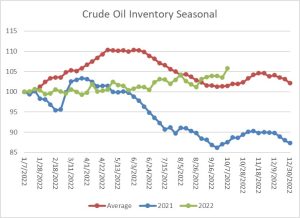

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are past the seasonal trough in inventories. The build seen in October into November is usually due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build has been exaggerated this year.

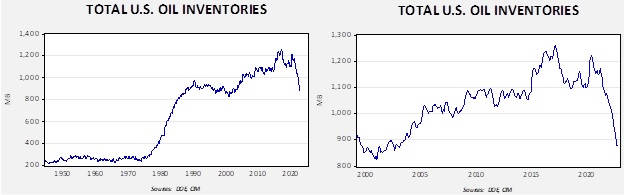

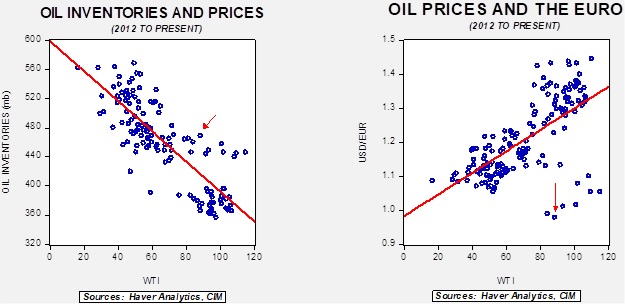

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $105.85.

The SPR: As we discussed earlier, the SPR has become something of a buffer stock; thus, it makes sense when analyzing prices to consider U.S. inventories as the SPR and commercial stocks combined, as we do above. Another element of the reserve is its composition. Oil is broadly described as heavy or light (the measure of viscosity) and sweet or sour (the level of sulfur). U.S. refineries have made investments over the years to favor sour crudes; the idea was that as fields aged, more oil would be of that variety.[1] And so, when officials filled the SPR, sour crudes were favored, and until recently, the mix was 60/40 in favor of sour. However, in the recent withdrawals, sour crudes were drawn much faster than sweet crudes. Over the past year, 190 mb of crude oil has been pulled from the SPR: 156 mb have been sour, and 44 mb have been sweet. At present, there are only 213 mb of sour crude remaining in the SPR, meaning its effectiveness to provide supply security has been compromised.

Unsavory Tradeoffs: The OPEC+ decision to cut allocations by 2.0 mbpd has broad ramifications. The cartel has argued that falling demand is behind the output decision. This is what we see so far:

- The Biden administration is clearly upset. The president traveled to Riyadh earlier this year to attempt to improve relations. Clearly, that didn’t work. Biden did not have kind things to say about Crown Prince Salman during the U.S. elections, and so relations between the U.S. and the KSA had cooled. In the aftermath of the OPEC+ decision, the administration has accused the KSA of aligning with Russia and has warned of other measures to counteract the loss of production from the cartel. The alignment with Russia isn’t just rhetoric. We note the president of the UAE is visiting St. Petersburg to speak with President Putin. There are also reports that the U.S. has asked the KSA to delay the announcement for a month (ostensibly to avoid prices increasing heading into the midterms); Riyadh pressed ahead The White House is indicating that the U.S. will “re-evaluate” relations with the kingdom.

- The KSA has denied the allegations that it is in league with Russia.

- Some members of Congress have called for the removal of U.S. military contractors and troops from the region. There have also been discussions of halting arms sales.

- Additional SPR sales have been announced.

- NOPEC legislation has been resurrected. This legislation would give the U.S. Attorney General the right to enforce U.S. antitrust laws on foreign national oil companies. Although it is not clear how that would work exactly, it’s conceivable that it would make it impossible for the affected OPEC+ nations to sell directly to the U.S. We doubt this legislation will pass as it often returns when the U.S. isn’t happy with the cartel’s behavior. However, we may be reaching a point where divisions between the U.S. and various cartel members have become strained enough that momentum may build for the bill’s passage.

- Another measure would build a case to take OPEC+ to the WTO on restraint-of-trade charges.

- What has not been mentioned yet is some sort of action against Saudi investments in the U.S.

- Clearly relations are cooling.

- We should note that all of these actions have a clear potential for adverse consequences. Withdrawing troops from the KSA and UAE may create conditions where Iran could undermine these governments, leading to potentially catastrophic outcomes for the West. Complicating matters is the U.S. political environment. Currently, a significant element of the electorate believes that if the other party is in power, civilization as we know it is at risk. Such attitudes lead those in power to take extreme measures to stay in power. The aggressive SPR sale has elements of maintaining political power at the risk of not having the reserve if a broader crisis emerges. Some of the discussion of attacking OPEC+ is shaded by seeing the KSA as supporting the GOP. At the same time, Riyadh should note that attitudes toward the KSA are hardening in a bilateral fashion.

