Weekly Energy Update (October 19, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Continued tensions in the Middle East are supporting crude oil prices.

(Source: Barchart.com)

(Source: Barchart.com)

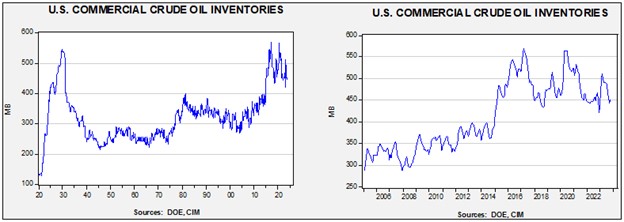

Commercial crude oil inventories fell 4.5 mb compared to forecasts of a 0.6 mb draw. The SPR was unchanged, which puts the net draw at 4.5 mb.

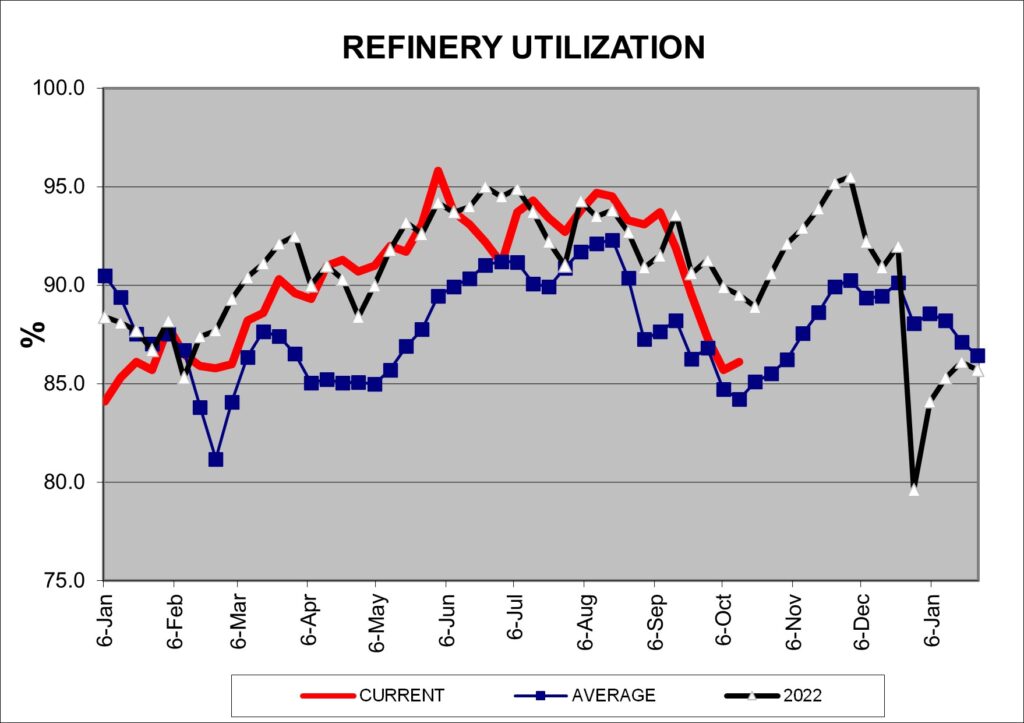

In the details, U.S. crude oil production was steady at 13.2 mbpd. Exports rose 2.3 mbpd, while imports fell 0.4 mbpd. Refining activity rose 0.4% to 86.1% of capacity. The rise likely signals that we are coming to the end of the autumn refinery maintenance period, which should lift oil demand.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

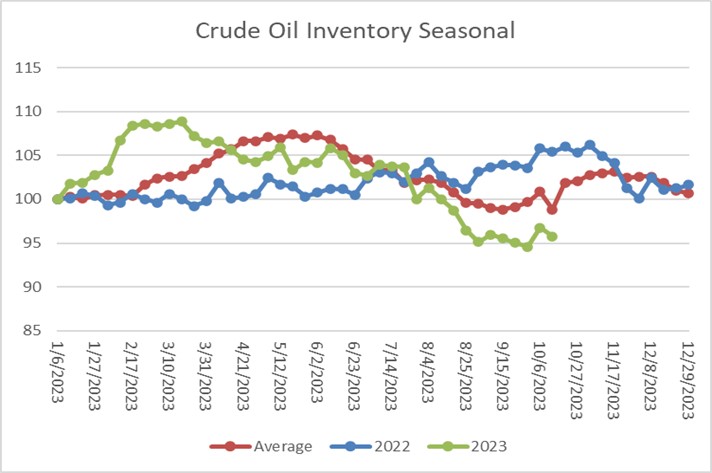

The above chart shows the seasonal pattern for crude oil inventories. Last week’s is contrary to seasonal patterns, but we do note that refinery operations rose this week.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

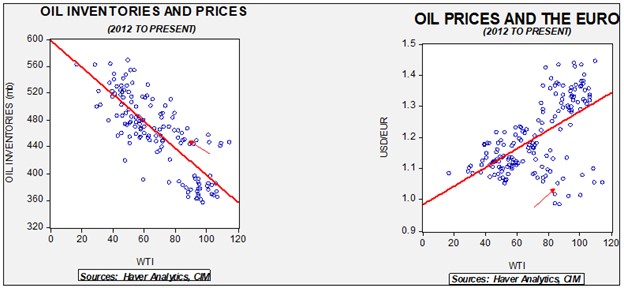

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $74.38. However, given the level of geopolitical risk in the market, we are not surprised that oil prices are well above this model’s fair value.