- Finally, it should be remembered that the EU embargo on Russia crude goes into effect on December 5. It may not make sense to punish OPEC+ when the world will need to offset the potential loss of Russian oil.

- At the same time, the administration has been ignoring the effects of some of its actions on the concerns of the Gulf producers. The aggressive draining of the SPR was seen as a clear threat. The talk of price caps isn’t welcome either.

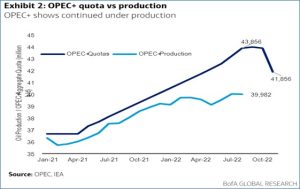

- One item to keep in mind is that the actual level of cuts will not approach 2.0 mbpd, because the cuts are coming from allocations, not actual production. The actual cuts will likely be closer to 0.8 mbpd, as the Gulf states, who are meeting their production quotas, cut back output.

- The IEA is warning that the OPEC+ cuts could plunge the global economy into recession.

- In addition to expressing anger about the KSA, the U.S. continues to negotiate indirectly with Iran for the latter’s return to the JCPOA. In theory, this could add one to two million barrels per day of oil to world markets, although we have our doubts that there is this much oil available. The sanctions regime has weakened and thus the available supplies would likely be modest. However, the “unsavory tradeoffs” include Iran’s human rights problems, and, perhaps more worrisome, it is in the midst of a crackdown on expanding unrest. The optics of cozying up to Tehran at this particular moment are troublesome as it is estimated that at least 185 people have died, including 19 children. This is especially the case since the protests appear to be widening with anecdotal evidence that security forces may be joining the rioters. Energy sector workers are also going on strike in sympathy. The longer these protests persist, the greater the threat to the regime. The government seems to have little fear of using force against young protestors but appears to be reluctant to attack oil workers. We also note that we are seeing some level of dissent from the clerical class.

- Although we don’t expect the government to fall, we do note that authoritarian regimes tend to collapse without warning. At least initially, an overthrow would be bullish for oil because it isn’t obvious if the lack of government would affect the oil infrastructure. If a Western-friendly government were to take power, however, we would expect the West to rapidly take steps to support that government, which would almost certainly include lifting sanctions.

- There have been reports that the administration may ease sanctions on Venezuela in a bid to increase oil supplies, although we note they have been denied. The Maduro regime has also been repressive against opponents, and, again, the optics are not good.

- Perhaps the most important point that has been lost in all the controversy is that the world has dramatically underinvested in oil production. As we have noted for months, ESG concerns continue to weigh on non-OPEC supply, but even OPEC+ is underinvested. The fact that OPEC+ now talks about “production targets” instead of “quotas” shows how much conditions have changed. As long as investment remains depressed, oil prices will remain elevated and could conceivably move much higher.

The bottom line is that the commodity business can require compromises. At times, governments can decide that they will bear the cost of higher commodity prices because a producer is so far beyond the pale that cooperation is impossible. For example, the U.S. has avoided buying Iranian oil since 1979, but in other cases, governments will turn a “blind eye” to such behavior to secure resources. The Ukraine War has exacerbated these difficult decisions. The EU delayed applying embargos on Russian oil and gas until early 2023, for example. We expect more difficult issues to develop in the future.

Market News:

- The EU held talks about setting a natural gas price for the group. The idea is that they agree on a price and if the market price is above that level, the cost would be subsidized. At the time of this writing, the meeting did not succeed in setting a policy.

- A leak in the Durzhba pipeline was discovered in Poland. Although there are fears of sabotage, first accounts seem to indicate that it was an accident. The event has reduced oil flows to Germany.

- As the EU ramps up LNG purchases, emerging market (EM) nations are struggling to acquire supplies and the buying will also likely push U.S. prices up as LNG production ramps up.

- The U.K. has announced a new round of drilling licenses for the North Sea. The U.K. government stopped issuing licenses in 2019, promising a comprehensive environmental review. High prices have prompted the decision to start issuing licenses again.

- In an ominous sign, so-called “ducs,” or drilled but uncompleted wells, inventory is shrinking. This development suggests that wells are being completed faster than new wells are being drilled. Without rapid investment soon, U.S. production will likely begin to contract.

- In the late 1970s, President Carter gave his famous “malaise” speech, commenting on energy while wearing a cardigan. The message was that sacrifice would be required in the face of high energy prices.[2] French President Macron is offering a similar message today. Partly in response, Paris, the “City of Lights” is darker.

- Another element of the 1970s was price caps on energy products. These caps were blamed for the infamous gas lines at filling stations. Price fixing is one response to scarcity, but if rationing isn’t included, it usually leads to shortages. Why? There is a political incentive to set the price below the market-clearing price. If the market price were acceptable, no one would have an interest in fixing the price. During WWII, price fixing coupled with rationing worked reasonably well. However, the incidence of this policy fell on higher income households who had the money to buy more food but were restricted by rationing. As the war ended, so did rationing, and prices were allowed to fluctuate. Note that as rations were lifted, food prices jumped after the war.