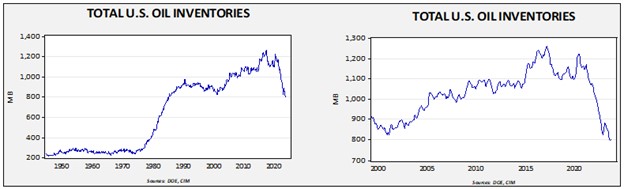

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $94.45.

Market News:

- Rising prices for diesel fuel are creating an opportunity for China to expand product exports. Although China is dependent on foreign oil supplies, it has expanded its refining capacity, giving it the ability to export product. It is worth noting that China has been buying sanctioned oil from Iran and Russia at discounts and in its own currency, likely creating attractive refining margins. Russia has been curtailing diesel exports to secure domestic supplies which is giving China an export opportunity.

- For the first time in history, crude oil is poised to become America’s largest export. The combination of rising production and higher prices, along with demand from Europe, have led to this development.

- At the same time, environmental activists are working to create impediments to U.S. LNG exports.

- Canada is nearing the completion of its Trans-Mountain Pipeline, which will allow it to send oil from central Canada to the Pacific coast. This development will likely raise prices on Canadian oil exported to the U.S. At the same time, it should also reduce prices to Asia.

Geopolitical News:

- As Israel begins its ground offensive in Gaza, we continue to watch for signs of escalation. Iran is warning Israel not to expand its offensive into Gaza, while the U.S. is warning Iran not to escalate the current conflict into a regional war. In the wake of the missile strike on a Gaza hospital, Iran has called for an oil embargo on Israel and is warning of pre-emptive strikes. There is a dispute over who is responsible for the attack on the hospital: Israel claims it was a misguided missile launched by either Hamas or Islamic Jihad, while Hamas accuses Israel.

- The U.S. has issued new sanctions on Iran, mostly targeting Iranian firms tied to supporting Iran’s missile and drone programs. The firms are based in Iran, Hong Kong, China, and Venezuela.

- The U.S. has sent a second carrier strike force into the region, suggesting rising concern about a widening conflict.

- Last week, we speculated that the Hamas invasion and Israeli response would likely lead to at least a suspension of Israel/KSA talks. The Saudis have confirmed that the talks are on hold for now.

- China and Russia are decidedly siding with Hamas, likely to undermine U.S. influence in the Middle East.

- At the onset of the war in Ukraine, there were widespread concerns that the global fertilizer market would be disrupted. Russia, Belarus, and Ukraine were all significant producers of fertilizer. In addition, one of the key feedstocks of fertilizer is natural gas, which has seen a jump in prices. We are now seeing reports of fertilizer shortages, which will reduce crop yields, especially in the emerging economies.

- As the U.S. moves to tighten sanctions on Russia, Washington is also moving to ease them on Venezuela, likely to restrain oil prices. The Maduro government is agreeing to hold elections under international observation.

- The House of Representatives is planning to issue a subpoena to Robert Malley, the former Biden administration official who is under scrutiny on concerns he may be acting in the interests of Iran.

Alternative Energy/Policy News:

- For EVs to be a viable replacement for ICE (internal combustion engine) cars, the issue of range anxiety will need to be addressed. Currently, the range is about 350 miles, which is serviceable, but recharging can take a long time and finding places to recharge can be a challenge. However, Toyota (TM, $177.68) may have the ultimate solution: a solid state battery that has a range in excess of 900 miles with a 10 minute recharge. Such a combination would be an improvement over ICE vehicles and would likely resolve much of the range concern. Toyota is working to mass produce these batteries, which are expected to be in its cars by the end of the decade.

- Meanwhile, EV sales have started to fade in the U.S. due to rising costs coupled with range anxiety.

- Although there is general agreement among environmentalists that fossil fuel use needs to be curtailed, there is persistent opposition to the mining of the metals needed to make the transition. Often, these resources reside in environmentally sensitive areas. Although we understand the concern, if areas where the metals can be found continue to be excluded, it may become difficult to accelerate the transition away from fossil fuels.

- As Britain contemplates achieving net zero by 2050, it is starting to count the costs of decommissioning its natural gas distribution network. These costs will be formidable.

- A recent study by the Dallas Federal Reserve is a “good news, bad news” story for wind and solar. There is clear evidence that these alternative power sources helped Texas avoid brownouts this summer. The bad news is that the intermittency of these two sources have made managing the grid difficult as solar and wind power tend to increase in the daytime and taper off in the evening. This pattern requires grid operators to adjust other power sources to accommodate this pattern. Ramping up other sources, primarily natural gas fired turbines, tends to increase maintenance costs. Battery storage may help grid operators deal with the intermittency issue.

- Within the EU, France and Germany are at loggerheads over the nuclear power issue. The former wants nuclear power to be included as a green alternative. Germany, which has decided to close its reactors, opposes this characterization.

Note: The next edition of this report will be published on November 2.