- China’s LNG demand will remain elevated in the coming years. As we noted above, without increasing investment, the globalization of natural gas will tend to move U.S. domestic prices to overseas prices, meaning Americans will pay more for heating, fertilizers, and electricity.

- Despite these experiences, price caps are being reconsidered as a way to make it through the winter. Several different ideas are being considered, but without proper care, the end result is likely shortages.

- Refinery workers in France have gone on strike and there are numerous reports of spot shortages and tensions at filling stations. The Macron government is trying to force workers back to the refineries but is struggling to enforce its will. There is talk of wider protests against inflation.

- The Permian Basin has been responsible for nearly all the production growth this year. However, to continue to expand, associated natural gas that comes from drilling must be processed. Flaring, which could be one way to address this issue, has become untenable. While there is still some natural gas processing capacity available, without additional investment, production growth could stall.

- Although OPEC+ has called on production cuts, we note that the KSA has signaled a reduction in supplies to Asia. It appears supplies will be met by drawing down inventories.

- Munich Re (MURGY, $24.40), the world’s largest reinsurer, announced restrictions on issuing policies on oil and gas projects. Financing constraints have been a factor in restricting oil and gas production.

- Venture Global (1557028.MC, €10.16) announced a deal to send U.S. LNG to Germany.

Geopolitical News:

- Germany’s unilateral energy price support package continues to raise hackles across the EU. In response, Germany is proposing to support unified EU debt to broaden subsidy support. Increasingly, the EU and Eurozone have been creating bonds as opposed to member nation debt instruments.

- Sweden’s investigation of the recent Nord Stream pipeline attacks strongly suggests sabotage.

- Last week, we noted that Lebanon and Israel were nearing a deal on production sharing for offshore natural gas development. A deal has been tentatively agreed upon but will need ratification by both governments. We expect it to pass as Israel wants energy security without the distraction of tensions with Lebanon, and Lebanon desperately needs the revenue from natural gas sales. The U.S. cheered the arrangement, which may ease tensions between Israel and Hezbollah, which dominates the Lebanese government.

- Iran has been an observer of the Shanghai Cooperation Organization (SCO) since 2005. It has wanted to join the group, but the leadership was uncomfortable admitting a member under sanctions, fearing that the SCO would face scrutiny from the West. However, now that Russia, a long-time member of the SCO, is under sanctions, there is a higher likelihood that Iran will be admitted. If so, the SCO will probably become an anti-U.S. organization.

- In Iran, state television was hacked during a news bulletin.

- The IAEA reports that Iran is aggressively moving to expand uranium enrichment at its underground facility at Natanz. This news will raise questions about the wisdom of returning to the JCPOA.

- The U.S. energy industry is warning against implementing product export constraints.

Alternative Energy/Policy News:

- Florida’s electrical grid has reportedly recovered rather quickly in light of the hurricane devastation. The grid was strengthened by using concrete and steel power poles and burying power lines underground. Areas that built solar capacity have mostly emerged unscathed.

- One problem with EVs is their high cost. Ford (F, $12.16) has announced a second price increase of the F-150 Lightning since summer. The base model now costs over $50k.

- The recently passed Inflation Reduction Act has provisions that provide large subsidies for EVs if the vehicle is mostly made in the U.S. with American components. The EU is crying foul, suggesting this is protectionism.

- Copper is critical to EVs, and the West is short on copper supplies.

- Austria is challenging the EU ruling that nuclear power and natural gas are “green” fuels. This suit joins others from environmental groups. If the challenges are successful, ESG guidelines will restrict investment in these two sources of energy.

- General Motors (GM, $32.65) has decided to expand its battery production to include electricity storage for home and commercial use. For homeowners, this possibility will be tied to an EV.

- Researchers have developed a prototype lithium battery with 40% more capacity.

- A new cobalt mine, the only one of its kind in the U.S., recently opened.

- The EU wind industry is contracting due to rising input costs.

- New Zealand is applying taxes on livestock to curtail methane emissions.

- The uranium miner Cameco (CCJ, $21.95) announced an investment in the nuclear power division of Westinghouse, which is owned by Brookfield Partners (BBU, $19.48). Cameco’s investment looks like a bid to vertically integrate.

[1] This decision turned out to be a mistake. Crude oil from fracking turned out to be sweet, meaning that it wasn’t ideal for U.S. refiners. Thus, sweet crude is usually exported, forcing the U.S. to import sour crudes. In broad terms, this means the U.S. is oil independent, but in practical terms, it’s not, due to the sweet/sour imbalance.

[2] It wasn’t a popular speech.